- A whale wallet bought $8.37M worth of SOL near resistance, signaling long-term confidence.

- SOL trades around $192 with strong momentum but mixed indicators.

- Breaking above $196 could spark a 10% rally, while rejection might push it back to $180.

Solana has been on a bit of a tear lately, climbing around 10% in just a few days. The rally has brought it right up to a make-or-break level — one that could decide whether SOL keeps pushing higher or slips back again. What’s catching everyone’s attention though, is a massive whale quietly scooping up millions worth of SOL right at this key zone.

Whale Activity Signals Growing Confidence

According to data from Lookonchain, a crypto wallet identified as Ax6Yh7 recently bought 44,000 SOL, worth roughly $8.37 million, while the token hovered near resistance. This isn’t a random buy either — this same whale has been steadily building a position for months. Since April 2025, they’ve accumulated around 844,000 SOL, valued at roughly $149 million, through platforms like FalconX and Wintermute. Most of these tokens are staked, showing clear confidence in Solana’s long-term potential rather than short-term speculation.

Big money tends to move early, and this kind of accumulation often precedes larger price swings. It’s like they’re positioning ahead of something. Still, traders are split — some see it as bullish conviction, while others think it’s just whales using the hype to test resistance again.

Price Action and Resistance Watch

As of now, SOL trades around $192, up slightly by 0.75% in the past 24 hours. Despite the price uptick, trading volume has actually dropped by about 22%, sitting near $5.1 billion. That shows retail interest might be cooling off a bit even as whales buy in. The real test now sits at the $196 resistance level — one that’s rejected Solana multiple times before.

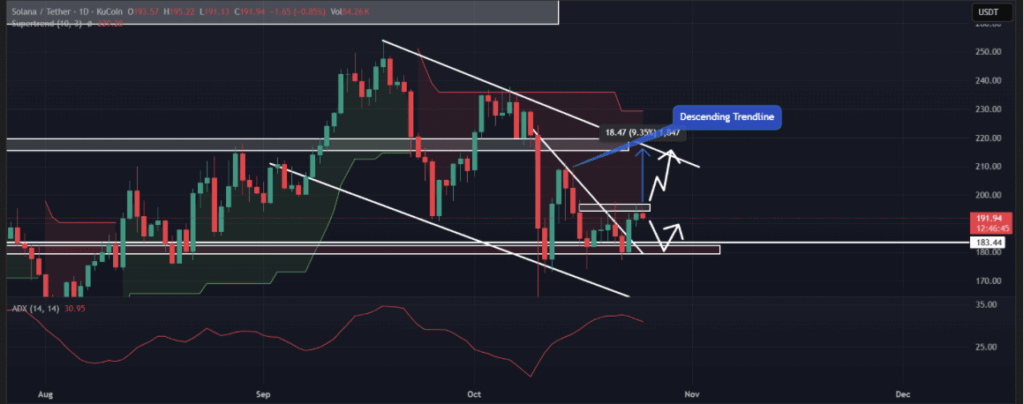

On the charts, SOL has already broken above a descending trendline, which is often a bullish sign. But this same resistance has historically triggered sharp sell-offs whenever price reached it. If history repeats, SOL could slip back toward the $180 zone again. However, if the bulls manage to punch through and close above $196, it could spark a 10% rally toward $218 pretty quickly.

Indicators and Market Sentiment

Technical signals are mixed. The Average Directional Index (ADX) is sitting around 31, which shows strong momentum behind the current move. Yet, the Supertrend indicator is still bearish, hovering above the price and flashing red — meaning the broader trend hasn’t flipped bullish just yet.

Meanwhile, derivatives data paints a cautious picture. According to CoinGlass, traders are leaning heavily on short positions, hinting that many expect a rejection at this level. The major liquidation zones sit near $189.80 below and $195.80 above, with about $65 million in longs versus $84 million in shorts. If prices squeeze upward, those shorts could get caught off guard — possibly fueling a quick breakout rally.

For now, all eyes are on $196. Break it cleanly, and Solana could light up again. Fail to hold, and history might just repeat itself.