- Whales added around $26 million in net spot inflows and opened $457 million in longs on Solana this week.

- Solana ETFs from Grayscale and Bitwise now hold about $351 million in SOL and haven’t seen a single day of outflows since launch.

- SoFi Bank becomes the first U.S. bank to let users buy Solana directly through their checking accounts, boosting retail accessibility.

Solana’s been quietly warming up again. After a few sluggish weeks, the network is showing early signs of life, driven by whale inflows, steady ETF interest, and a surprising boost from traditional finance.

Whales slowly drift back into Solana

In the first half of this week, Solana (SOL) finally caught some upside momentum, though the overall crypto market mood still feels uncertain. The difference this time? Whales. Big players have started circling again, and their activity could be hinting at something brewing underneath the surface.

Data from Coinglass shows that since Monday, large Solana holders have been far more active. Across Binance, OKX, and Coinbase, whales poured in an average of $26 million in net spot inflows over the last three days. That’s a decent pulse of confidence considering how quiet it’s been recently. On top of that, they opened over $457 million worth of long positions on Binance and OKX during the same stretch — another sign that some big wallets are betting on a potential rebound.

For the past few weeks, demand from whales was basically flat as prices drifted lower. This new wave of inflows might mean the price has reached a level attractive enough for accumulation. That said, it’s still early. The buying pressure isn’t overwhelming yet — it’s more like cautious optimism rather than full-blown conviction.

Solana ETFs add fuel to the confidence fire

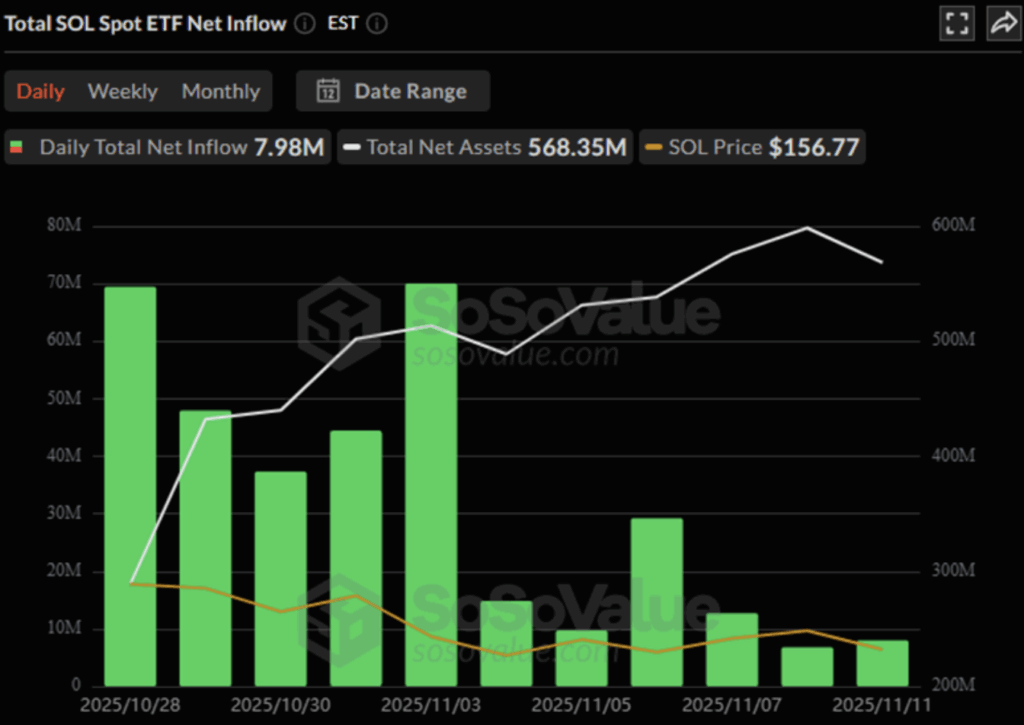

Beyond the whales, there’s another story quietly building strength: Solana’s ETFs. Over the last two weeks, Solana-focused exchange-traded funds have been mostly positive. Two new staking SOL ETFs recently got approval, and since going live in late October, they haven’t seen a single day of negative flows.

That’s rare. Even major Bitcoin and Ethereum ETFs have recorded multiple days of outflows lately, so seeing Solana maintain green numbers through a choppy market says a lot about investor confidence. Combined, Grayscale and Bitwise’s Solana ETFs now hold around $351 million worth of SOL.

Still, it’s worth noting that while inflows are steady, they’ve shown slight signs of cooling off compared to their initial burst. The market may be waiting for a stronger catalyst before doubling down again — maybe something like a sustained breakout or renewed retail hype. But even now, these ETF flows stand as proof that institutional demand for Solana hasn’t disappeared.

SoFi Bank gives retail access to SOL

The institutional side isn’t the only one picking up. Retail investors just got some good news too. SoFi Bank, a major U.S.-based financial institution, announced it will start supporting crypto trading — and Solana is part of the lineup.

According to Solana’s official X (Twitter) account, SoFi is the first bank to allow users to access SOL directly through their checking accounts. That’s a pretty big deal because it bridges traditional banking with blockchain investing in a way that’s easy for everyday users. It may not sound flashy, but it’s exactly the kind of infrastructure that quietly builds long-term adoption.

Market outlook for Solana

For now, SOL’s price action still mirrors the cautious mood across crypto — slightly bullish, but far from euphoric. Whale activity and consistent ETF inflows show that confidence is rebuilding under the surface. If broader market conditions stay stable and retail access expands through platforms like SoFi, Solana could finally break out of its consolidation phase and retest higher resistance zones soon.

Momentum is slowly but surely returning, and Solana might just be one solid catalyst away from its next big move.