- Solana’s real economic value (REV) was 111% of Ethereum’s REV in October 2024, up from 1% in the same period last year.

- Solana’s total application revenue (TAR) was 109% of Ethereum’s in October 2024, compared to 1% a year ago.

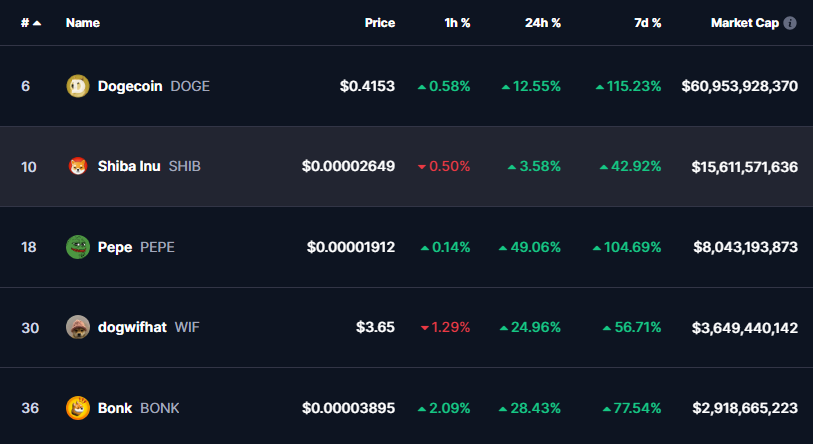

- Solana’s memecoin mania, with several new memecoins gaining traction within the ecosystem in October, contributed to the surge in economic activity.

The Solana network has been rapidly gaining ground against Ethereum. Key metrics show Solana’s market share and revenue have risen dramatically in 2022.

Solana’s Economic Growth

According to the Syncracy Capital report, Solana’s real economic value (REV) was 11% of Ethereum’s in October 2024, up massively from just 1% in October 2023. REV includes transaction fees and validator tips, indicating overall network economic activity.

Solana’s total application revenue (TAR), referring to fees paid to protocols and dApps, hit 10% of Ethereum’s in October 2024 compared to just 1% a year prior.

Memecoin Speculation Fuels Growth

Solana’s surge is largely attributed to memecoin mania, with several new memecoins gaining traction in October. Notable gainers include GOAT, SPX6900, Apu Apustaja, and FWOG.

This memecoin interest has driven up Solana’s network volumes, fees, and total value locked (TVL), which hit a 2-year high of $4.2 billion on October 26.

Stress Testing Solana’s Reliability

While memecoin speculation has sparked concerns about sustainability, Syncracy views it as a valuable stress test of Solana’s reliability. Solana has experienced multiple outages since launching in 2020.

Syncracy notes Solana is attracting major decentralized infrastructure projects, with 9 “unicorn” DePIN protocols compared to Ethereum’s 18.

Conclusion

Solana has seen massive growth in key economic metrics versus Ethereum, fueled largely by memecoin mania. This growth has stress tested Solana’s infrastructure as the network aims to accommodate rising activity levels.