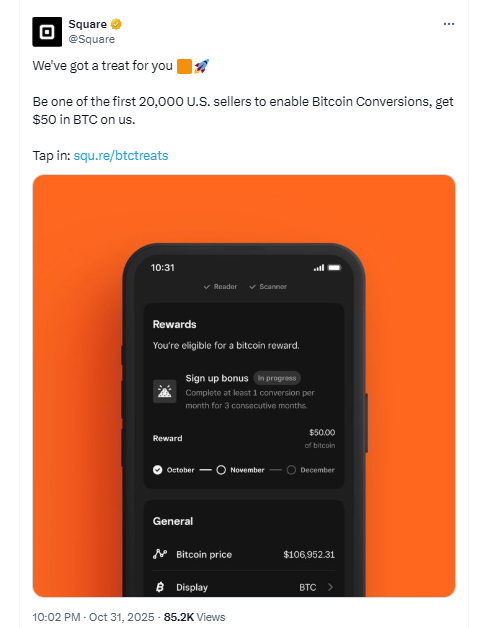

- Square is giving $50 in BTC to the first 20,000 U.S. merchants who enable its new Bitcoin Conversations feature.

- The feature lets sellers chat and learn about Bitcoin directly within their Square dashboard.

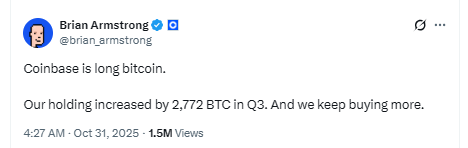

- Corporate Bitcoin buying remains strong, with Coinbase and Prenetics adding to their BTC holdings.

Jack Dorsey’s Square just gave the crypto world a treat this Halloween. The company announced that the first 20,000 U.S. sellers to enable its new “Bitcoin Conversations” feature will each get $50 in Bitcoin. It’s part of a campaign to make crypto talk as common as small talk—especially for merchants who might be new to the space. The initiative aims to get more people using and understanding BTC, not just holding it.

Bitcoin Conversations: Turning Merchants Into Crypto Natives

Bitcoin Conversations lets small business owners chat about Bitcoin directly inside their Square dashboard—think of it like a crypto-focused chat window for real-world sellers. Merchants can share insights, ask questions, and learn from others while managing payments. This comes shortly after Square rolled out a zero-fee Bitcoin wallet for local businesses, valid through 2026. Together, these steps show Dorsey’s long-term mission to weave Bitcoin into everyday business.

Corporate Bitcoin Buying Heats Up

The campaign arrives amid a surge in corporate Bitcoin interest. Coinbase just added 2,772 BTC to its reserves in Q3, signaling continued accumulation from major players. Meanwhile, Prenetics revealed another 100 BTC purchase, pushing its total holdings to 378. Even Strategy, led by Michael Saylor, reported $3.9 billion in income and $20 billion in unrealized BTC gains—showing that institutional conviction hasn’t cooled.

Bitcoin Price and Market Mood

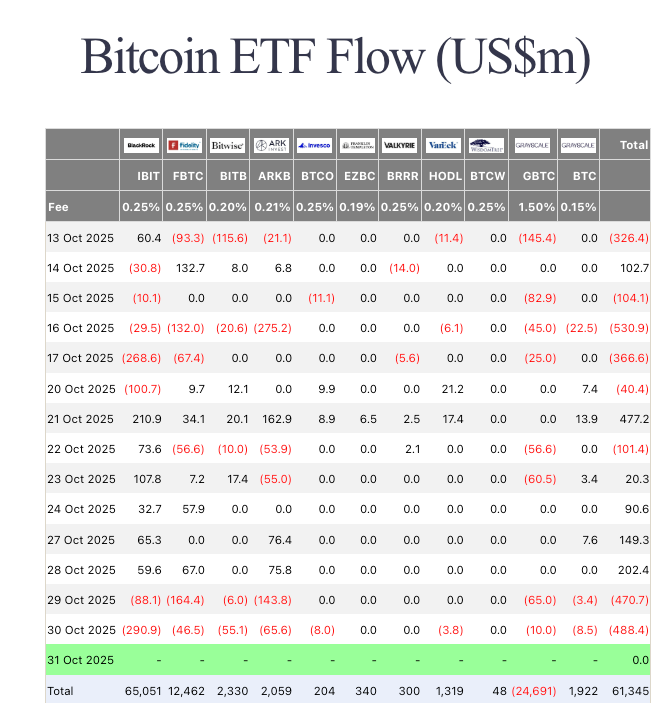

Despite all the optimism, Bitcoin’s price has been stuck around $109,000, struggling to break through the $110,000 resistance level.

ETF outflows and nerves around U.S.–China trade talks have capped the rally. Still, campaigns like Square’s could help reignite retail curiosity, putting Bitcoin back in the center of payment innovation. And if more companies follow suit, BTC adoption could look a whole lot different by 2026.