- Solana transfer volume reached a record $318 billion, three times its market cap, on November 16.

- Analysts highlight bot activity inflating Solana metrics, with Raydium pools showing unrealistic trading volumes.

- Despite skepticism, Solana’s price has surged 43% in a month, sparking bullish price predictions.

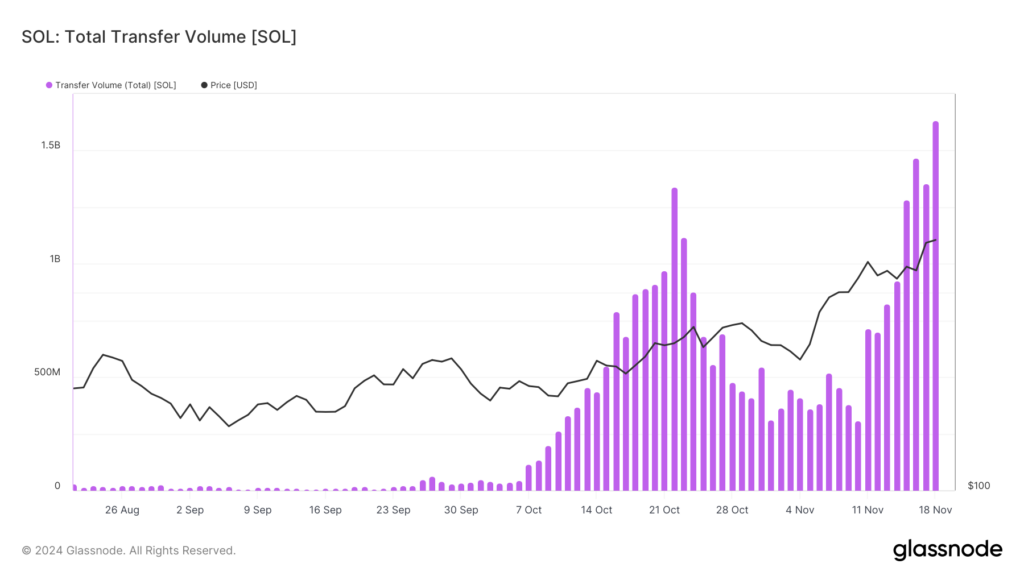

Solana has achieved unprecedented levels of onchain activity, with its transfer volume hitting $318 billion on November 16. However, market intelligence firm Glassnode has raised concerns that much of this volume is driven by bots rather than organic user activity, sparking debates about the network’s real growth trajectory.

Record Volume, Rising Skepticism

Solana’s daily active addresses surged to 22 million, and its network revenue reached nearly $6 million on November 20. According to DefiLlama, participants paid $7.63 million in transaction fees, marking the highest revenue day for the blockchain. Additionally, Solana recorded $26 million in real economic value and $6.93 billion in decentralized exchange (DEX) trading volume on November 19, with Raydium accounting for 74% of the total.

However, Glassnode and other analysts have highlighted anomalies within Solana’s ecosystem. For instance, Raydium liquidity pools show instances of negligible liquidity but disproportionate trading volumes. The SOL-HAT pool, with only $7 in liquidity, reported $400,000 in 24-hour trading volume. Such patterns indicate bot-driven transactions, which have historically contributed to inflated metrics on the network.

Source: Glassnode

Price Surge Fuels Optimism

Despite concerns over artificial activity, Solana’s price has been on a steady rise. The token, trading at $238, has gained 15% in the past week and 43% over the last month. Its market capitalization reached an all-time high of $117.8 billion on November 18, making Solana the fourth-largest cryptocurrency by market value.

Market analysts remain optimistic about Solana’s future. Pseudonymous trader Titan of Crypto suggested that SOL could climb to $400, supported by a cup-and-handle chart pattern. Veteran trader Peter Brandt echoed similar views, setting a near-term target at $275, citing historical swing patterns as a guide.

While questions linger about the authenticity of Solana’s onchain activity, its growing market value and bullish technical patterns have continued to attract investor interest, fueling speculation about its long-term potential.