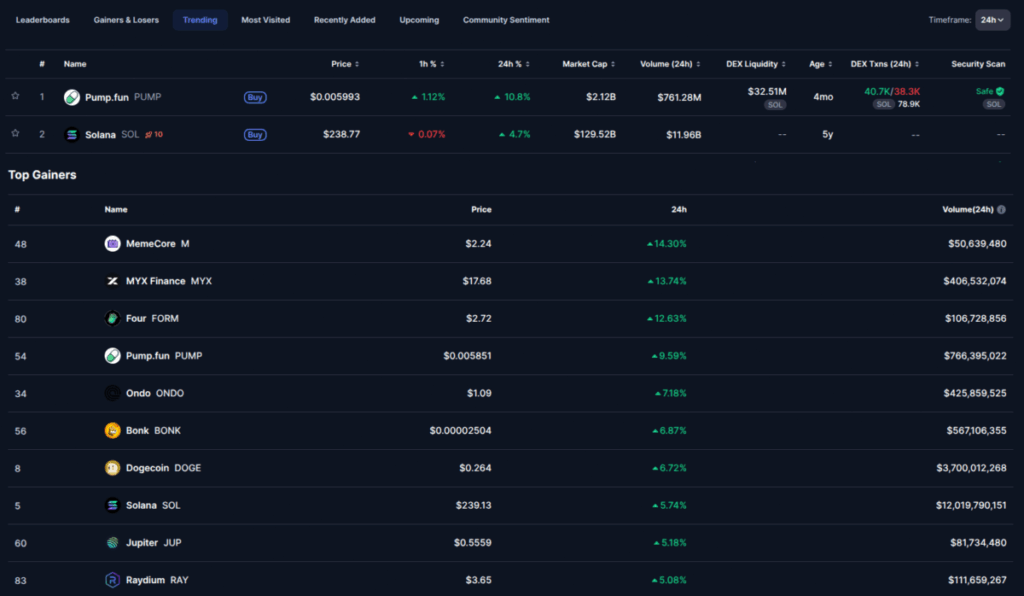

- Solana broke above $220 for the first time in 8 months, triggering $17M in short liquidations that fueled bullish momentum.

- Analysts see resistance at $238–$250, with targets stretching toward $280–$300 if momentum holds.

- Galaxy Digital bought 1.35M SOL worth $302M in 12 hours, adding strong institutional backing to Solana’s breakout.

Solana just smashed through the $220 barrier, a level it hasn’t seen in months, and traders are buzzing. The move wasn’t random either—more than $17 million worth of short liquidations lit the fuse, giving bulls the kind of tailwind that makes people start whispering about $300, maybe even $400 if things really line up.

Shorts Get Burned as Solana Clears $220

SOL’s surge past $220 triggered a cascade of liquidations—$17 million gone in a flash. Sellers who were betting against Solana got squeezed hard, and the rush to cover only added fuel to the fire. What makes this different is that most of the liquidation action came from on-chain perpetuals rather than centralized exchanges, showing just how much of the flow is native to Solana itself.

Now that $220 is behind it, the structure shifts. Analysts at SolanaFloor say if SOL holds $220 as support, the next big walls sit around $238 and $250. These are spots where sellers have pushed back before, but this time bulls have both liquidity and momentum on their side. September might just turn into the breakout month that traders have been waiting on.

Bulls Eye $300 as Next Major Target

Momentum’s building fast. Analysts like Sheldon_Sniper are already calling $300 as the next milestone after this push. The chart is lining up too—higher lows stacked into the breakout, RSI still has breathing room, and volume keeps growing. SOL is trading around $224 right now, up a solid 3% in the past 24 hours.

If buyers can muscle through $238 and then $250, the path opens toward $280–$300. The technicals paint a picture of strength: reclaimed support at $216, steady higher highs, and a bullish flip that could set the tone for weeks. Analyst Lennart Snyder added that any dip back toward $216 would likely turn into a textbook “support retest” before the next leg higher. Beyond $238, it’s almost a straight shot toward Solana’s old all-time highs.

Institutional Buying Adds Fuel

This isn’t just retail hype either. Galaxy Digital has been loading up—fast. In the past 12 hours alone, they scooped up 1.35 million SOL, worth about $302 million, including a jaw-dropping $97 million haul in just one hour. That kind of conviction from a big player adds serious weight to the rally narrative.

Between the short squeeze, technical breakouts, and fresh institutional inflows, Solana is looking less like it’s staging a small bounce and more like it’s setting up for a run at $350–$400. The only question now—can the bulls keep momentum alive long enough to break into new territory?