• Gold faces a bearish correction but remains supported near $4,000 per ounce.

• Technical traders eye sell setups at $4,150 and buy opportunities near $3,980.

• Fed rate decisions and global central bank moves could spark renewed volatility — here is what to watch next.

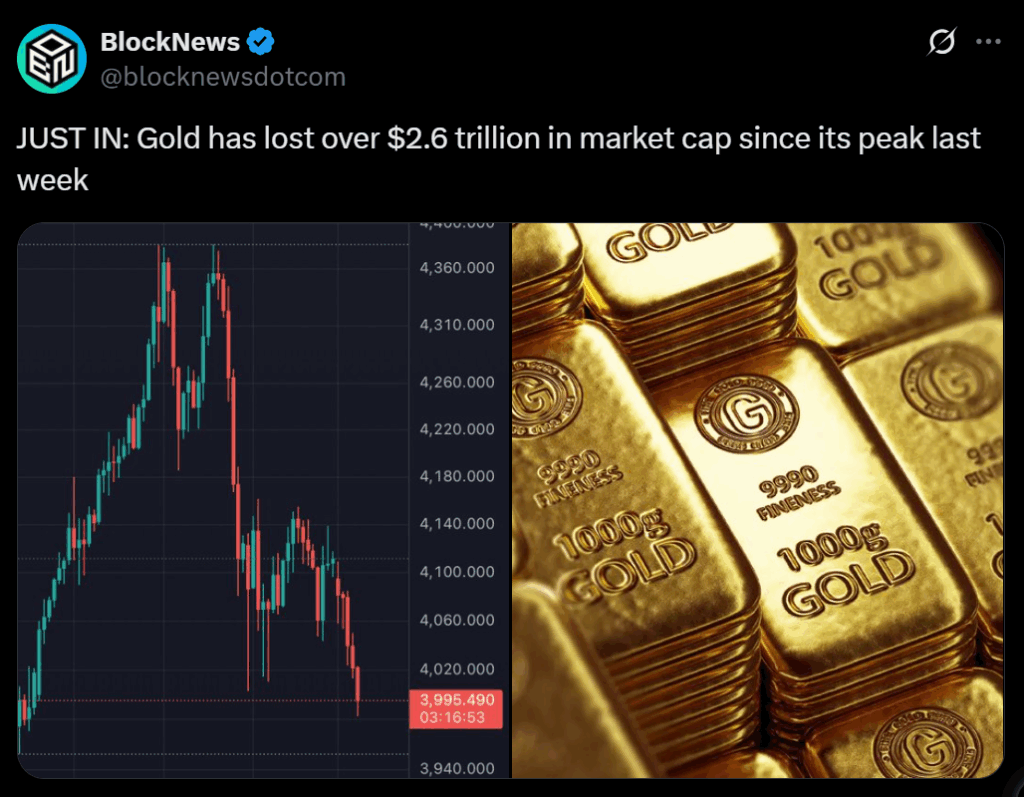

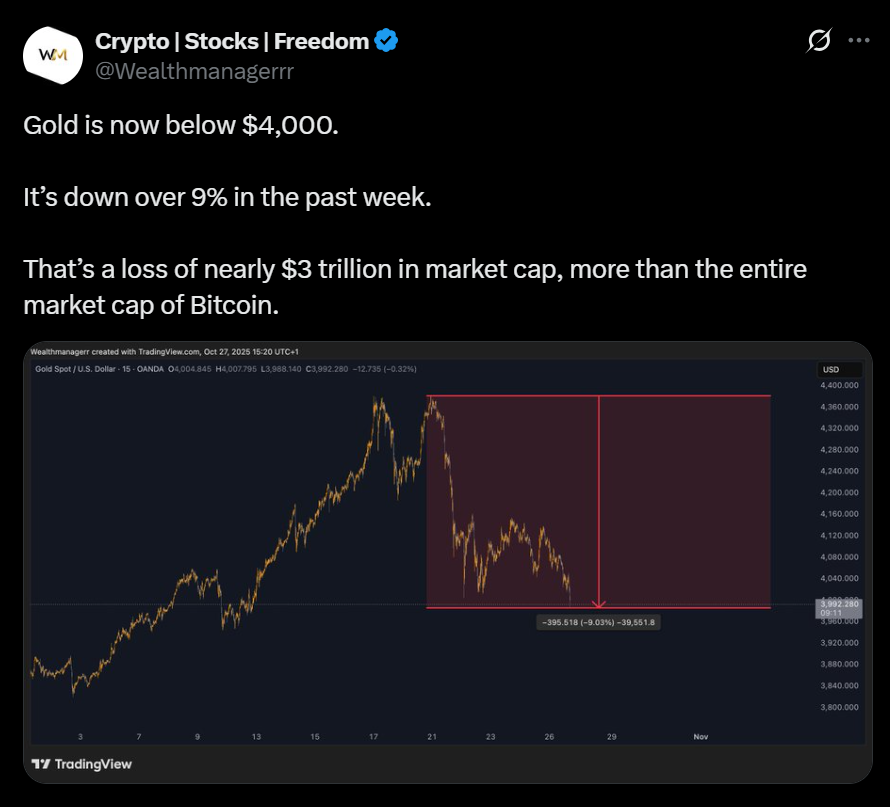

Gold continues to face a technical correction after retreating from its record highs earlier this month. The precious metal, which reached $4,382 per ounce in October, is now hovering around the crucial $4,000 level — a zone that has flipped from psychological resistance to key support. Analysts suggest that this price phase mirrors a familiar pattern, with gold repeatedly testing its lower trend boundaries before forming a new base. Today’s gold support levels sit at $4,020, $3,975, and $3,920, while resistance lies near $4,110, $4,180, and $4,240.

Key Trading Signals for the Day

Technical traders are eyeing two clear setups. A sell position from $4,150 is recommended with a target of $3,970 and a stop loss at $4,200. Conversely, a buy setup emerges from $3,980, targeting $4,200 with a stop loss near $3,910. The market’s current structure shows consolidation near $4,000, indicating indecision as investors await clarity from macroeconomic events — particularly the U.S. Federal Reserve’s policy announcement and a highly anticipated U.S.–China trade meeting that could shift global sentiment.

Market Outlook: Policy Moves Could Define Gold’s Next Trend

Traders anticipate that the Fed’s upcoming rate cut — coupled with softer inflation data — may provide short-term relief for gold. However, sentiment remains mixed. While short-term traders lean bearish following recent profit-taking, long-term investors still maintain a cautious bullish outlook. Analysts note that the correction, though sharp, was likely exaggerated by nervous market participants exiting positions ahead of this week’s policy-heavy calendar.

Consolidation and Longer-Term Support

Despite near-term weakness, experts argue that gold is forming a healthy buying base between $4,000 and $4,300. This consolidation range could set the stage for another rally once macro uncertainty clears. With central banks across the globe signaling dovish tones, gold’s fundamentals — inflation hedging, geopolitical risk, and policy-driven liquidity — remain intact. Still, caution is advised: traders should monitor both the Fed’s tone and bond market reactions for signs of renewed momentum.