• S&P 500, Dow, and Nasdaq all hit record highs, led by AI stocks like Nvidia and Microsoft.

• The Fed is expected to cut rates again this week, with investors eyeing another move in December.

• A potential U.S.–China trade deal and improving global sentiment are fueling optimism.

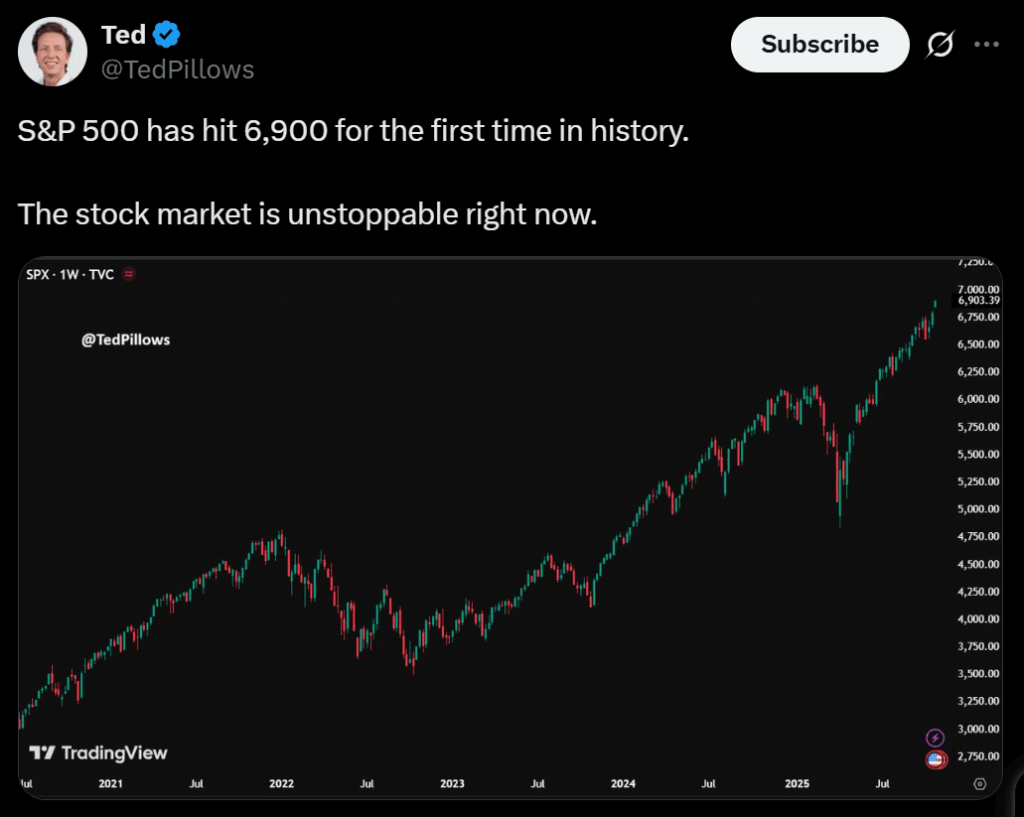

U.S. stock markets soared to fresh highs on Tuesday, with the S&P 500 climbing 0.23% to close at 6,890.89, briefly topping the 6,900 level for the first time intraday. The Nasdaq Composite surged 0.8% to 23,827.49, while the Dow Jones Industrial Average gained 161.78 points to settle at 47,706.37. All three major indexes — along with the small-cap Russell 2000 — hit new all-time highs, continuing an impressive streak fueled by artificial intelligence optimism and upbeat earnings.

Nvidia and Microsoft Lead the AI Wave

Market momentum was led by Nvidia, which jumped 5% to a new record high after unveiling a $1 billion investment in Nokia at its GTC conference. The Finnish telecom giant said the capital would help fund its own AI expansion, deepening ties between traditional tech infrastructure and next-generation computing. Meanwhile, Microsoft rose 2% ahead of its Wednesday earnings report, buoyed by news that OpenAI had completed its recapitalization — a move expected to deliver a major financial windfall to Microsoft, which holds roughly 27% of OpenAI’s for-profit arm.

Big Tech heavyweights Apple, Alphabet, Amazon, and Meta Platforms — part of the “Magnificent Seven” — are also set to report this week. Together, these firms account for nearly 25% of the S&P 500’s market value, and so far, the earnings season has exceeded expectations, with 83% of S&P companies beating estimates, according to FactSet.

Fed Rate Decision and U.S.–China Optimism

Investors are now turning their focus to Wednesday’s Federal Reserve meeting, where policymakers are widely expected to deliver a second rate cut this year, lowering the benchmark rate from 4.1% to around 3.9%. Traders are also watching for signals of another cut in December, as Fed Chair Jerome Powell seeks to balance labor market risks with inflation trends.

Adding to bullish sentiment, U.S.–China trade talks are showing signs of progress ahead of Thursday’s meeting between President Donald Trump and President Xi Jinping. Reports suggest the two sides are working toward a deal involving tariff reductions, rare earth mineral access, and TikTok’s U.S. operations.

The Bigger Picture

With AI breakthroughs, strong corporate earnings, and improving geopolitical tone, markets appear to be entering a new growth phase. Still, analysts warn that valuations remain historically high — meaning the next leg of the rally will need to be driven by earnings, not just policy easing.