- Solana controls a disproportionately large share of DeFi relative to its market cap

- Short-term price structure remains pressured below the $120 level

- Long-term charts suggest accumulation rather than trend breakdown

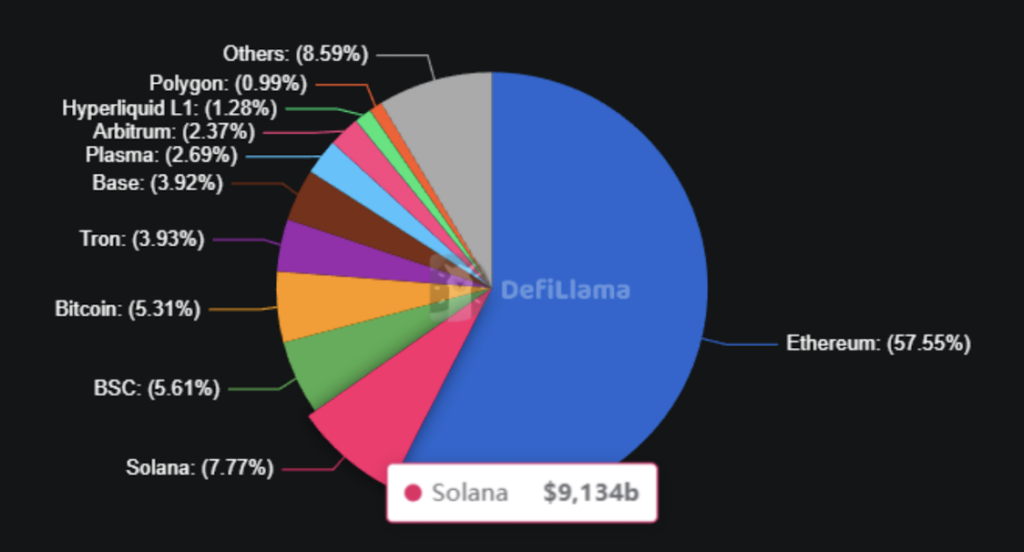

Solana continues to punch well above its weight in decentralized finance, even as price action stays under pressure. The network now ranks as the second-largest blockchain by DeFi total value locked, holding roughly $9.1 billion, or about 7.7% of all capital deployed across DeFi. What makes that stand out is that Solana represents only around 2.32% of the total crypto market cap.

That gap matters. It suggests Solana commands more than three times the DeFi share relative to its market value, pointing to real usage rather than passive holding. Capital isn’t just sitting there, it’s being used, moved, and redeployed on-chain, which keeps demand active even when price cools off.

SOL Price Slips, but Participation Remains High

At the time of writing, SOL is trading near $116.54 after dipping about 1.08% over the past 24 hours. On the week, losses add up to more than 9%, which hasn’t felt great for short-term holders. Still, daily trading volume remains elevated above $7.3 billion, a sign that interest hasn’t vanished, even if sentiment feels shaky.

With roughly 570 million SOL in circulation, Solana’s market cap sits near $66.1 billion. The recent decline looks more like a price reset than an exit of capital. Traders are active, liquidity is there, and the network itself hasn’t gone quiet, not even close.

Short-Term Structure Leans Bearish

Zooming into shorter timeframes, SOL has clearly lost the $120 range floor, shifting near-term structure to the downside. Price has slid into the $115 to $113 demand zone, where buyers are now trying to stabilize things. This area is doing the heavy lifting at the moment.

According to Crypto Tony, the $120 level remains the line in the sand for momentum. A clean reclaim above it would signal a range-low recovery and could open the door toward $130. Until that happens, sellers still control the tape. Earlier rejections in the $145 to $150 zone confirmed strong supply overhead, and recent bounces have struggled to follow through, printing lower highs instead.

Immediate support sits near $113. If that level gives way, deeper demand around $108 comes into view fairly quickly, especially if broader market pressure picks up again.

Bigger Picture Points to Accumulation

From a longer-term perspective, analyst BATMAN urges patience. He views Solana as building a broad, multi-month base rather than rolling over into a full trend reversal. Price has been oscillating between roughly $120 to $130 support and $220 to $240 resistance, carving out a wide consolidation range.

Each defense of the lower boundary strengthens the case for accumulation, while rejections near the top of the range remain corrective rather than structural failures. This kind of behavior tends to reward disciplined positioning, not fast reactions. A decisive breakout above $240 would likely change the conversation entirely, opening potential paths toward $300 and, longer term, even the $450 to $600 region. Until then, consolidation is the game.