- Major crypto firms file briefs supporting a Texas company’s lawsuit against the SEC

- Lawsuit challenges SEC’s classification of digital assets as securities without clear rules

- Amicus briefs argue SEC enforcement threatens companies without transparent regulatory guidelines

Leading crypto firms and advocacy groups have backed a Texas-based company, Beba, in its lawsuit against the United States Securities and Exchange Commission (SEC) over its handling of digital asset regulation. The DeFi Education Fund (DEF) and Texas-based Beba filed the lawsuit to seek a court ruling that the SEC’s approach to classifying digital assets, such as tokens distributed through airdrops, as securities lacks formal guidelines.

Source: Law360News

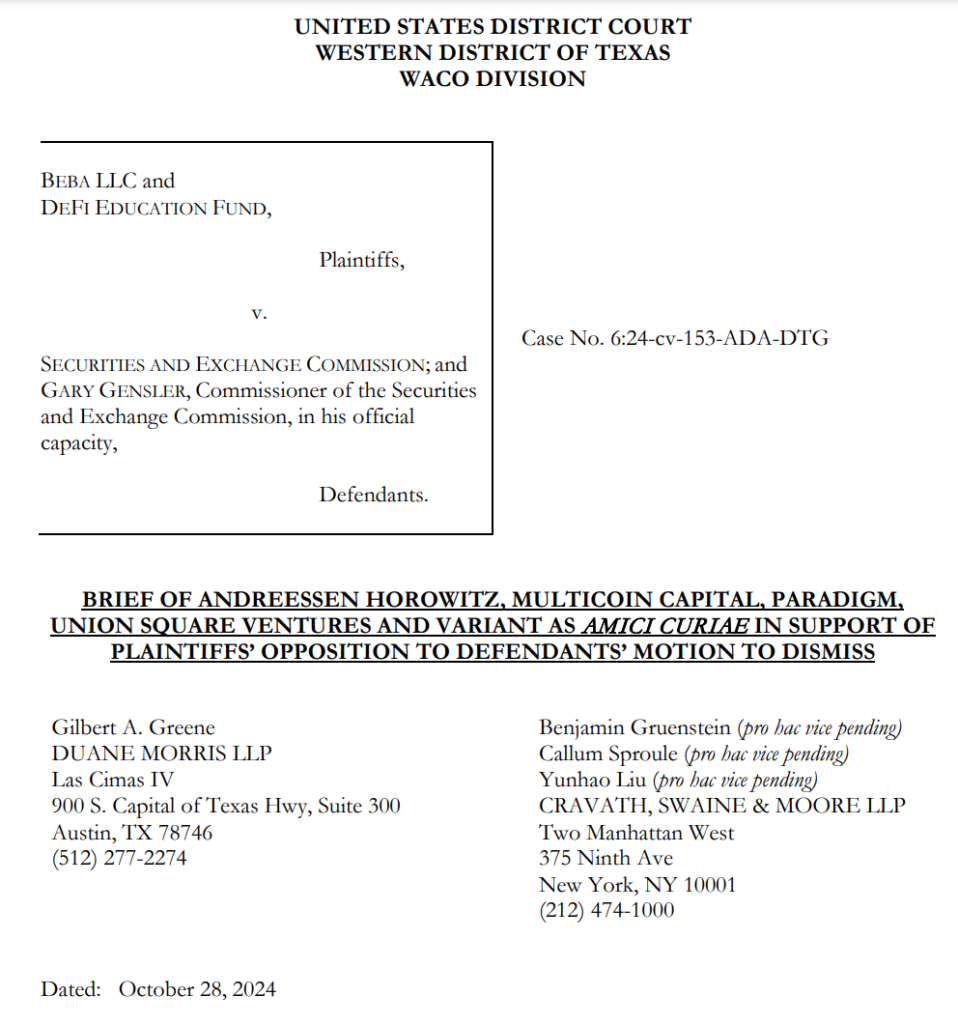

Support for the lawsuit came in the form of an amicus brief filed on October 28 by crypto firms Coinbase, Andreessen Horowitz, Multicoin Capital, Paradigm, Union Square Ventures, and Variant. In the brief, these companies argued that the SEC’s enforcement poses a credible threat to firms like Beba without providing adequate regulatory clarity. This view was echoed by the Texas Blockchain Council and Investor Choice Advocates Network, both of which stated that the SEC has pursued numerous enforcement actions while refusing to establish clear guidelines.

Concerns Over Regulatory Clarity

The original lawsuit, filed in March, contends that the SEC’s “unwritten policy” treats most digital asset transactions as securities without public rulemaking or guidance, leading to enforcement threats for companies issuing tokens like BEBA. Beba claims that the SEC labeled their digital token, issued through a free airdrop, as an “investment contract” under the 1933 Securities Act, putting it at risk of regulatory action.

The SEC moved to dismiss the case in July, labeling the lawsuit as “premature” and suggesting Beba had not identified any specific policy it opposed. However, the amicus brief argues that the SEC’s enforcement stance has led to tangible harm for businesses affected by the agency’s position.

Crypto Advocates Demand Due Process

Coin Center, a think tank focused on crypto policy, also filed a brief supporting Beba on October 22. In its statement, Coin Center argued that when regulatory agencies bypass formal rulemaking, affected organizations are left with little recourse other than legal action. Coin Center further argued that the lack of clear guidelines creates costly uncertainty for companies like Beba and for DeFi-focused groups such as DEF, which bear expenses from the SEC’s regulatory stance.

Supporters of the lawsuit contend that the SEC’s approach has created significant legal and operational challenges for businesses trying to navigate digital asset regulation in the absence of structured guidance.