- Solana surged to $200 before dumping back below after a $58M long squeeze—but it’s still holding a strong structure above $180.

- A golden cross and breakout above $180 suggest the bullish trend may continue, with room to rally back toward the $293 all-time high.

- On-chain upgrades like the 60M CU block limit boost Solana’s performance, cementing its lead in DeFi and gaming throughput.

Solana’s been putting on a show lately. It ran up more than 10% in just a few days, jumping from $180 to touch $200—only to get slammed right back down overnight. That entire gain? Gone in a flash. Classic crypto. Now with the market cooling off a bit, everyone’s asking the same thing: what’s the best crypto to buy right now?

SOL’s still sitting about 37% below its all-time high of $293 (hit earlier this year in Jan), and plenty of analysts are still throwing around wild targets—$700 or even higher by the peak of this cycle.

Yep, it’s chaotic. But chaos can be opportunity, too.

Longs Get Wrecked: $58M in Solana Liquidations

It was rough out there for leveraged bulls. Solana saw $58 million in liquidations in just 24 hours, and guess what? Shorts barely got touched—only $3.68 million cleared. Longs? Brutal. $54.3 million vanished. This came after open interest hit a record $12 billion.

Funding rates were way up, too. So yeah—everyone was long, and it set up perfectly for a long squeeze. When too many people lean in one direction, the market has a way of humbling ’em.

Still, SOL had ripped 56% over the last month. A 9% dip isn’t the end of the world. Honestly, it’s probably healthy. Charts still look okay, and $180 has now become the key support level bulls will wanna hold.

Structure Still Bullish If $180 Holds

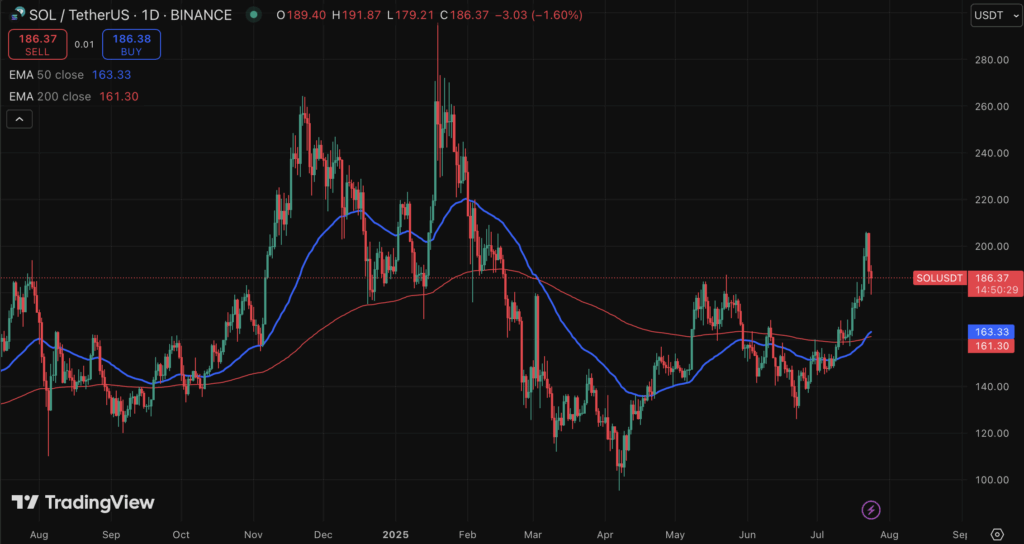

Earlier this week, Solana broke out above $180, flipping a big technical level and confirming its first bullish shift since late 2024. It rallied nearly 12% before this latest pullback.

That breakout also triggered a golden cross—when the 50-day EMA crosses above the 200-day EMA. Last time we saw that? SOL shot up 730% from October ‘23 to March ‘24. Not saying it’ll happen again, but history’s worth watching.

If SOL holds $180, the uptrend stays alive. But if it loses that zone, next supports are between $157 and $168. Either way, with current prices and big upside potential, SOL still looks like one of the best setups on the board.

Solana Is Getting Faster—And That’s Huge

Price action aside, Solana’s tech is moving fast too. The Solana Foundation just bumped the block limit from 50M to 60M Compute Units (CUs). That’s thanks to the SIMD-0256 proposal—led by validator Andrew Fitzgerald and backed by the broader Solana crowd.

This means more transactions can fit into each block. It’s a big win for DeFi and gaming projects that rely on fast throughput and low fees. And there’s talk of pushing this even higher—to 100M CUs—before year-end. If things stay stable, of course.

So yeah, price might be bouncing around… but the chain? It’s leveling up fast.