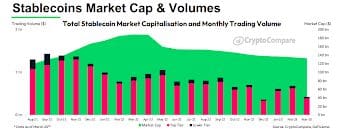

- The total market capitalization of stablecoins fell 1.34% to $133 billion in March.

- Stablecoins trading volume reached $51.9 billion after USDC and other stablecoins recovered their USD peg.

- True USD’s market cap increased 82.6% to $2.04bn due to Binance’s resumption of TUSD trading pairs.

Stablecoins have grown to become an essential category of cryptocurrencies. These digital assets have grown significantly in size over the last few years. Stablecoin daily trading volume reached the highest level since November 10 after the collapse of FTX, according to the report by CryptoCompare.

Market Cap Continues To Fall As Stablecoins Depeg

Cryptocompare, an FCA-regulated digital asset data provider, released its Stablecoins & CBDCs Report on March 22- a monthly publication that provides a broad overview of the stablecoins sector. The latest review focuses on analysis related to market capitalization and trading volume of stablecoins, segmented by their type based on collateral, and the pegged asset, among others.

Regarding market value, the report notes that when stablecoins depeg, their cumulative value falls. For example, the overall market capitalization of this crypto class fell 1.34% to $133 billion in March, hitting the lowest level since September 2021. It was also the twelfth straight monthly decline.

According to the crypto data provider, this fall in the market cap can be attributed to the depegging of several stablecoins following the collapse of the crypto-friendly Silicon Valley Bank (SVB) earlier this month.

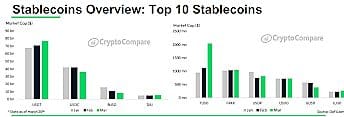

Circle’s USDC stablecoin, the second-largest stablecoin at $34.4 billion of market cap, depegged from the U.S. dollar after announcing that over $3.3 billion of its $40 billion reserves had been locked in the Silicon Valley Bank.

The USDC/USD trading pair dropped as low as 87 cents, the lowest price since April 2021, on March 11. It regained its 1:1 USD peg after the U.S. government intervened to ensure that all depositors had access to their deposits with SVB.

Other stablecoins, including DAI, FRAX, and True USD (TUSD), also depeged as contagion from the collapse of Silicon Valley Bank spread.

Stablecoins market dominance stood at 11.4% on March 20, falling from 12.6% in February and recording the lowest end-of-month market share since April 2022, according to the Cryptocompare report. The decline in stablecoin dominance highlights the rally in the prices of non-stablecoin cryptos amidst the recent depeg of USDC and other associated stablecoins.

The chart above also shows that the trading volume of stablecoins increased between December and February, rising 11.4% to $682bn from January. The report highlighted the following:

With the rise in trading activity following the depeg of stablecoins, trading volume is on track to rise in March, having traded a volume of $564bn (as of March 20).

At the time of writing, the 24-hour stablecoins trading volume stood at $51.93B, which is 91.85% of the total crypto market 24-hour volume, according to data from CoinmarketCap.

Another key takeaway from the Cryptocompare report is that True USD’s market cap increased 82.6% to $2.04 billion after Binance, the largest crypto exchange in the world by trading volume, resumed TUSD trading pairs and converted $1 billion worth of BUSD to TUSD and USDT.

Notably, Binance USD (BUSD)’s market cap continued to slide following the SEC’s action against the stablecoin in February. BUSD’s market value fell 22.2% to $8.29bn.