- Strategy’s Bitcoin holdings have gained over $102.5B in unrealized profits with an average buy price of $66,384.

- Some recent buys above $97K are still in the red, but earlier purchases under $40K are offsetting the losses.

- With Bitcoin’s halving and ETF inflows, Strategy’s long-term strategy could pay off even more.

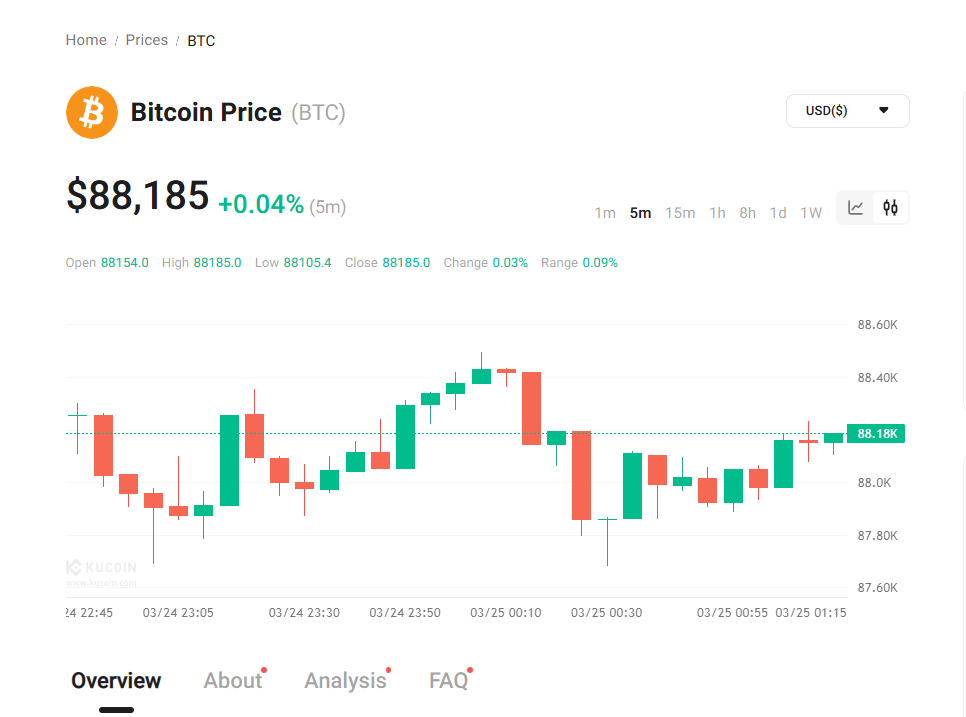

So, get this—Strategy’s Bitcoin stash is now sitting on over $102.5 billion in unrealized gains. That’s not a typo. Thanks to Bitcoin’s rocket ride past $87,000, the company’s bold BTC strategy is finally paying off in a big way.

Saylor’s Long Game

Under Executive Chairman Michael Saylor Strategy has gone all-in on Bitcoin using a dollar-cost averaging strategy. And for the most part? It’s worked. The company now holds close to 500,000 BTC, picked up at an average price of $66,384. With BTC flying high, those coins are now worth around $43.66 billion, a tidy 31.74% gain overall.

But… Not Every Purchase Is in the Green

While the headlines sound amazing, zoom in a bit and you’ll see the cracks. Some of the more recent buys—especially from late 2024 and early 2025—are still in the red.

Take this: On Jan. 27, Strategy bought 10,107 BTC at $105,596. That chunk is down nearly 20%. And another 20,000+ BTC scooped up on Feb. 24 at $97,514? Down about 10.65%. Not great.

Still, Saylor’s not sweating it. The early buys—at $30K and even $40K—have stacked so much profit that they more than cancel out the recent losses. That’s kind of the whole point of his strategy: buy during dips, hold through chaos, win long-term.

The Halving Tailwind

Looking ahead, Saylor’s bet might keep getting stronger. With Bitcoin’s halving event tightening supply and spot ETF inflows picking up steam, many believe BTC could be headed even higher. That would turn those underwater positions green—and then some.

Still One of the Boldest Moves in Corporate Finance

Sure, other firms hold crypto. But nobody’s doing it quite like Strategy. The firm now boasts over $10 billion in unrealized profits, and its diamond-hands strategy is outperforming more conservative institutional players.

So, yeah—not every BTC buy was perfect, but the broader play? Looking more genius by the day.