- SOL holds strong at $179.66 support, aligning with 61.8% Fibonacci retracement.

- Rising MVRV ratio reflects renewed investor confidence and gradual recovery momentum.

- RSI remains neutral-to-bullish, leaving room for further upside without overbought risks.

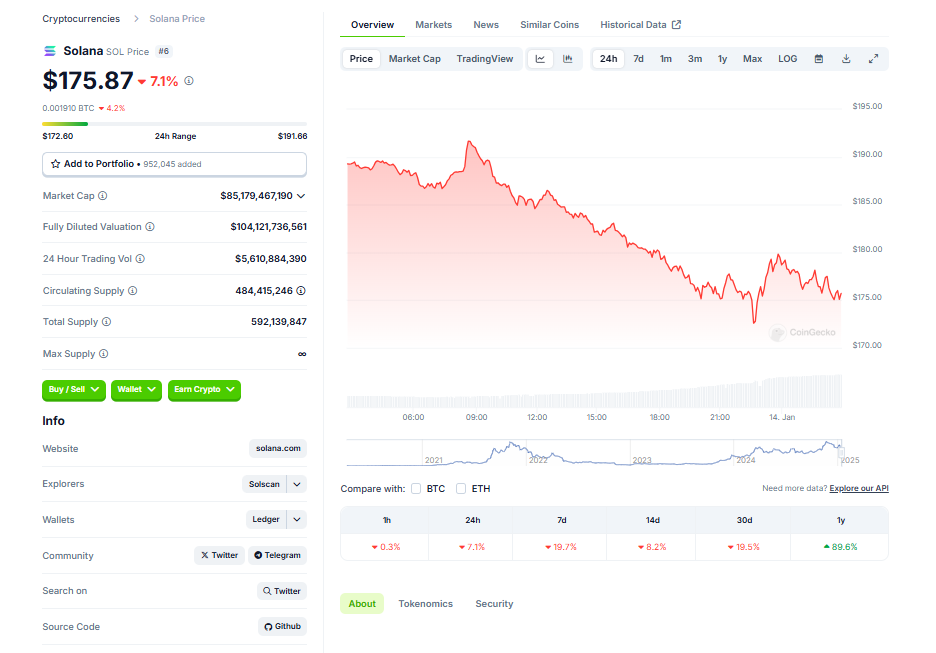

Solana (SOL) has caught traders’ eyes with its impressive V-shaped recovery, bouncing strongly from its key support at $179.66, a level that perfectly aligns with the 61.8% Fibonacci retracement zone. Historically, this retracement level acts as a pivotal area where bearish pressure often gives way to renewed buying interest.

This bounce not only reaffirms the $179.66 level as a reliable support zone but also sets Solana up for potential upward moves toward $254.35, $302.02, and even $345.76, in line with Fibonacci extensions. What’s more, the presence of higher lows in Solana’s price action hints at growing buyer interest, suggesting that the bullish trajectory could hold if market sentiment remains favorable. However, a break below $179.66 would invalidate this setup, making it a level to watch closely.

MVRV Ratio: Renewed Confidence Among Investors

Solana’s MVRV ratio is steadily climbing, signaling that investors who entered during accumulation phases are either at break-even or in slight profit. This recovery phase points to a growing optimism in the market.

Currently, the ratio hovers near a neutral zone, neither overvalued nor undervalued, which is ideal for attracting new buyers. If the MVRV continues its gradual climb without spiking into overbought territory, it could align with Solana’s bullish price targets. On the other hand, an extreme jump in the ratio might trigger profit-taking behavior, so maintaining a range between 1.0 and 2.5 would support a sustainable rally.

RSI: Room for Further Growth

The Relative Strength Index (RSI) for Solana currently trends in a neutral-to-bullish range, around 55–60, signaling that the asset has not yet entered overbought territory. This provides plenty of room for further upside without risking an immediate reversal.

In previous rallies, Solana’s RSI peaked near 70–75 before corrections began, meaning the current levels offer a healthy margin for buyers to continue driving the price higher. As long as the RSI remains below critical thresholds, the bullish setup for SOL appears intact.

Final Thoughts: Solana’s Road Ahead

Solana’s technical indicators present a compelling case for a sustained bullish rally. With solid support at $179.66, rising confidence from the MVRV ratio, and a neutral RSI providing room to grow, SOL seems poised to challenge higher levels in the coming weeks. Keep an eye on $254.35 as the next key target if this momentum holds strong.