- DeFi Development Corp. now holds over 2 million SOL, worth more than $400M, making it the second-largest corporate Solana holder.

- The top 5 corporate whales control $1.7B in SOL, highlighting growing institutional interest in the network.

- The Alpenglow upgrade will slash transaction times to 150ms, a leap that could supercharge Solana’s adoption.

DeFi Development Corp. isn’t slowing down—it just scooped up even more Solana [SOL], cementing itself as one of the biggest corporate whales in the game. The firm’s stash now tops 2 million SOL, worth well over $400 million at current prices. And let’s be honest, the timing doesn’t feel random. Solana’s been on a hot streak lately, racking up double-digit gains as the Alpenglow upgrade creeps closer.

Climbing Into the Big League

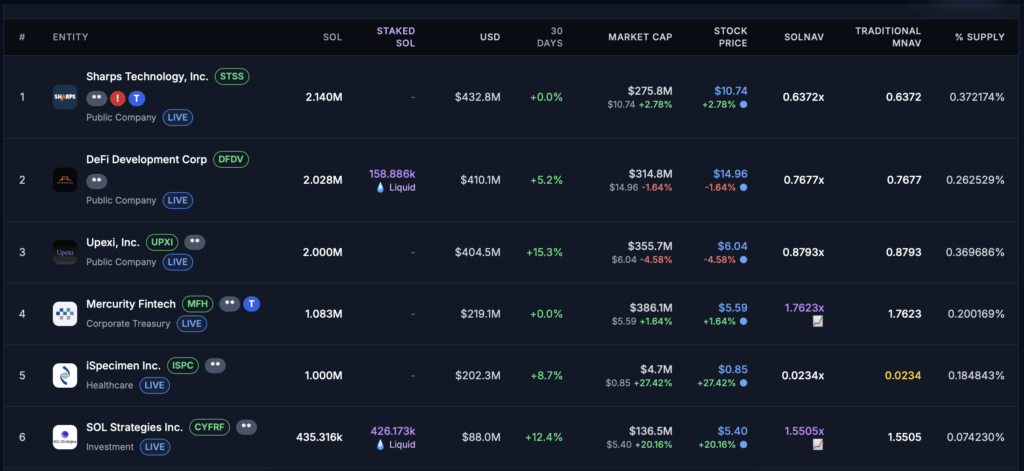

The latest buy—196,141 SOL snapped up at an average of $202.76—pushed DeFi Development Corp.’s total to about 2,027,000 tokens. That’s a mountain of SOL. With this, the firm just leapfrogged Upexi’s holdings of 2 million, officially locking in the spot as the second-largest corporate Solana holder. Only Sharps Technology holds more, sitting on 2.14 million tokens.

The Big SOL Five

DeFi Development Corp. isn’t flying solo here. Alongside Sharps Tech and Upexi, Mercury Fintech (1.08M SOL) and iSpecimen (1M SOL) round out the heavy-hitter list. Together, these five players control more than $1.7 billion worth of Solana. That’s not just bullish—it’s a clear sign that big money wants in.

What’s Next for Solana?

Solana’s price has been flexing, shooting back over $200 after weeks of steady rallying. In just 4.5 years, the network hit a $100 billion market cap—faster than Google (7 years) and even Facebook (9 years). That’s insane growth by any standard.

Now the Alpenglow upgrade is the big story. With 98% validator approval, it’ll slash transaction finality from 12 seconds to 150 milliseconds. That’s lightning speed, the kind of leap that could cement Solana’s role as the go-to chain for serious builders and big institutions.

For now, the road ahead looks wide open. With whales piling in and Solana gearing up for one of its biggest upgrades yet, the project’s momentum feels less like hype and more like a runway for the next leg higher.