- The SEC has asked SOL ETF applicants to revise and refile submissions by end of July, fueling speculation of an ETF approval before October.

- Solana’s daily active addresses just hit a record 15.39 million, pointing to rising demand and user engagement on the network.

- SOL price is hovering below key resistance; a breakout above $159 could trigger upside, but momentum indicators remain cautious for now.

Solana (SOL) nudged slightly higher on Tuesday, clawing back a bit of ground after dipping nearly 2% the day before. The technical picture? Kinda murky. Momentum’s fading, and SOL’s sitting at a pretty pivotal spot. One wrong move, and it might tumble. Or, we could be right on the edge of a breakout—depends who you ask.

Meanwhile, the SEC’s got everyone’s attention again. They’ve told ETF hopefuls to tweak and resubmit their Solana applications by month’s end, which—naturally—has triggered fresh speculation that an approval could be just around the corner. Add in the fact that Solana’s daily active addresses just hit a new record, and well… something’s definitely brewing.

SEC’s Nudge Fuels Solana ETF Speculation

The SEC is working on a new system to streamline the approval process for crypto ETFs. As part of that effort, they’ve asked SOL ETF issuers to go back, revise their filings, and try again before July wraps. That doesn’t mean a green light is coming tomorrow—but it does hint that the wheels are turning.

Bloomberg ETF analyst James Seyffart chimed in, saying it’s a positive move from the regulators. Still, he expects more paperwork before we get anything official. Patience required.

Solana’s Network Is Buzzing Behind the Scenes

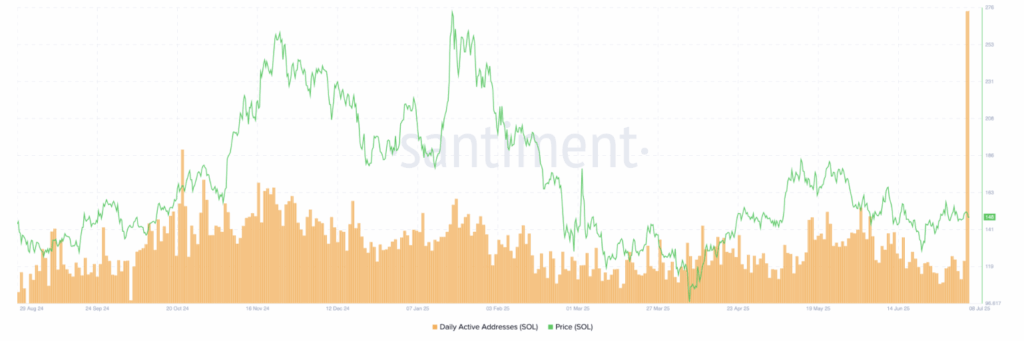

User activity on the Solana network is absolutely popping off. According to Santiment, the number of daily active addresses hit a fresh record—15.39 million on Monday alone. That kind of surge usually means growing demand, since more people using the network = more need for SOL tokens. And with ETF chatter heating up, the timing of this spike couldn’t be better.

It’s not just speculation either. The high DAA shows real usage—think DeFi, NFTs, token swaps, and a bunch of other Web3 stuff that relies on the SOL token to function.

Price Still Caged Beneath Resistance Wall

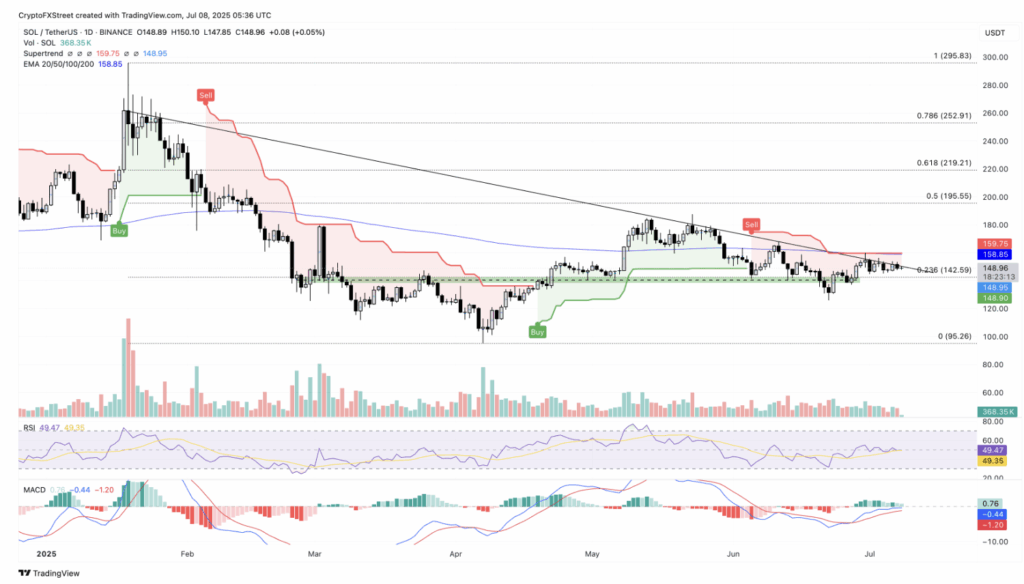

Despite the hype, SOL hasn’t broken free yet. It’s still sitting below a stubborn trendline that stretches all the way back to January. After bouncing nearly 2% lower on Monday, it’s now creeping up again—just about 0.5% in the green as of now.

Right now, SOL is hovering above the 23.6% Fib retracement level around $142. A daily close above $151 could be the first sign of a proper breakout. But honestly, a real shift likely needs a move past $159, where the Supertrend and 200-day EMA both hang out. If that happens, the next stop might be $195—right at the 50% Fibonacci line.

But here’s the thing: the MACD indicator is flirting with a bullish crossover, but those shrinking histogram bars? Not a great sign. And RSI’s hanging out near 50, which basically screams “meh” from the broader market.

Final Thoughts

If SOL can’t stay above $142, we might be staring down another drop—potentially all the way back to the $100 zone. That’d be a blow, considering how much buzz is floating around right now. But if the stars align—ETF approval, bullish charts, and sustained demand—this could flip fast. Right now though? We’re just waiting to see which side blinks first.