- S&P launched the Digital Markets 50, blending 15 cryptos and 35 blockchain stocks into a new index.

- Partnering with Dinari, the index will trade as a tokenized product on the dShares platform.

- It offers diversified, rules-based exposure at a time when Bitcoin and crypto equities are hitting record highs.

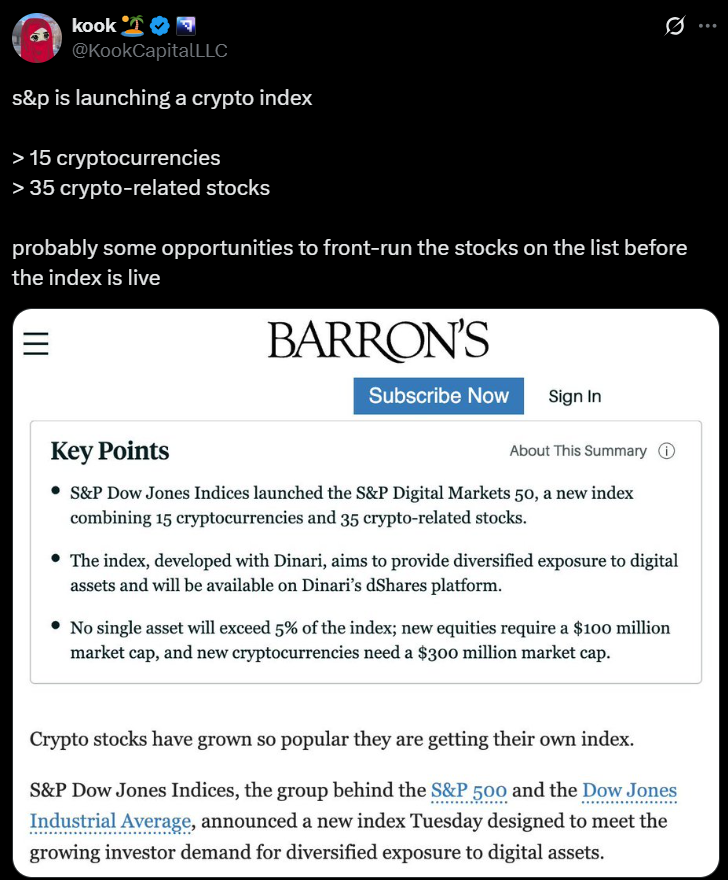

S&P Dow Jones Indices, the firm behind the S&P 500 and Dow Jones Industrial Average, has launched the S&P Digital Markets 50. The index blends 15 major cryptocurrencies with 35 crypto-related stocks, offering diversified exposure to the digital asset economy. Developed in partnership with Dinari, the index aims to meet growing demand from investors seeking structured, rules-based access to crypto without directly holding tokens.

How the Index Works

No single asset will account for more than 5% of the index, ensuring balanced representation. New crypto entrants must have a market cap of at least $300 million, while equities need a $100 million market cap. Like other S&P indices, it will follow quarterly rebalancing and strict governance rules. Constituents include a mix of tokens like Bitcoin and Ethereum, alongside companies such as Coinbase, Circle, and Strategy, the corporate Bitcoin treasury giant.

Tokenization and Dinari’s Role

The index will be investable through Dinari’s dShares platform, where a tokenized product will track performance. Tokenization allows the index to trade on blockchain rails rather than traditional exchanges, giving investors fractional, global, and always-on access. Dinari CEO Gabriel Otte emphasized that demand from wealth managers and RIAs is growing, with clients increasingly requesting “the S&P 500 of crypto.” This product aims to deliver exactly that—broad, liquid, and diversified exposure.

Why It Matters for the Market

The launch comes during a strong year for crypto assets: Bitcoin just hit a record high above $125,000, Coinbase stock is up 55% YTD, and crypto IPOs like Circle have gained traction. By combining tokens with equity exposure, S&P’s Digital Markets 50 provides a unique multi-asset bridge between Wall Street and Web3. For institutional investors cautious about volatility, indexation offers more stability—while still retaining crypto’s high-risk, high-reward edge.