- Stellar has dropped over 21% since July 19 but is showing short-term signs of a potential rebound as bulls defend the $0.42 support zone.

- Spot demand and open interest are rising, while funding rates have flipped positive, hinting at near-term bullish momentum.

- Retail activity has cooled off, and there’s no major selling pressure — giving bulls some breathing room to attempt a breakout above resistance.

Stellar (XLM) hasn’t exactly had a smooth ride lately. Since July 19, it’s dropped about 21.2%, which is a lot steeper than what we’ve seen across the rest of the crypto market. For some perspective, altcoins are down just over 4%, and Bitcoin’s barely flinched at -2.9%. So yeah, Stellar’s been on a bit of a wild ride.

But — and it’s a big but — that kind of volatility? It can create chances. While the price has taken a hit, bulls aren’t exactly waving the white flag. In fact, they’re trying to hold the line at $0.42, aiming to turn it back into support. If that happens, it could clear a path toward $0.515 — a decent little pump if the stars (no pun intended) align.

Short-Term Signs Point to a Possible Turn

Right now, the short-term data actually looks… not bad. According to Coinalyze, both the spot CVD and open interest have been ticking upward over the last 24 hours. That means traders are stepping back in — there’s more buying in the spot markets and a bit more speculative energy creeping in.

Plus, the funding rate’s positive, which adds another tick to the bullish side. Taken together, those signals suggest that, at least in the next day or two, XLM might try to claw its way back up.

But Technically Speaking… Still Some Hurdles

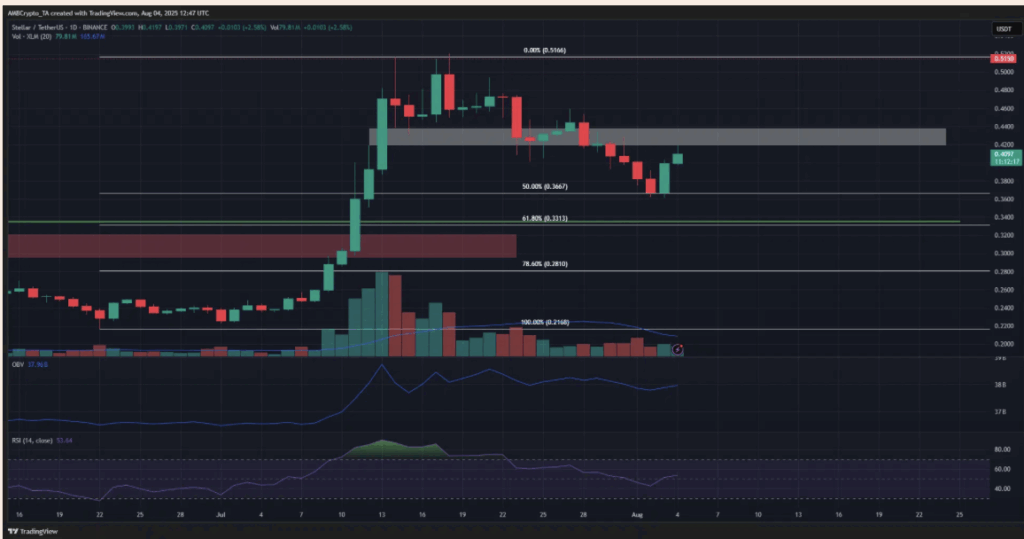

Zooming out a bit, the 1-day chart still leans bearish. Even though XLM bounced 12% off its $0.366 retracement level, it’s really just retesting the old support zone around $0.42–$0.44 — now acting as resistance. That zone’s gotta flip before we talk real momentum.

The RSI is neutral, the OBV is going sideways, and there’s no clear sign of strength yet. Basically: hope’s not lost, but the bulls have some work to do if they wanna flip the script.

What’s the Crowd Doing?

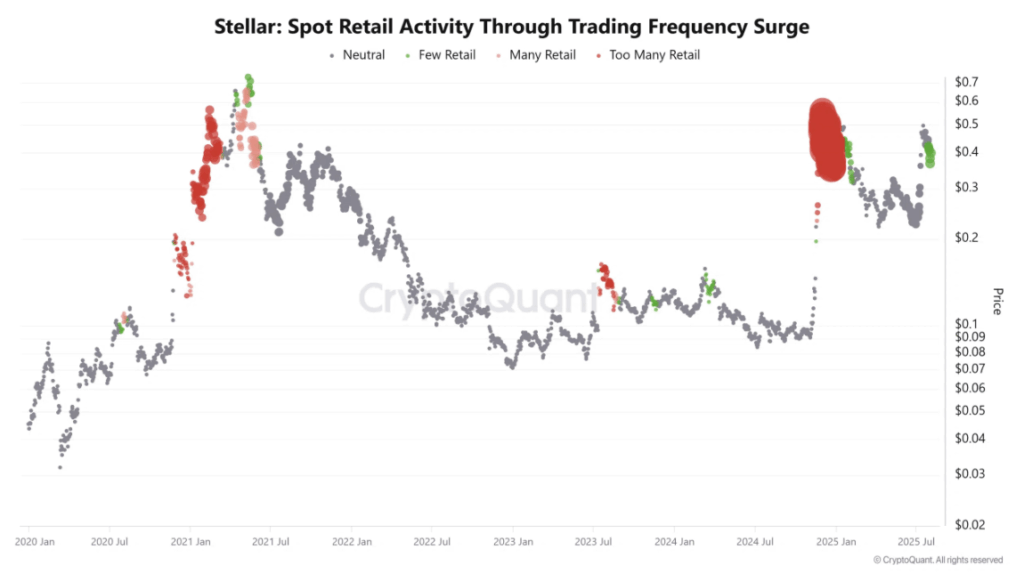

Retail traders? They’re kinda sitting this one out. CryptoQuant’s data shows spot retail activity dropping off lately. And that’s not a terrible thing — sometimes when there’s too much retail action (think giant red bubbles), the market overheats. So this little breather might actually be healthy.

Meanwhile, the spot taker CVD is holding flat, which isn’t super exciting, but it does line up with the idea that there’s no heavy selling pressure either. That’s key. Back in December 2024, Stellar got crushed by aggressive sell-offs. Right now, though? That’s not happening.

If bulls can keep the pressure on and push through that $0.42-$0.44 range, we could finally see some fresh upside action.