- Solana hit $166 with 12% weekly and 104% yearly gains; momentum is building fast.

- Ali Martinez suggests a path to $2,700 if SOL closes above $170 and confirms a cup-and-handle breakout.

- Strong fundamentals + ETF potential could make 2025 a breakout year for SOL.

Solana (SOL) just jumped another 3% in the last 24 hours, landing around $166 right as Bitcoin soared to a new all-time high of $122,838. Yeah, things are starting to get spicy again across the board.

Zooming out, SOL’s now up 12% in a week, 16.5% over the past month, and a solid 104% over the last year. Not bad for a coin that spent much of the year quietly grinding. And now? Some analysts are eyeing the big numbers again—$2,000, maybe more. Might sound wild, but with market sentiment flipping and SOL’s fundamentals still looking sharp, the long-term outlook’s got plenty of upside.

Analyst Sees $2,700—If This Level Holds First

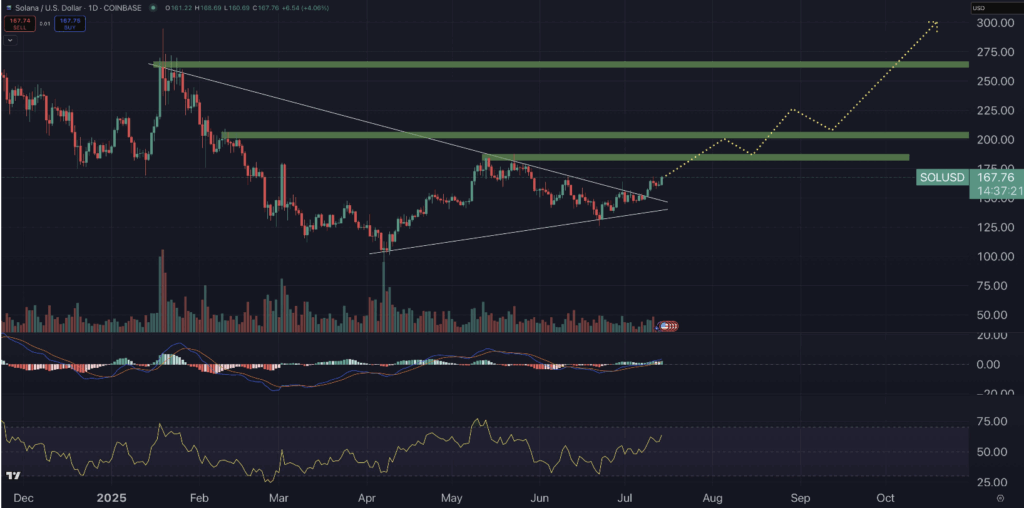

Over on X, analyst Ali Martinez tossed out a bold one: if SOL can close the week above $170, we could be looking at a breakout all the way to $2,700. That’s based on a textbook cup-and-handle pattern showing up on the one-week chart—a pattern that’s triggered some big moves in the past.

Not everyone’s buying it though. Some folks in the replies were quick to poke holes in the target, and fair enough. After all, Solana’s still trading 43% below its previous high of $293. That’s a lot of ground to cover. Still, it’s not completely off the table. With the right market conditions and some sustained momentum, SOL could surprise people before the year’s out.

Fundamentals Still Rock-Solid—and ETFs Could Change the Game

Now here’s where it gets interesting. Solana’s not just riding hype—it’s also the second-largest layer-1 blockchain in terms of total value locked (TVL). That’s not nothing. And with buzz building around the potential for a spot-based SOL ETF in the U.S., the narrative’s only getting stronger.

Bloomberg analysts say there’s a 95% chance we get a green light on Solana ETFs. Given the SEC already gave Ethereum the go-ahead, there’s not much standing in the way of SOL’s approval either. If or when that hits? Yeah, price could move fast. That kind of exposure pulls in capital from places that typically don’t touch crypto.

Technicals Backing the Trend—$200+ Looking Likely

Looking at the chart, Solana’s momentum is real. The RSI just climbed above 60—not quite overbought, but definitely cooking. If it keeps trending, we could see that number hit 70 or even 80 before a pullback. Meanwhile, the MACD just flipped more bullish too, with those lines separating nicely and green bars growing again. All signs are pointing up… for now.

So what’s next? Well, if this pace holds, SOL could push past $200 sometime in August. And by Q4? $300 doesn’t feel that crazy. $2,700? Okay—maybe not this year. But if this rally has legs, don’t count anything out.