- MSCI could remove Strategy (MSTR) from major equity indexes by Jan. 15.

- JPMorgan estimates up to $8.8B in outflows if index providers follow suit.

- Strategy’s stock is down 37% this year as Bitcoin volatility raises sustainability concerns.

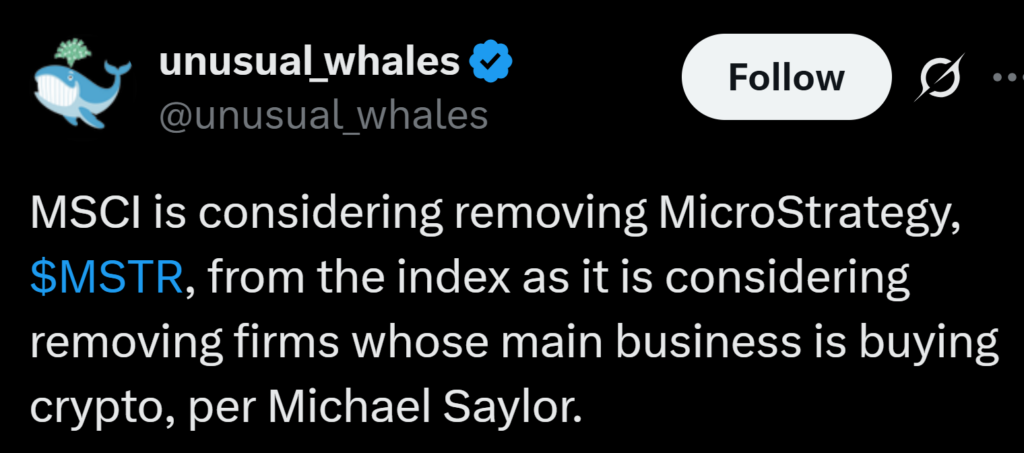

Strategy (MSTR), the largest publicly traded holder of Bitcoin, is now in discussions with index giant MSCI over whether the company will remain part of major equity benchmarks. Reuters reports that a decision is expected by Jan. 15, setting the stage for what could be one of the most consequential rulings in Strategy’s history as a public firm.

MSCI Review Could Trigger Major Outflows

JPMorgan analysts warned last month that Strategy’s removal could lead to as much as $8.8 billion in outflows if other index providers follow MSCI’s lead. Because Strategy sits inside indexes like MSCI USA and MSCI World, it’s automatically held by a massive range of passive index funds. Any removal would force those funds to sell their positions, potentially pressuring Strategy’s already volatile stock.

Michael Saylor confirmed that discussions with MSCI are underway, though he said he wasn’t sure JPMorgan’s estimates were accurate. Even so, the situation highlights the growing tension between Strategy’s aggressive Bitcoin strategy and the expectations of traditional equity benchmarks.

Bitcoin Volatility Fuels Pressure on Strategy

Strategy holds 650,000 BTC on its balance sheet, making it the largest corporate Bitcoin holder in the world. But the position has been under scrutiny after Bitcoin fell from an all-time high above $120,000 to lows near $82,000 in recent weeks. While BTC has since recovered to around $93,000, it remains 26% below its peak — and critics argue that Strategy’s heavy use of debt and equity issuance to buy more Bitcoin is becoming harder to justify.

The company’s stock has dropped 37% this year, amplifying questions about sustainability as markets deal with heightened volatility and index providers review exposure.

What Happens Next

The MSCI decision now looms large over Strategy’s immediate future. If it keeps its index placement, the company avoids massive structural outflows. If it’s removed, the selling pressure could be significant — and may redefine how equity benchmarks handle companies with crypto-dominant balance sheets.