- Solana grabbed over 60% of tokenized stock volumes, surpassing Ethereum with $807M out of $1.3B total.

- Strong user activity (2.5M daily active addresses) and lower transaction costs pushed Solana ahead.

- Despite network strength, SOL price faces short-term bearish pressure near $192 but could rebound soon.

Solana just pulled off something big. For years Ethereum was the top dog in tokenized assets, but now Solana has flipped it on its head. Trading volumes in tokenized stocks on Solana shot past $800 million, giving it more than 60% of the total market share. For a blockchain that was once seen as an “Ethereum alternative,” that’s a pretty loud statement.

The overall tokenized stock volume hit nearly $1.3 billion, but Solana’s share was massive compared to everyone else. Gnosis came in second at around $307 million, while Ethereum trailed behind with just $127 million. Avalanche, Polygon, and Arbitrum? Barely even a blip compared to these numbers. This marks a real shift in leadership, one that Ethereum probably didn’t expect to give up so soon.

Why Solana is Pulling Ahead

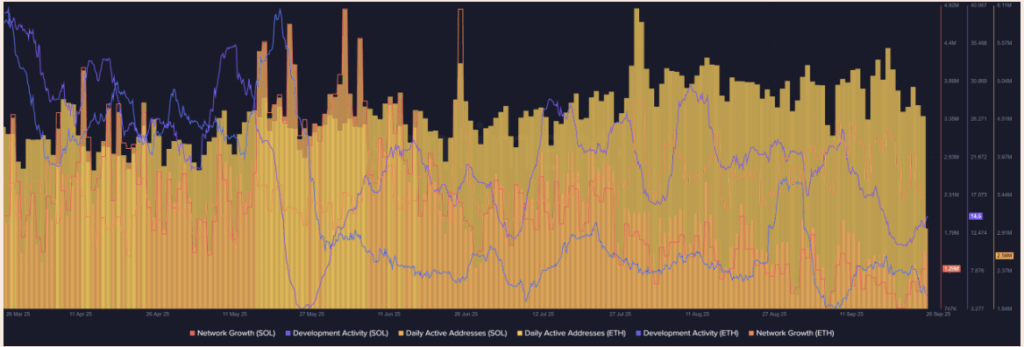

So what’s actually driving this? A quick look at the on-chain data makes it clear. By late September, Solana had over 2.5 million daily active addresses, while Ethereum managed only about 747,000. That’s a massive gap in user activity. On top of that, Solana added roughly 1.3 million new wallets recently, far outpacing Ethereum’s slower growth.

And let’s be real—faster and cheaper transactions are a huge factor. Solana is simply easier for high-volume trading like tokenized stocks. While Ethereum continues to build and innovate, Solana’s actual user engagement is what’s carrying it forward right now.

Short-Term Price Pressure on SOL

Even with these wins, Solana’s price isn’t reflecting pure strength at the moment. SOL slipped down to around $192, falling below the mid-Bollinger Band and sitting close to support at $193. The RSI dropped near 35, showing oversold conditions after traders rushed to lock in profits.

That doesn’t mean it’s all doom and gloom though. Oversold conditions often lead to a rebound, and Solana’s fundamentals—especially after dominating tokenized stocks—look stronger than ever. If buyers step in around these levels, we could see a bounce back toward higher ranges soon.

Final Take

Solana overtaking Ethereum in tokenized stocks isn’t just a headline—it signals a real change in where activity is flowing. With faster speeds, lower costs, and an exploding user base, Solana has shown it can lead when it comes to adoption-heavy markets. Prices might be under short-term pressure, but the bigger picture looks like Solana has a strong grip on this new narrative.