- Solana (SOL) is seeing increased whale activity, rising social buzz, and strong development metrics, with price currently testing key resistance at $153.65 after a recent 1.74% dip.

- Retail sentiment remains optimistic while institutional investors are more cautious, suggesting short-term volatility but a bullish longer-term setup.

- Technical indicators point toward a potential breakout, with a cup-and-handle pattern forming and the MACD showing bullish divergence — a successful breakout could send SOL toward the $180 level.

Solana (SOL) has been making some noise again — and not just from price charts. A pretty major whale transfer just happened: over 17,481 SOL moved to Kraken after being staked for two whole years. Big moves like that? Yeah, they usually get the market talking.

At the time of writing, SOL was trading around $148.52, down about 1.74% over the past 24 hours. That dip, combined with the whale moves, is definitely stirring up a lot of speculation and social buzz. Both retail traders and bigger institutional players are watching closely to see if this triggers Solana’s next big price swing.

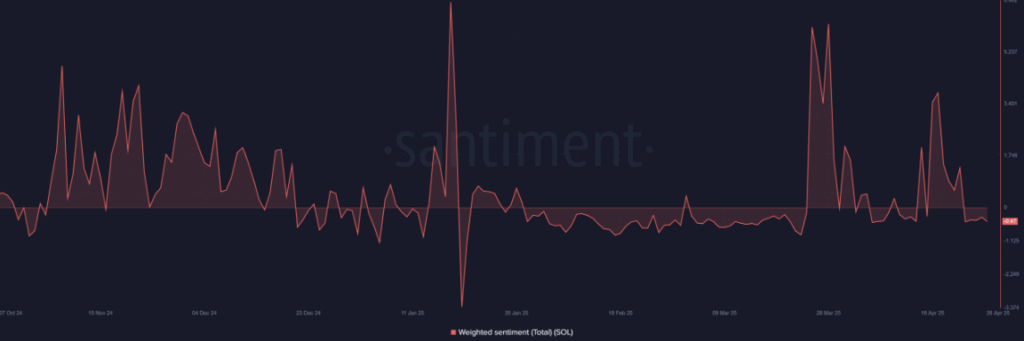

Retail vs. Smart Money: A Split in Sentiment

On the sentiment side, things are kinda… split. As of April 26, 2025, Solana’s weighted sentiment was sitting at -0.47— not exactly a roaring bullish signal.

But here’s the twist: crowd sentiment was still strong at 1.81, showing retail investors aren’t ready to back down yet. Meanwhile, smart money sentiment (aka the institutional folks) came in a bit cooler at 0.88, signaling they’re a little more cautious after the price dip.

So you’ve got regular investors feeling upbeat, while bigger players are playing it safe.

What’s that mean? Short-term volatility is probably on deck… but the long-term view? Still leaning bullish.

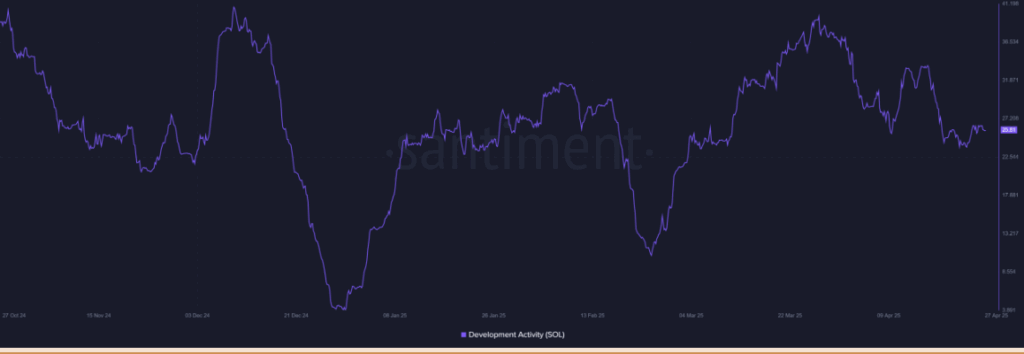

Development Work Stays Strong Behind the Scenes

Underneath the price action and hype, Solana’s fundamentals are still rock solid.

Development activity was holding steady at 25.81 as of April 27, 2025. That’s a big deal. It means that while the market gets noisy, the builders are still building — which sets the stage for long-term growth.

Healthy development keeps boosting network efficiency and scalability, making it more attractive for future users (and investors). So even if prices wobble short-term, the foundation looks strong.

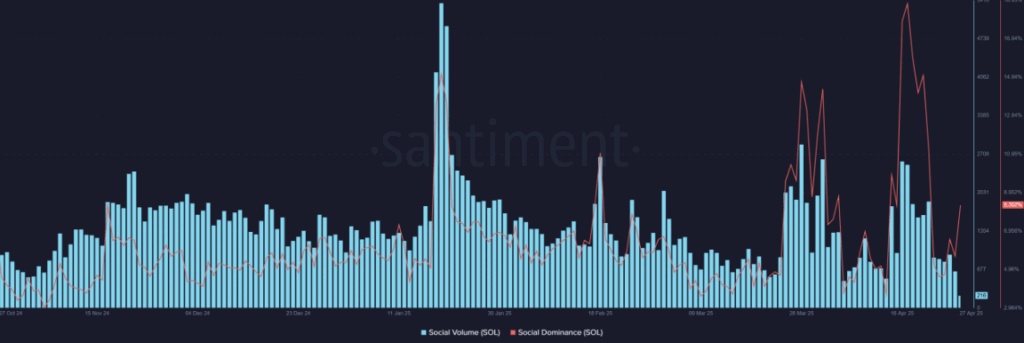

Social Buzz Picks Up Steam

If it feels like you’ve been seeing Solana everywhere lately, you’re not imagining things.

SOL’s Social Volume hit 216, and its Social Dominance rose to 8.3% at the time of writing. In simple terms: people can’t stop talking about it.

Social Volume measures how many times Solana pops up across platforms, while Social Dominance shows how much it’s standing out compared to other cryptos.

An uptick here usually means growing retail interest — and it often ends up influencing short-term price action, especially if hype builds fast.

Technical Setup: Key Resistance at $153.65

Right now, Solana’s price action is shaping up into a cup-and-handle pattern, which typically hints at a potential breakout.

SOL is inching closer to a critical resistance level at $153.65.

The MACD indicator is flashing a bullish signal too, with the MACD line crossing above the signal line — another good sign for bulls.

If SOL can smash through that resistance? The next big target looks like $180.

But if it gets rejected? We might see some consolidation or even a short pullback before the next move.

Final Take: Solana Poised for a Big Test

Right now, Solana’s market vibe is a spicy mix: whale transfers, rising retail hype, solid development, and bullish technicals.

If SOL can break through $153.65, we could be looking at a serious leg up toward $180.

But even if there’s some turbulence, the long-term structure — with strong fundamentals backing it — keeps the outlook promising.