- SOL dropped to $213, wiping out $112M in leveraged longs as traders pulled back from risk.

- Network activity dipped, but corporate adoption like Fitell’s $100M treasury plan shows long-term confidence.

- Despite macro pressure, Solana still leads in transactions and holds 2nd place in TVL, keeping recovery potential alive.

Solana’s native token, SOL, slid to a two-week low at $213 this Tuesday, showing just how quickly sentiment in crypto can flip. The buzz that came right after the Fed’s rate cut last week has already faded, replaced by worries about inflation creeping higher and the U.S. labor market softening.

Over just 48 hours, SOL shed about 12% of its value, sparking more than $112 million in long liquidations, according to CoinGlass. Traders now find themselves split—was this just another shakeout in a fragile macro setup, or is it the start of a deeper correction that could drag SOL toward $200 or worse?

Futures Funding Rates Point to Caution

Funding rates tell part of the story. On Tuesday, the annualized rate for SOL perpetual futures hovered close to zero. Normally, under healthy conditions, it ranges between 6% and 12%—a sign that long positions are paying to stay open. But here, demand for leveraged longs was nearly absent.

This wasn’t always the case. Back in mid-August, funding shot up to 30%, reflecting extreme bullish bets. Interestingly, even during SOL’s brief pop to $253 last Thursday, funding stayed neutral—suggesting traders weren’t eager to pile on. That doesn’t scream bearish, but it shows hesitancy.

History gives some perspective: when funding rates dipped negative earlier in August, it actually lined up with solid entry zones. SOL fell hard, then bounced just as hard. Whether this time plays out the same remains to be seen.

Competition and Network Activity Slowdown

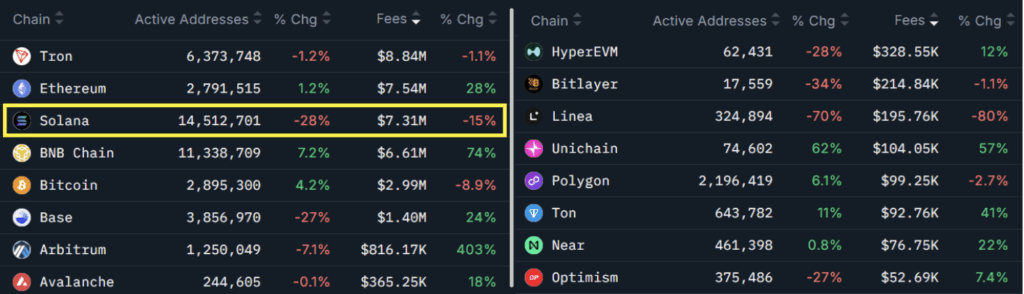

Another weight on SOL is its own network activity. Active addresses dropped 28% in the past week, while network fees slid 15%. In contrast, Ethereum saw fees climb 28%, and BNB Chain jumped an even bigger 74%. At the same time, newer players like Aster and Hyperliquid are starting to chip away at Solana’s edge, even teasing plans for their own chains.

Despite that, not all signals are bearish. Corporate adoption is quietly rising. Fitell Corp, an Australia-based firm, just raised $100 million through a convertible note to fund a “Solana treasury strategy,” combining onchain activity with derivatives for yield. Moves like these could add long-term support even when retail traders pull back.

Macro Pressure Adds to Crypto Weakness

Zooming out, this isn’t just about Solana. Broader macro jitters hit risk markets across the board. Fed Chair Jerome Powell flagged inflation and labor worries again, and the Nasdaq slipped 1% on Tuesday. In crypto, total market cap shrank by $178 billion since Sunday—a brutal reminder of how sensitive digital assets remain to macro headlines.

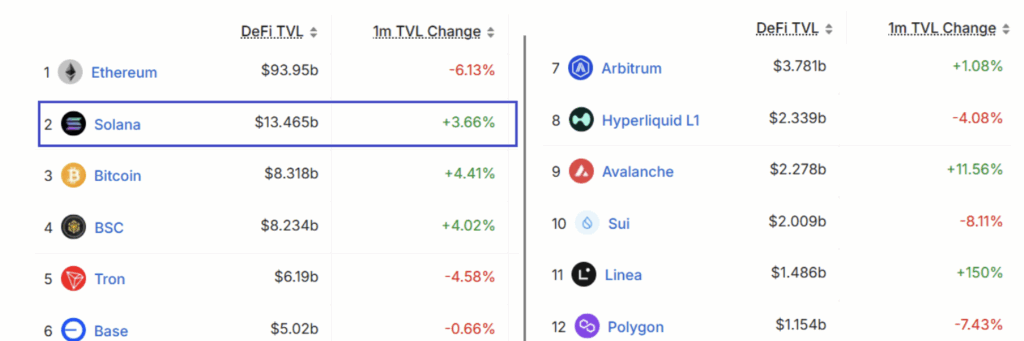

Still, SOL isn’t down and out. It continues to lead the pack in transaction counts and remains second in total value locked (TVL), according to DefiLlama. If buyers can defend the $210–$213 range and risk appetite returns, the odds for a bounce back above $230–$240 aren’t off the table.