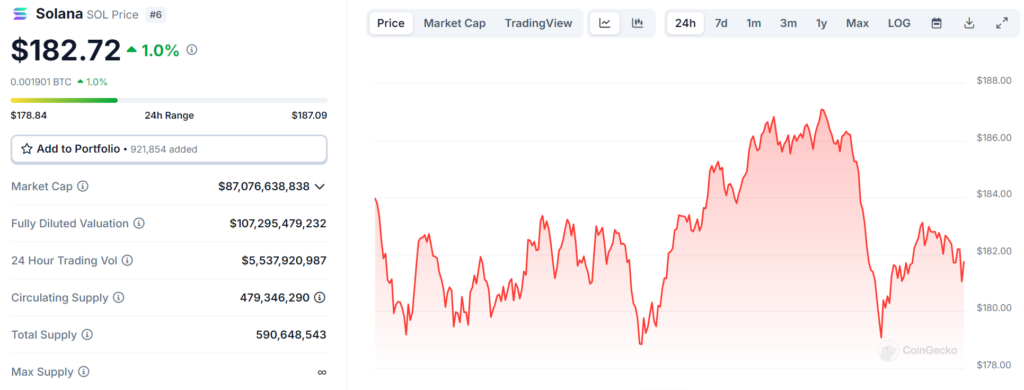

- Solana trades at $182.72, showing a modest 1 percent daily increase.

- Trading volume reaches $5.53 billion, reflecting sustained market activity.

- Circulating supply stands at 479.35 million SOL, with market cap at $87.07 billion.

Solana has demonstrated resilience as it navigates a dynamic market landscape, with its price increasing slightly to $182.72. This marks a 1 percent gain over the past 24 hours, reflecting continued investor interest. The cryptocurrency remains one of the top players in the blockchain ecosystem, thanks to its high transaction throughput and energy-efficient design.

Solana’s market cap shown in CoinGecko has reached $87.07 billion, supported by a circulating supply of approximately 479.35 million SOL. The 24-hour trading volume of $5.53 billion signals consistent market engagement, even as fluctuations characterize its short-term price movements. Over the past day, Solana’s trading range has been between $178.84 and $187.09, highlighting a period of relative consolidation.

Factors Contributing to Solana’s Performance

Solana’s ongoing popularity can be attributed to its robust ecosystem of decentralized applications and growing adoption among developers. Its unique proof-of-history consensus mechanism has positioned it as a scalable and efficient platform, appealing to a wide range of projects.

The cryptocurrency’s recent performance has been influenced by broader market trends, including investor sentiment and macroeconomic factors. While Solana has faced periods of volatility, its long-term fundamentals remain strong. Partnerships and integrations within its ecosystem, such as DeFi and NFT platforms, continue to bolster its market presence.

Additionally, Solana’s community-driven development has attracted attention from institutional investors. As decentralized finance gains traction, Solana’s scalability and low transaction costs are viewed as key advantages over competing networks. Analysts note that its ability to handle thousands of transactions per second could drive further adoption in the coming years.

Outlook for Solana

Solana’s future appears promising as it solidifies its role as a versatile blockchain platform. Key support levels are expected to hold near $180, while resistance around $190 may test its upward momentum. Analysts suggest that breaking through this range could pave the way for new highs, particularly if broader market conditions improve.

Solana’s commitment to innovation, combined with its growing ecosystem, positions it as a leading contender in the blockchain space. As institutional adoption and developer interest continue to expand, Solana’s potential for long-term growth remains a focal point for investors. However, short-term fluctuations will likely persist as market participants respond to evolving economic and regulatory landscapes.