- SOL trades around $185.63, showing resilience despite a 50% drop in trading volume.

- Invesco and Galaxy Digital’s Solana ETF filings gain traction, boosting investor optimism.

- Analysts see $240 as the next resistance and $300 as the next big target if bullish momentum continues.

Solana (SOL) is holding its ground even as the broader crypto market wobbles. The token’s showing a quiet kind of strength—up just under 1% in the last 24 hours but slightly down by about 3.4% for the week. At the time of writing, SOL trades around $185.63 with a daily volume of $3.26 billion, down more than 50% from the day before. Still, its market cap sits steady at roughly $102.5 billion, keeping it well within the top ranks of major altcoins.

Solana ETF Hype Gains Momentum

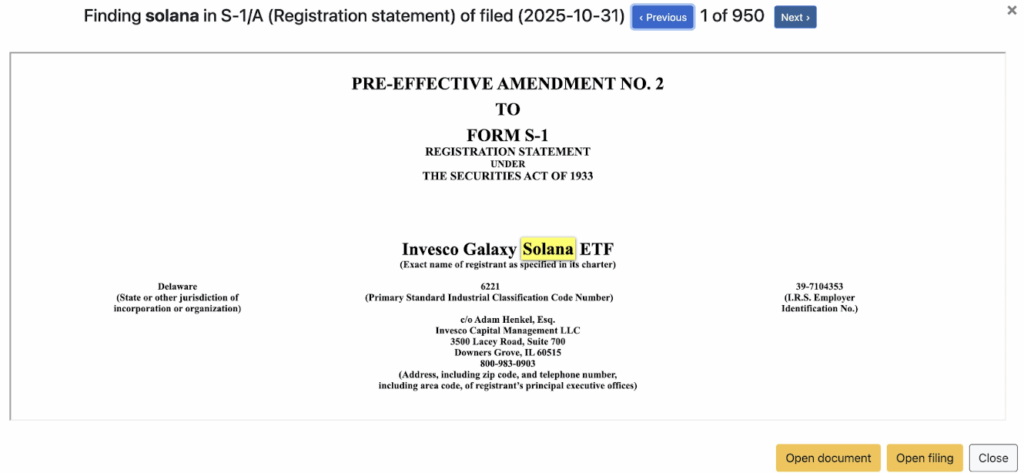

The latest fuel for Solana’s growing momentum comes from ETF news. Analyst Marty Party noted that both Invesco and Galaxy Digital have updated filings with the SEC for their Solana ETFs, officially confirming the ticker QSOL. The revised S-1/A document also lists the Bank of New York Mellon as the authorized participant and Coinbase Prime as the fund’s prime broker—clear signs that the ETF structure is now ready for listing.

That’s a big deal. Solana could soon join Bitcoin and Ethereum in the expanding lineup of institutional-grade crypto ETFs. The buzz alone has already lifted market confidence, and analysts think approval could spark a new wave of investment demand from traditional finance circles. If that happens, it could easily light a fire under SOL’s next rally.

Technical Strength Points to a $300 Target

Market watchers, including analyst Ali, have pointed out that Solana continues to trade firmly above its 200-day Simple Moving Average—an indicator many traders view as a gauge of long-term strength. This stability suggests that the market still trusts Solana’s uptrend despite recent volatility.

Analysts see the area near $240 as the next key resistance to watch. A breakout above it could quickly send the price climbing toward $300, a level many view as the next major milestone for confirming Solana’s comeback run. But for that to happen, bulls need to stay in control and keep defending current support levels around $180–$185.

Market Outlook — Bulls Need to Prove It

In short, Solana’s setup looks solid, but it’s not bulletproof. The ETF momentum is real, yet technical follow-through is what’ll decide whether SOL can push higher or fall back into consolidation. Traders are watching closely—especially as institutional buzz meets market reality.

If the ETF approval lands and momentum returns, the next leg up could form faster than expected. But if Solana loses its 200-day support, that $300 dream might have to wait a bit longer.