- Solana rose 5% after reports that the SEC is advancing the process for spot SOL ETFs.

- Major asset managers like Fidelity and Grayscale have filed to launch SOL-based investment vehicles.

- The SEC is expected to review updated filings over the next 30 days, signaling potential progress toward approval.

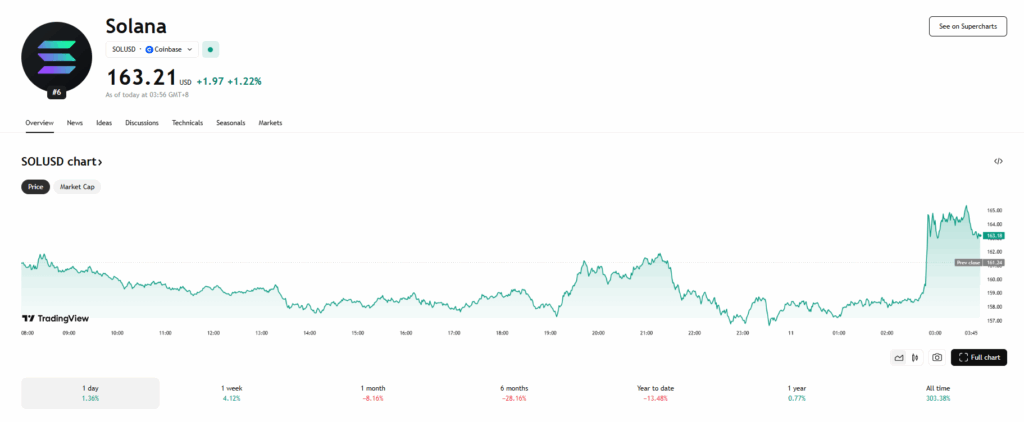

Solana (SOL) jumped 5% late Tuesday following a report from Blockworks that U.S. regulators are inching closer to greenlighting spot SOL ETFs. The news sent a jolt through the market, pushing SOL past the $164 mark in after-hours trading and lighting up bullish sentiment among investors.

According to the report, the U.S. Securities and Exchange Commission (SEC) has requested that prospective ETF issuers revise and submit their S-1 filings within the next week. Once received, the agency will begin a 30-day review process—an early but meaningful step in what could become a major milestone for Solana’s institutional adoption.

ETF Race Expands Beyond Bitcoin and Ethereum

With spot bitcoin and ether ETFs already trading in the U.S., the push for Solana-based products has accelerated. Major asset managers including Fidelity, Grayscale, Franklin Templeton, and VanEck have filed to launch SOL ETFs, hoping to tap into rising demand from traditional investors who want crypto exposure without dealing with wallets or private keys.

SOL has already been performing well in 2025, and this new ETF development could serve as a key catalyst. If approved, a Solana ETF would not only boost accessibility but also potentially bring greater stability and long-term capital inflow into the SOL ecosystem.

Market Reaction and Next Steps

Shortly after the news broke, SOL spiked to $164.89, continuing a steady climb that has seen it outperform much of the market. The token is now up nearly 5% in the past 24 hours and could see further upside if regulatory momentum holds.

While the SEC hasn’t officially confirmed timelines or approvals, the request for updated S-1 filings suggests the agency is taking the proposals seriously. CoinDesk reached out to the asset managers involved for further comment, but responses hadn’t come through at press time.