- Solana climbed above $228 after MOGU invested $20M and Safety Shot added $5M in BONK.

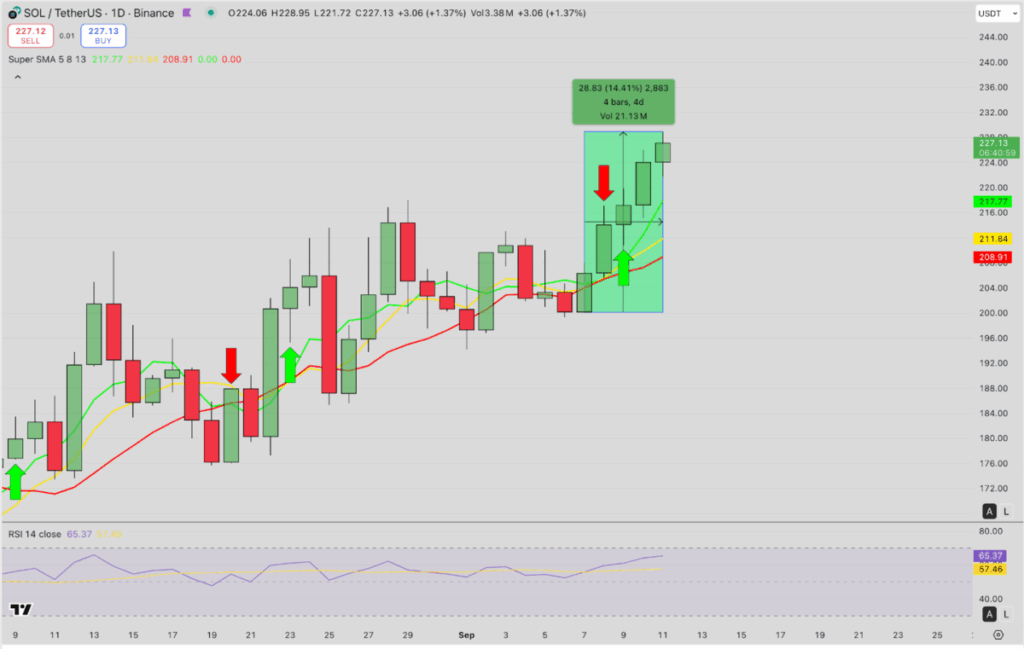

- A golden cross triggered a 14% rally, with RSI at 65 leaving room for further gains.

- SOL holds support at $217–$208, with resistance ahead at $240–$250.

Solana has been on a tear lately, notching another 2% gain and pushing its price past $228 for the first time since February. The rally isn’t happening in a vacuum—fresh capital is pouring in from unexpected corners. A Chinese fashion company, MOGU, just committed up to $20 million into crypto assets like Bitcoin, Ethereum, and Solana. At the same time, Nasdaq-listed Safety Shot revealed it scooped up $5 million worth of BONK, adding fuel to Solana’s growing ecosystem.

Momentum From Technical Signals

On the charts, things are looking just as lively. A golden cross has appeared, with the short-term moving average flipping above the longer ones—traders usually take this as a sign of extended upside. In the last four days alone, Solana has jumped 14%, showing no signs of cooling despite the RSI sitting near 65. That still leaves room for more growth before hitting overbought levels. Price is holding solid support around $217, which keeps bulls confident, while traders are eyeing the $240–$250 resistance zone as the next battleground.

Corporate Inflows Shape Narrative

The bigger story is how companies are starting to treat crypto like a serious treasury play. MOGU’s $20 million allocation signals that adoption isn’t just a Western trend—it’s global. Safety Shot forming BONK Holdings LLC, with a fresh $5M boost to its memecoin reserves, highlights how businesses are diversifying into more than just Bitcoin. Solana’s place in these allocations puts a spotlight on its strength as both a network and an investment bet, and it’s helping to set the stage for even more institutional participation.

Looking Ahead to $250 and Beyond

For now, Solana is consolidating gains above $220, a level that could serve as the launchpad for the next move up. If momentum holds, $240 seems within reach, and $250 could be tested again for the first time since January. On the flip side, if the $217 support cracks, traders might look toward $208 for a reset. With trading volume rising faster than price itself, there’s plenty of incentive for speculative money to keep piling in. Between technical signals and corporate inflows, Solana’s golden cross moment might just be the spark for another big leg higher.