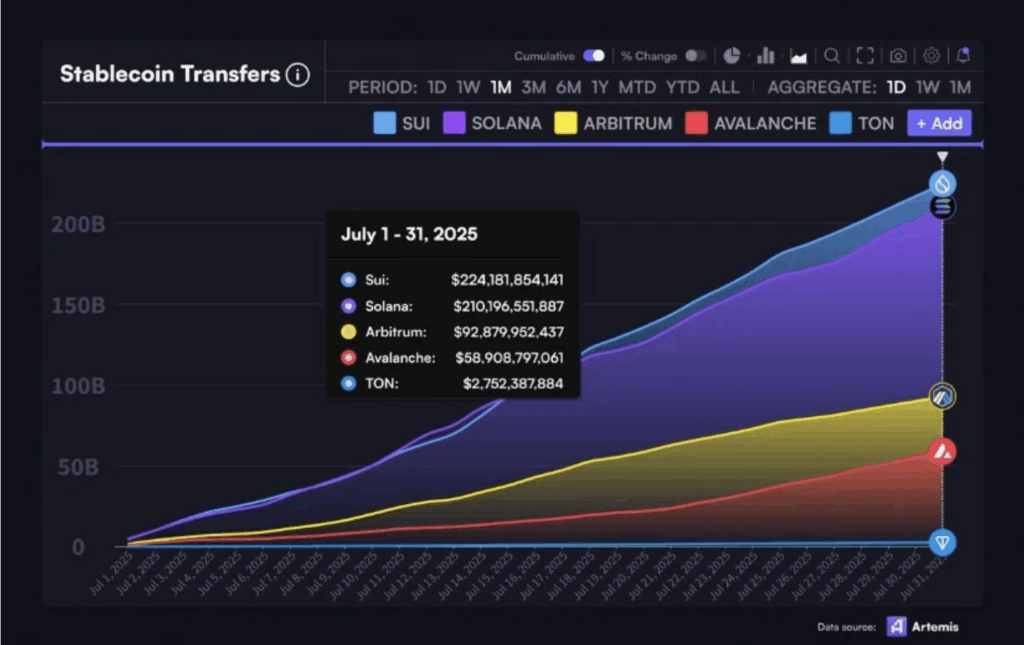

- SUI beat Solana in July stablecoin volume: first time ever.

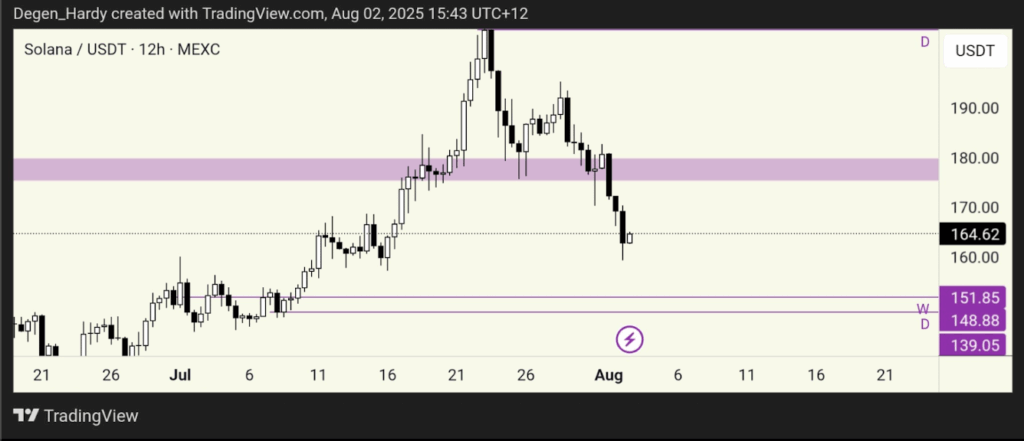

- Price action broke support, now testing $151/$148.

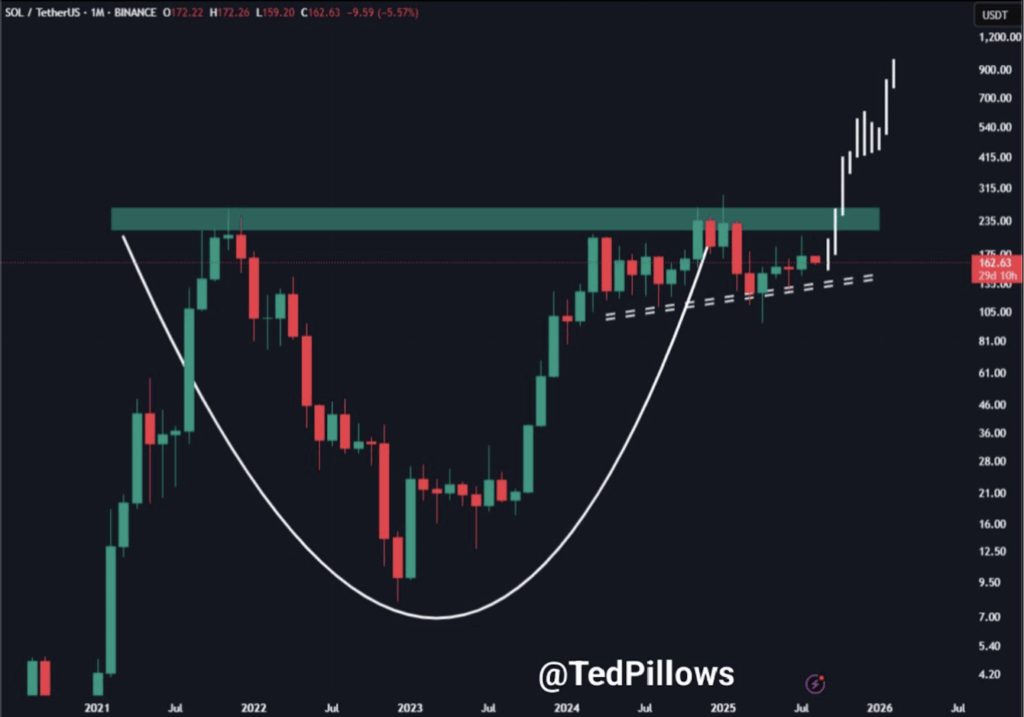

- Short-term looks bearish, but cup & handle may be forming.

Solana’s been riding high for months… but lately? The wind’s shifting. It just lost a key edge in stablecoin volume, and the charts aren’t looking too hot either. Traders are split—some see warning signs, others think we’re just building up steam before the next big move.

SUI Overtakes Solana in Stablecoin Transfers

For the first time in a long while, Solana’s no longer the top dog in monthly stablecoin transfers. July’s data (thanks to Artemis and shared by Torero_Romero) showed SUI clocking in at $224.3B—beating Solana’s $210.7B. That’s not a huge gap, but it’s a first. And that kind of shift makes people notice.

It doesn’t mean Solana’s toast—far from it. Its ecosystem is still stacked. But it does suggest that newer chains like SUI are starting to bite into its dominance, especially if this trend keeps up. That could bleed into price action if SOL doesn’t bounce back soon.

SOL Price Dips, Support Zones Get Tested

On the price front, things have turned, well… messy. Solana’s broken below its recent chop zone, and now eyes are on the $151 and $148 levels—both are untested zones that might act as short-term support.

Hardy’s chart showed the breakdown clearly. Since topping out around $206, SOL’s been stuck in a slow fade. And the fact that mid-range buyers didn’t step up? That’s not the strongest look.

Could $170 Get Rejected Again?

Karman_1s laid out a likely roadmap: maybe SOL gets a weak bounce up to the $170 area, but odds are it’ll smack into resistance and roll over. If that happens, price might fall back toward $145 or even lower. That zone’s looking heavy, and without strong bullish volume, it’s hard to argue against further downside.

Basically, unless buyers wake up soon, this could play out like a classic lower high rejection before more bleeding.

The Bullish Wildcard: Cup and Handle Formation

Now here’s the twist. While short-term charts are looking gloomy, TedPillows spotted something interesting—a potential cup and handle forming on the higher timeframe.

Yep, that old-school bullish pattern. And it’s clean: rounded base, tight handle forming, and a neckline that could trigger a breakout if price holds this correction zone ($140–$150). If that plays out, SOL could make a run for new all-time highs. Seriously.

So while the near-term pressure is real, the bigger structure might still be pointing up.

So, Is This a Breakdown or Just a Breather?

Short answer? Both are still possible.

Solana’s clearly under some heat—on-chain competition is picking up, and the charts show weakness. But if this dip holds firm around $140 to $150, and volume starts creeping back in, this whole correction might just be part of a bigger setup.

The key battle’s happening around $170. Reclaim it? Bulls are back. Lose $145? The bears tighten their grip. Either way, this next stretch could define SOL’s next big move.