- Solana spot ETFs finally broke a 21-day outflow streak with $5.37M in net inflows, led mainly by Grayscale’s GSOL and Fidelity’s FSOL.

- Despite renewed institutional demand, SOL price slipped back under $140 and remains down 30% over the past month.

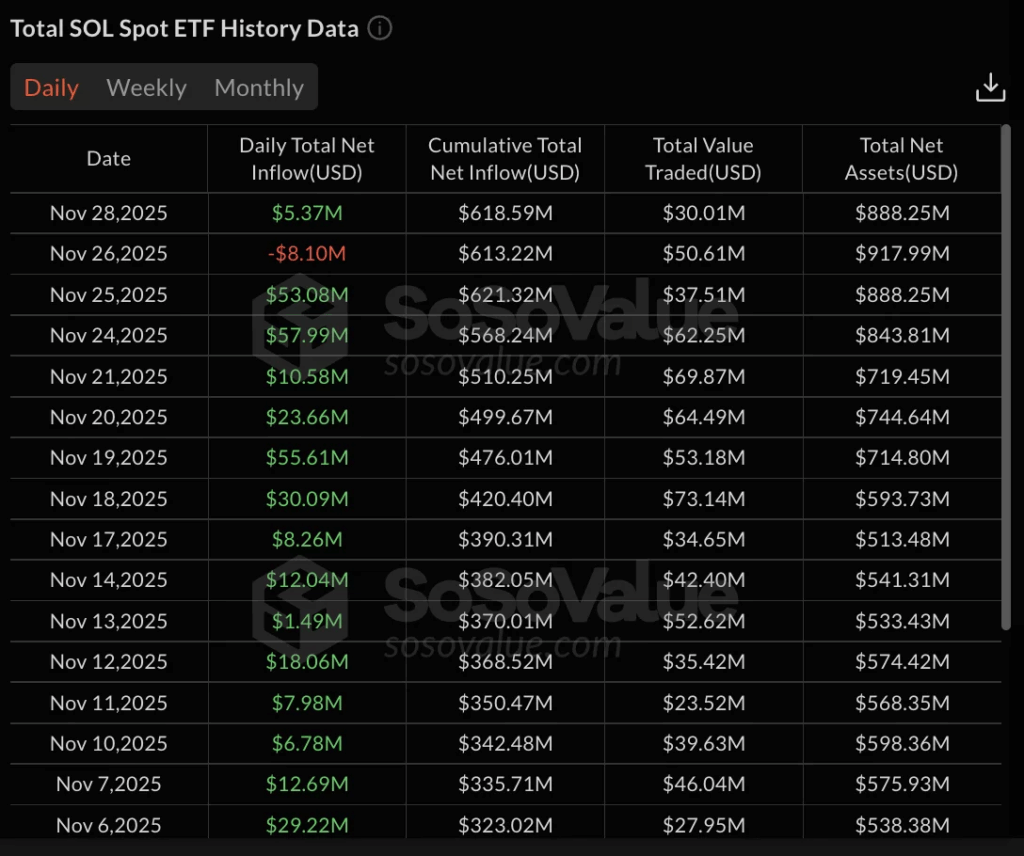

- Total Solana ETF inflows reached $618.59M, but the disconnect between rising ETF demand and weak price action suggests accumulation at lower levels.

Solana’s spot ETFs finally flipped green after a long 21-day stretch of straight outflows, giving traders a little breather… even though the price itself didn’t follow the mood. On November 28, the ETFs pulled in $5.37 million in net inflows, snapping the losing streak, but SOL still couldn’t hold above $140 and drifted lower again. It’s one of those weird market moments where institutional money comes in—but the chart kinda shrugs anyway

GSOL and FSOL Lead the Push, but Outflows Offset Part of the Bounce

Grayscale’s GSOL carried most of the weight, pulling in $4.33 million all on its own, with Fidelity’s FSOL adding another $2.42 million. On the flip side, 21Shares’ TSOL shed $1.38 million, trimming some of the gains, while Bitwise’s BSOL, VanEck’s VSOL, and Canary’s SOLC basically stayed silent—zero flow activity at all. Not exactly fireworks, but at least it wasn’t another red day after three straight weeks of bleeding.

The inflow comes right after a stretch where SOL ETFs were dumping capital—Nov. 26 alone saw an $8.10 million outflow. Just before that, though, November 24 and 25 brought in sizeable inflows of $57.99M and $53.08M. Kinda like the market has been tug-of-war’ing all month.

Price Action Still Weak Even as ETF Flows Recover

Despite the ETF rebound, Solana’s price action didn’t perk up. SOL is down 2% in the last 24 hours and a heavy 30% in the last 30 days. It briefly touched $143 earlier in the day but couldn’t hang on, slipping back under $140 where it’s been stuck more often than not. The only bright spot is a modest 8% gain over the past week—not enough to offset the larger downtrend but at least something.

Cumulative net inflows across all Solana ETFs now sit at $618.59 million as of Nov. 28, with total AUM at $888.25 million. Trading volume for the day hit $30.01 million, showing that interest is still circulating even while the token price cools off.

Grayscale and Bitwise Still Control the Narrative

Zooming out, Bitwise’s BSOL is still the clear heavyweight with $527.79 million in total inflows since launch. Grayscale’s GSOL sits at $77.83 million, while Fidelity’s FSOL holds $32.30 million. 21Shares’ TSOL, meanwhile, has fought a losing battle since day one with $27.60 million in cumulative outflows. VanEck’s VSOL and Canary’s SOLC continue to operate with smaller bases.

The funny part is the disconnect—institutions are clearly nibbling at SOL at these lower levels, yet the price isn’t acknowledging it. Whether that’s stealth accumulation or just broader market fatigue is still up for debate, but for now, SOL hasn’t been able to reclaim the $140 handle even with the ETF recovery helping from the sidelines.