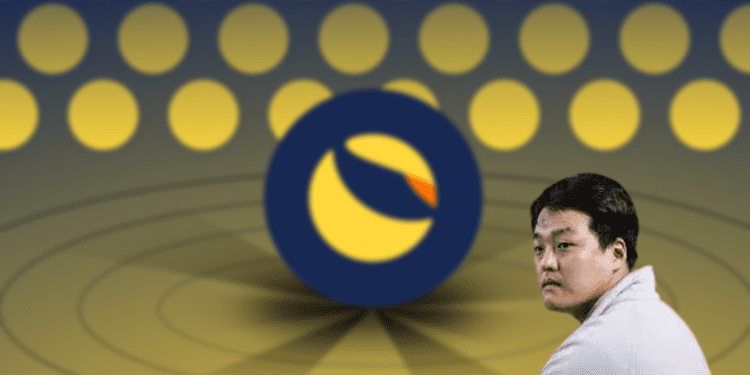

The Luna Classic (LUNC) community was excited after the crypto rallied 40% on Tuesday to trade close to $0.0004. This excitement was short-lived following the issuance of an arrest warrant against the CEO of Terraform Labs Do Kwon by South Korean authorities.

Terra and Luna Founders Wanted For Violating Capital Markets Laws

A court located in South Korea’s capital Seoul has reportedly issued a warrant for Do-Kwon and five others on several claims, including violation of the country’s capital market laws. According to the Seoul Southern District Prosecutor’s Office’s Financial and Securities Crime Unit, the arrest warrants were requested and issued against the Terraform Labs officials, including CEO and co-founder Kwon Do-hyeong, a founding member of Nicholas Plates, and Han Mo, a Terraform Labs employee.

The Prosecutor’s office alleges that the cryptocurrencies within the Terra ecosystem, TerraUSD (UST) and TerraLuna (LUNA), all fell under “investment contract securities” under the Capital Market Act. The Act defines an investment contract security as a security where “money is invested in a joint project in the hope of making a profit, and a payment is received according to the result.” It is alleged that Terraform Labs issued its tokens as securities, subjecting them to South Korea’s security laws.

At the time of issuing the warrant, all key members of the Terra company were residing in Singapore, including Do Kwon. In a recent interview, Kwon claimed that no South Korean investigators have ever contacted him and that it was difficult for him to decide whether to return to Korea.

According to the warrant, the prosecution plans to collaborate with international law enforcement bodies such as Interpol and use such measures as passport invalidation to ensure justice is served.

UST/LUNA Collapse Marked The Beginning Of Do Kwon’s Woes

By May this year, LUNA had climbed to be among the top 10 cryptocurrencies in the world by market capitalization. Its sister token, UST, became the 3rd largest dollar-pegged stablecoin. But in mid-May, following what was referred to as a coordinated and focused attack on UST, the Terraform ecosystem collapsed after the stablecoin de-pegged from the dollar.

As a result, LUNA’s price dropped by more than 99.99% as investors swiftly dumped the altcoin in what was likened to a bank run-in. Investors then sued Kwon and his colleagues for violating the Capital Markets Laws on the Regulation Fraud and Similar Receipts under the Special Offer Act.

The UST/LUNA debacle caused one of the most devastating market crashes in the history of cryptocurrencies marking the start of the 2022 bear market. This triggered the loss of UST and LUNA (now renamed Terra UST Classic – USTC and Luna Classic – LUNC, respectively), worth millions of dollars by investors.

Terra’s crash also took several decentralized finance (DeFi) protocols, leading to an up to 80% decline in most of the projects associated with the stablecoin. Crypto lending, borrowing, and crypto hedge firms also went down, including Three Arrows Capital (3AC), Galaxy Digital, and Celsius.

At the time of writing, LUNC was down 20% on the day to trade at $0.00028, undoing all gains made on Tuesday.