- Solana rebounded 132% in 2025, with strong on-chain data backing its growth in DeFi, NFTs, and DePIN.

- The Firedancer upgrade promises to fix Solana’s reliability issues, adding both stability and scale.

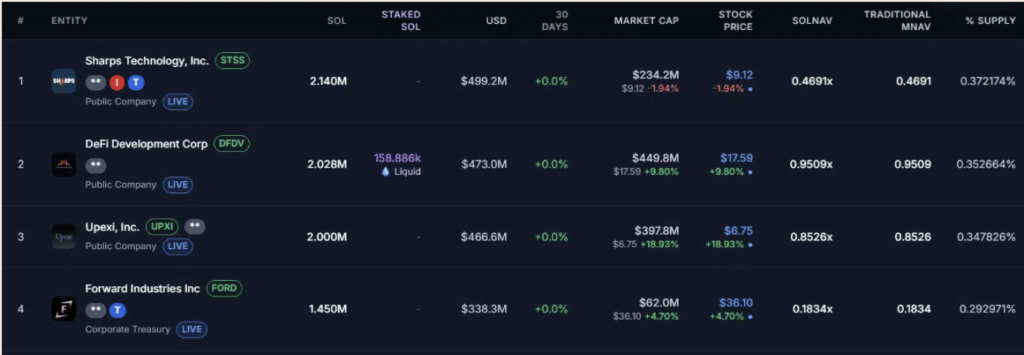

- Institutional interest is rising, with $600M in SOL held by public companies and spot ETF applications pending SEC approval.

Solana’s year has been nothing short of chaotic. The token started 2025 trading well above $200, only to lose more than 60% of its value in just four months. That brutal slide had many doubting whether SOL could bounce back at all.

But summer changed the story. Solana staged one of the strongest comebacks in the market, surging more than 132% on the charts. Even with a slight dip of under 4% in the last 24 hours, SOL still trades around $236—right in line with where it opened the year. Technicals are leaning bullish too, with moving averages under price candles and Chaikin Money Flow showing capital inflows.

Solana Network Fundamentals: Explosive Growth in 2025

Under the hood, Solana looks healthier than ever. Daily users have stayed consistently high, with monthly active addresses holding above 90 million. That’s real adoption, not just hype.

Transaction activity has been just as impressive. In 2025, the network processed over 2,300 transactions per second, setting a record and proving it can scale. Decentralized exchanges are driving much of that activity, as Solana grabs market share thanks to its speed and low fees.

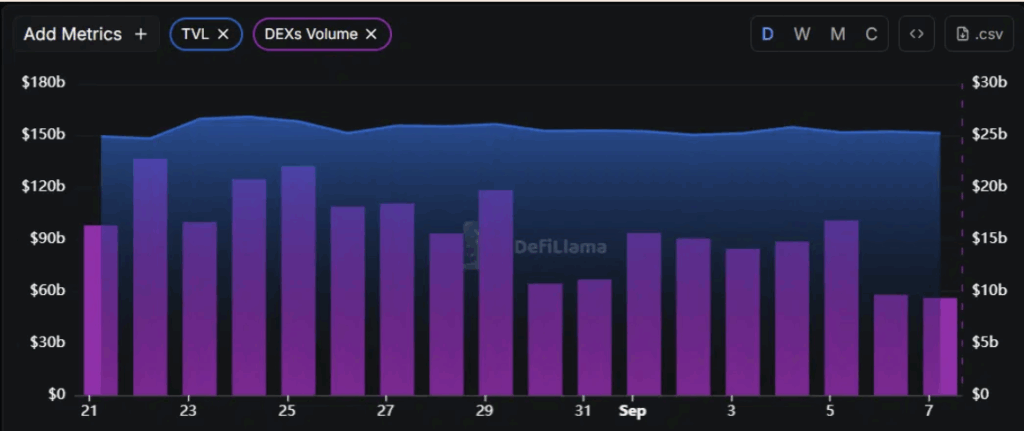

On the DeFi side, Total Value Locked (TVL) smashed to a new all-time high of $7.8 billion in May, a 105% jump year-over-year. These numbers show investors are comfortable locking capital in Solana’s ecosystem again.

Firedancer Upgrade: Solana’s Fix for Stability Issues

For years, Solana’s biggest weakness wasn’t speed—it was reliability. Outages plagued the chain, sometimes lasting hours or days, eroding trust among developers and traders. But things have changed. The network has now been stable for more than 40 straight weeks, its longest run of uptime since launch.

The real game-changer, though, could be Firedancer. Built by Jump Crypto, this new validator client is designed for both resilience and performance. By introducing client diversity, it eliminates the single point of failure that caused past crashes. Firedancer is also built to handle up to 100,000 transactions per second, making it a direct solution to spam and overload issues. Early rollouts are already underway, with validators representing 6% of staked SOL testing it.

Solana Ecosystem Expansion: DeFi, NFTs, and DePIN Growth

Solana is no longer just “the fast chain.” It’s building full ecosystems across finance, culture, and even physical infrastructure.

- DeFi: With $7.8B TVL and $107B in monthly DEX trading volume, Solana’s DeFi sector is thriving. Projects like Jupiter, Raydium, Jito, and Marinade Finance are leading the charge.

- NFTs: Cheap, fast transactions have made Solana a hub for creators and collectors, with marketplaces like Magic Eden rivaling Ethereum.

- DePIN: Solana is pioneering Decentralized Physical Infrastructure Networks. Projects like Helium, Render, and Hivemapper are building real-world infrastructure with crypto incentives. The total value of Solana’s DePIN projects has already crossed $3.2 billion.

This diverse growth shows Solana isn’t just surviving—it’s maturing into a versatile blockchain platform.

Institutional Adoption and the Solana ETF Push

Wall Street is paying attention. Several public companies, including Upexi, DeFi Developments Corp, SOL Strategies, and Torrent Capital, now hold over 3.5 million SOL combined—worth nearly $600M. That’s a strong signal of confidence from traditional finance.

The bigger play, though, could be a spot Solana ETF. Firms like VanEck, 21Shares, and Bitwise have already filed applications. VanEck’s proposal is particularly creative, as it would use liquid staking tokens in partnership with Jito Labs.

The SEC has delayed decisions on multiple filings until October 16, 2025. While some insiders claim approval isn’t likely under the current administration, optimism lingers. Bloomberg analysts once gave it a 75% chance before year’s end. If an ETF does pass, it could open the floodgates for institutional demand, just like Bitcoin ETFs did earlier this year.