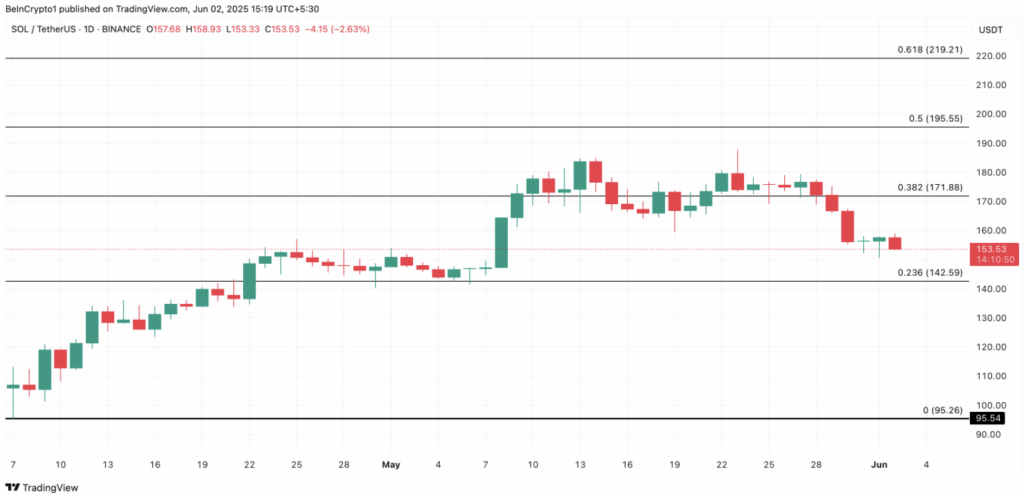

- Solana dropped 15% over the past week, falling to $153.53 amid a broader crypto market dip.

- On-chain data shows long-term holders are accumulating, with liveliness at a 14-day low and funding rates turning positive.

- If support holds, SOL could rebound to $195, but a stronger sell-off might push it down to $142.59.

Solana’s been sliding fast, dropping roughly 15% over the last week as part of a broader market dip that’s hit nearly every major altcoin. The Layer-1 token’s now sitting around $153.53—quite a fall from the $180 range it was pushing not too long ago. While this move might look rough on the surface, some deeper data hints that we might be near the end of the drop.

What’s interesting is how the metrics under the hood tell a slightly different story than just panic selling. Despite the pullback, long-term holders aren’t exactly rushing for the exits—in fact, they seem to be getting more involved, not less.

LTHs Buy the Dip as Liveliness Drops

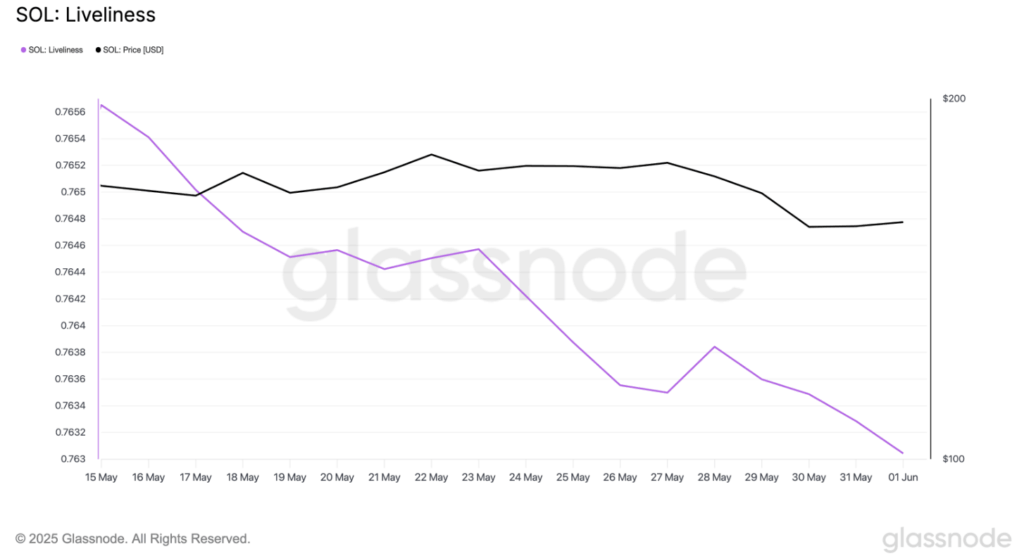

Solana’s “Liveliness” metric has taken a noticeable dip, suggesting that long-term holders are seeing the price drop as a chance to load up. According to Glassnode, that liveliness number is down to 0.76, the lowest it’s been in about two weeks. Basically, fewer old coins are being moved around, which hints that folks who’ve been holding SOL aren’t selling—they’re likely buying or at least staying put.

Liveliness is kinda like a gauge of how many “old” coins are suddenly active again. When the number goes up, that usually means long-time holders are cashing in. But when it dips, like now, it points to accumulation. That means people are pulling coins off exchanges and tucking them away, which is generally seen as a bullish signal.

On top of that, Solana’s funding rate has just flipped positive—currently sitting at about 0.0041%. That might not sound like a big deal, but it’s a sign that more traders are leaning long in the futures market.

Traders Lean Bullish, Eyes on $195

Funding rates are like a tug-of-war fee between bullish and bearish traders in perpetual futures contracts. When the rate’s positive, it means long positions are more popular—bullish traders are paying shorts, expecting the price to climb. So even though SOL’s price is down, a good chunk of the market thinks we’re due for a bounce.

If the long-term holders keep accumulating and overall market sentiment starts to shift, Solana might work its way back toward the $171.88 level. And if that spot turns into a solid support zone, there’s a chance it could push up to around $195.55. But hey, this is crypto—we know it’s not always smooth sailing.

Caution Ahead: $142 Support Still in Play

Of course, things could swing the other way too. If the market stays shaky and sellers dig in their heels, Solana could slide even lower, possibly toward $142.59. That level’s been a key support before, and if it breaks, the bearish side might get the upper hand again. For now though, all eyes are on whether SOL’s quiet whales keep holding the line.