- 97 crypto funds have shut down this year out of the more than 700 that exist around the world, according to Swiss investment adviser 21e6 Capital AG.

- The trend seems to have been driven by regulatory uncertainty, inconsistent industry movements, and the rebound of Bitcoin ahead of nearly all other crypto coins and tokens.

About 100 crypto funds have shut down since the beginning of this year. Out of the more than 700 cryptocurrency funds worldwide, 97 have closed this year, according to Swiss investment adviser 21e6 Capital AG.

The heightened uncertainty witnessed in the crypto industry since the beginning of this year seems to have manifested in customers and investors. However, this trend seems to have been driven by a range of factors, including regulatory uncertainty, inconsistent industry movements, and the rebound of Bitcoin ahead of nearly all other crypto coins and tokens.

While the funds returned 15.2% on average in the first half of the year, they underperformed Bitcoin’s gain of 83.3%. According to the report, many of the funds had been holding more cash than usual due to industry turmoil last year.

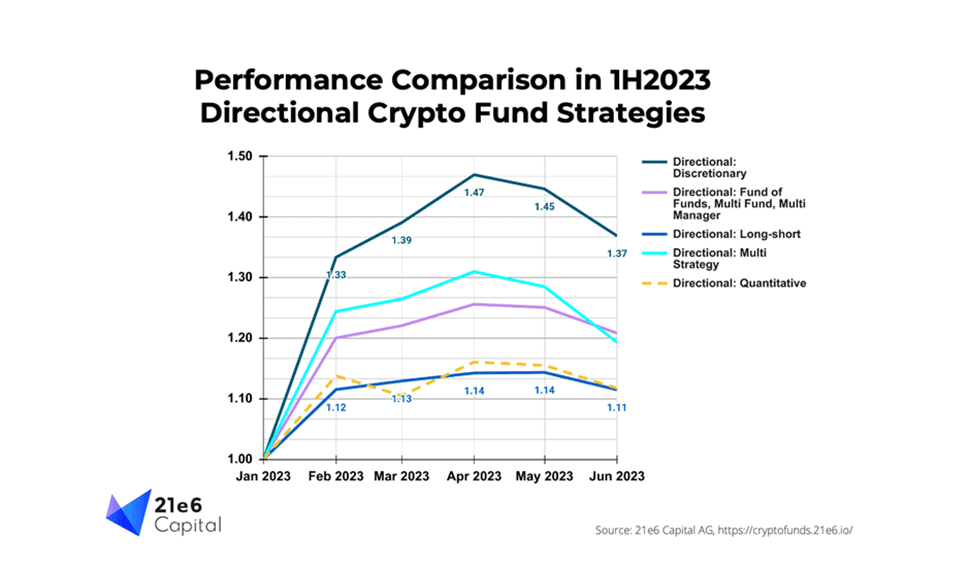

As per bitcoinmonthlyreturn.com data, Bitcoin saw an impressive gain of around 40%, nearly twice the performance of crypto funds, in January. While funds showed approximately similar results to Bitcoin in February, they failed to capitalize on the upward movement in March, with Bitcoin surging by 23%, while directional crypto funds only managed a 4% increase.

However, 21e6 Capital AG confirmed that this trend occurred due to the prevailing positive trajectory of the crypto market until the end of June, with regulatory uncertainties impacting various funds’ operational pace. Discretionary crypto funds were not affected by this problem. Still, many funds were forced to scale back their operations due to regulatory uncertainty surrounding well-known banking partners and fund administrators.

Directional Crypto Funds Underachieve To Catch Up with Bitcoin in 2023

Notably, the statistics platform has stipulated that directional crypto funds underperformed Bitcoin in 2023 because they were in “defensive mode after the devastating events of 2022, most notably FTX’s demise. This led to many hedge funds holding their funds in more extensive cash reserves than usual.

The FTX downfall also impacted various crypto funds directly. Some include Galois Capital which imploded in February with $40 million worth of assets trapped in the defunct exchange.

Moreover, the repercussions of the exchange’s demise led to top crypto-friendly banks, such as Silvergate, collapsing, leaving the crypto industry without banking services. This created skepticism in the rest of the traditional banking industry, with no bank rising to help the crypto industry. As a result, “even exceptionally well-performing funds shut down due to lack of a new banking partner,” the report stated.

Meanwhile, the “choppy” markets kept quantitative funds from rising, leading to inaccurate signals for trading algorithms employed by systematic crypto quant funds. According to Maximilian Bruckner, head of marketing and sales at 21e6, certain funds have had difficulty finding new partners for banking services. Bruckner added that although fund inflows and fund launches signal a slight improvement in sentiment among investors, it has not yet fully recovered.