- Grayscale still holds 116.8M XLM after accumulating heavily before Stellar’s 600% rally, but stopped buying in 2025 as XLM fell from $0.52 to $0.26.

- Stellar’s ecosystem is expanding fast, with 37% developer growth and $654M in tokenized RWAs, boosted by the new Blockchain Payments Consortium.

- Despite strong fundamentals, extreme market fear and historically weak November performance continue to pressure XLM’s price downward.

Stellar hasn’t had an easy run this year. After touching its 2025 peak around $0.52, XLM has now slipped all the way down to the $0.26 range — basically slicing its value in half. And while retail sentiment has been drowning in fear toward the end of the year, smart-money players like Grayscale have been quietly adjusting their XLM exposure through the chaos.

Grayscale Still Holds 116M+ XLM — But Accumulation Has Stopped

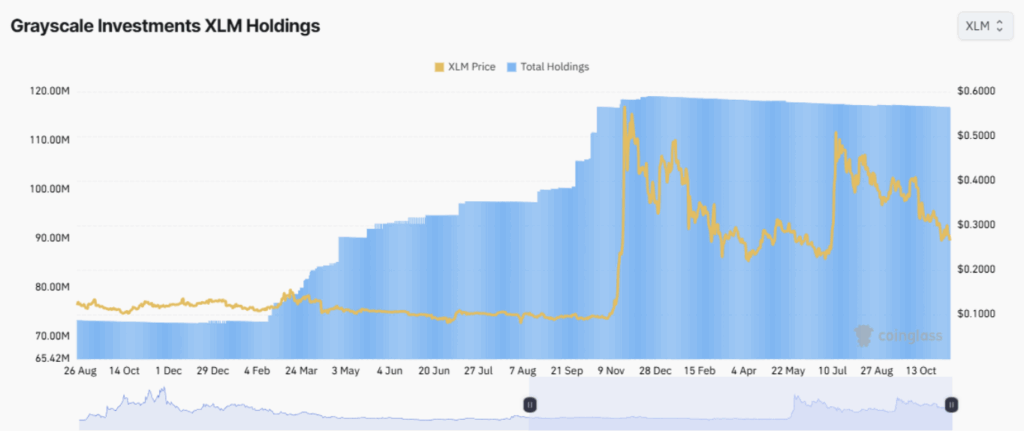

New data from Coinglass shows that Grayscale’s XLM strategy was spot-on last cycle. Before Stellar printed that monster “god candle” in November 2024 — the one that sent XLM up nearly 600% — the fund accumulated aggressively, boosting its holdings from 70 million to 119 million XLM.

It was one of those textbook smart-money moves: load up before the explosion, sit back during the mania.

But 2025 has been a different story. As XLM lost steam and stopped setting new highs, Grayscale’s holdings slipped slightly to 116.8 million. No big dumping, but also no new buying. The message feels like: “We still believe… just not enough to double down in this market.”

Interestingly, shares of the Grayscale Stellar Lumens Trust (GXLM) trade at a 10–15% premium over NAV. That means investors are literally paying above the underlying value just to get exposure — a sign that long-term conviction still exists, even in this nasty downturn.

But let’s keep this in perspective: even with over 116M XLM, Grayscale holds just 0.36% of the circulating 32+ billion supply. That’s nowhere near enough to control market direction, even if they wanted to.

Can Stellar Fight Back Against Heavy Selling Pressure?

Stellar isn’t without weapons heading into 2026. November 2025 marked a rare moment of unity in crypto when seven major players — including Solana Foundation, Polygon Labs, the TON Foundation, Mysten Labs, Fireblocks, and of course the Stellar Development Foundation — launched the Blockchain Payments Consortium (BPC).

The mission: build shared standards for blockchain payments and create real interoperability across ecosystems. For Stellar, a chain obsessed with borderless value transfer, this is basically home-field advantage.

Stellar says Q3 also brought 37% growth in full-time developers, outpacing the industry by 8x. The builder momentum seems real.

Meanwhile, the network’s push into Real-World Assets is exploding. RWA value on Stellar hit $654M in November 2025 — more than double the $300M it had at the start of the year. Tokenized products from Franklin Templeton and WisdomTree have been big contributors, pushing Stellar deeper into the regulated-asset lane.

Adoption Is Rising — But Market Sentiment Isn’t

Here’s the frustrating part for XLM holders: fundamentals look better than ever, but market sentiment doesn’t care right now. Historically, November has been a rough month for Stellar, and this year is no different.

With crypto still in “extreme fear,” XLM may struggle to break out of the broader altcoin downtrend… at least until the market stops panicking.

The question now isn’t whether Stellar is building — clearly, it is — but whether the market will actually reward that progress anytime soon.