• Solana’s price dropped below $200, holding at $194 with critical support at $186

• The NUPL metric shows investors still in profit, reducing sharp drawdown risks but limiting momentum for significant rallies

• The Chaikin Money Flow indicator signals increasing inflows, hinting at recovery potential if broader market conditions improve

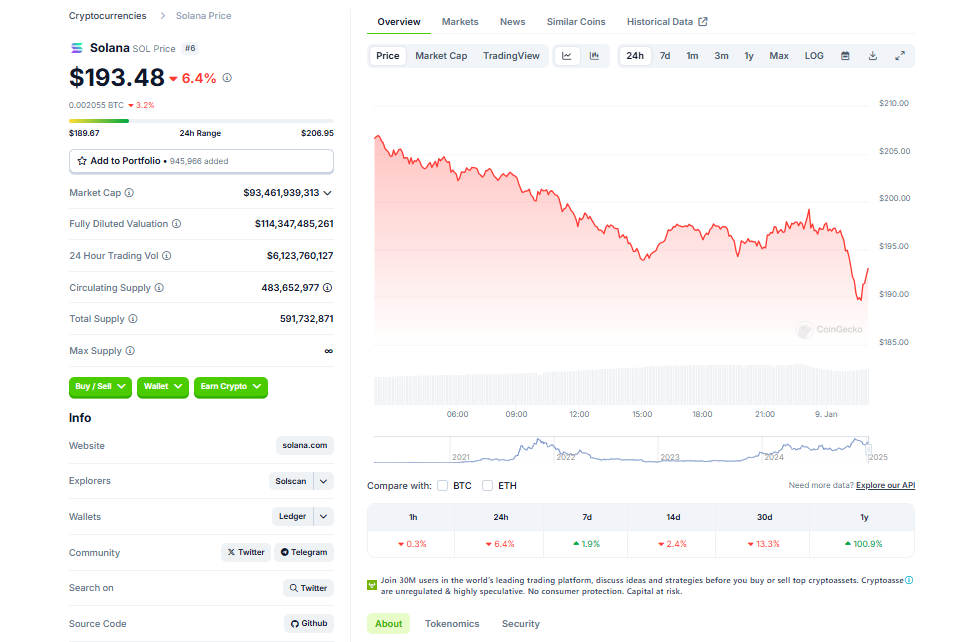

In the volatile world of cryptocurrencies, Solana has recently experienced a significant setback. The altcoin has plunged below the $200 mark, instigating concerns about its potential recovery. Amid this downturn, the critical support level rests at $186, but can increasing inflows boost Solana’s recovery, or will bearish signals further escalate the decline?

The Current State of Solana

Solana has displayed signs of weakness as its price has slipped below the $200 threshold amidst bearish signals in the broader market. Investors are increasingly focusing on securing profits, raising doubts about Solana’s ability to sustain a meaningful recovery. The lack of momentum has left the cryptocurrency in an unstable position.

Investor Sentiment and Market Trends

The Net Unrealized Profit/Loss (NUPL) metric suggests that Solana investors remain hopeful, with many still clutching onto gains. Traditionally, Solana’s presence in this zone has often resulted in stagnation, reducing the possibility of severe market drawdowns but also limiting the potential for significant rallies. The current sentiment reflects a market that is cautious but not entirely bearish, as investors wait for clearer signs of recovery.

Potential for Recovery

The Chaikin Money Flow (CMF) indicator is signaling an uptick, a positive sign for Solana’s recovery potential. The CMF’s position above the neutral line indicates increasing inflows into the cryptocurrency, which historically supports price recoveries. This increase in inflows suggests that, despite the broader bearish cues, investors are gradually re-entering the market. However, sustained momentum will require these inflows to persist and align with a shift in broader market conditions favoring growth.

Solana’s Price Outlook

In the last 24 hours, Solana’s price fell 11%, bringing the altcoin to $194 after dropping below the $200 mark. Despite the decline, Solana managed to hold above the critical support level of $186. The current indicators suggest a few quiet days ahead, with recovery likely if Solana can breach the $201 resistance level and convert it into support. However, a rally back to its all-time high (ATH) of $264 would require stronger bullish momentum and improved market conditions.

The Bearish Scenario

If bearish market cues persist, Solana risks slipping below the $186 support. Such a scenario could lead to further declines, potentially sending the price to $175 or lower. This would invalidate the bullish outlook and intensify investor concerns.

Conclusion

In the unpredictable landscape of cryptocurrencies, Solana is facing an uphill battle to regain its strength. While investor optimism and increasing inflows hint at a potential recovery, the altcoin remains at the mercy of broader market conditions. As the crypto-world watches with bated breath, Solana’s future hangs in the balance.