- Strategy purchased 22,305 Bitcoin at an average price of $95,284.

- Total holdings now stand at roughly 709,715 BTC, worth about $65 billion.

- The move underscores growing corporate interest in Bitcoin as a treasury asset.

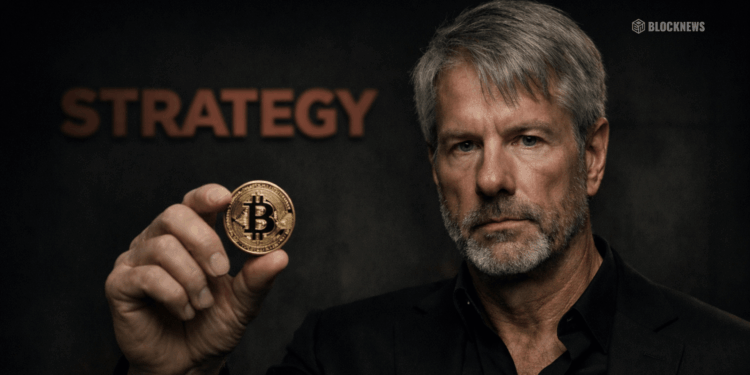

Strategy has doubled down on its Bitcoin conviction, adding another 22,305 BTC to its corporate treasury at an average purchase price of $95,284 per coin. The latest acquisition was disclosed shortly after the company raised roughly $2.1 billion through the sale of common and preferred stock under its at-the-market offering. The move further cements Strategy’s role as the most aggressive corporate buyer of Bitcoin in the public markets.

A Treasury Strategy That Keeps Scaling

With this purchase, Strategy’s total Bitcoin holdings have climbed to approximately 709,715 BTC, now valued near $65 billion at current prices. That scale is unmatched among public companies and continues to blur the line between software firm and de facto Bitcoin investment vehicle. The company has consistently framed these buys as a long-term strategy rather than tactical trades, even as prices push into historically elevated ranges.

Market Reaction Tells a Mixed Story

Despite the headline accumulation, Strategy’s shares fell about 5% in premarket trading following the disclosure. The stock has long been treated by institutional investors as a proxy for Bitcoin exposure without the complexity of direct custody. As Bitcoin prices rise, however, that leverage cuts both ways. Equity investors appear increasingly sensitive to dilution risk tied to repeated capital raises used to fund BTC purchases.

Why This Matters Beyond One Company

Strategy’s continued accumulation highlights a broader shift in how corporations view Bitcoin — not just as a speculative asset, but as a treasury reserve alternative. Large, repeated buys at high price levels also influence market psychology, reinforcing the idea that institutional demand isn’t fading as prices climb. Whether other firms follow suit remains to be seen, but Strategy’s playbook is becoming harder to ignore.