- Solana price dropped sharply after a Pump.fun class-action lawsuit and renewed macro uncertainty

- Legal risk and risk-off sentiment triggered heavy selling across SOL and related tokens

- Positive tokenization news was ignored, signaling fragile market confidence

Solana took a hard hit over the weekend, and it wasn’t subtle. A sharp wave of selling followed news of a class-action lawsuit linked to Pump.fun, the well-known Solana-based memecoin launchpad, just as global markets were already on edge. Add renewed macro stress into the mix, and SOL quickly found itself sliding with force.

Over the past seven days, SOL is down roughly 8%, trading around the $122 area. That move has investors eyeing the $120 level with a bit of nerves, because a clean break below it could open the door to a deeper slide toward $100. In markets like this, levels matter, sometimes more than narratives.

Why Solana Dropped So Fast This Time

This sell-off fits a familiar pattern. When fear hits stocks, bonds, and crypto all at once, altcoins tend to fall first and hardest. Solana, known for speed and volatility, rarely escapes that dynamic. With macroeconomic uncertainty heating up again, many traders are starting to suspect the broader crypto market may not have found a durable bottom yet.

These kinds of drops can feel chaotic, especially for retail traders. Price declines often blend real risk with panic-driven selling, and when leverage is involved, things can unravel quickly. Liquidations pile up, bids disappear, and fear feeds on itself. Right now, that fear is clearly visible across the market.

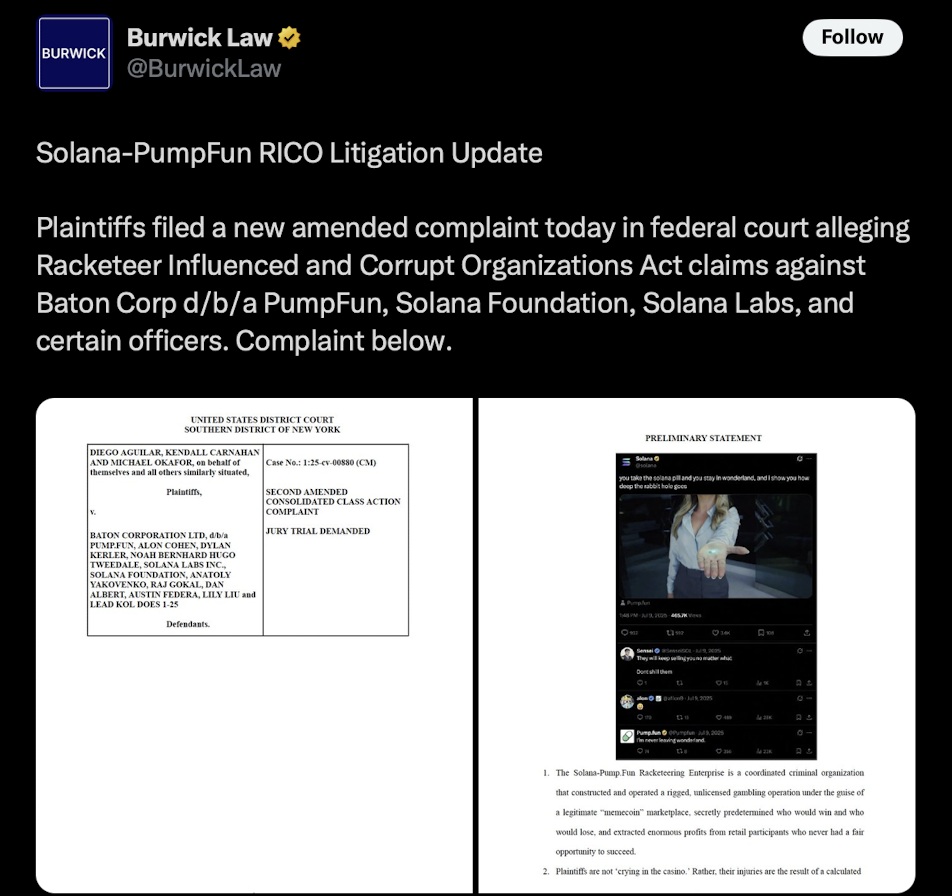

Pump.fun Lawsuit and Political Tension Add Fuel

The immediate trigger, though, was legal risk. A recent class-action lawsuit tied to Pump.fun reportedly pulled other Solana-related entities into focus, including the Solana Foundation. The allegations claim that certain token launches were structurally tilted in favor of insiders, using validator access and transaction-ordering tools to secure the best prices before public buyers could participate.

According to the complaint, what appeared to be a fair and automated marketplace was, in practice, designed to extract value from everyday users while rewarding those with privileged access to Solana’s infrastructure. Whether those claims hold up in court is still unknown, but the market didn’t wait for answers.

At the same time, global markets turned risk-off as political tensions around U.S. trade policy resurfaced, pushing European stocks lower and dragging crypto with them. Solana, like most high-beta assets, tends to drop sharply whenever Wall Street gets spooked.

Why SOL and PUMP React More Violently Than Others

Solana hosts a massive ecosystem of DeFi apps, memecoins, and fast-moving trading platforms. That attracts speculative capital, which is great on the way up and painful on the way down. When fear spikes, both leveraged and spot traders rush to unwind positions, and once liquidity thins out, prices can fall fast.

Notably, this price drop happened even as on-chain activity stayed relatively healthy. The network didn’t break. Usage didn’t vanish. That disconnect between fundamentals and price is common during panic phases.

Still, SOL is now drifting dangerously close to the $100 zone. If that level fails, several long-term support areas would be lost in quick succession, which is why traders are watching it so closely.

Pump.fun’s native token, PUMP, hasn’t been spared either. After starting 2026 strong and rallying from $0.0019 to $0.003 by mid-January, the token has reversed sharply. Over the last nine days, PUMP slid back to around $0.0025, with no meaningful bounce so far. The lawsuit and broader risk-off mood have weighed heavily on both assets.

When Good News Gets Ignored, Pay Attention

Here’s the part that really stands out. This same week, traditional finance firms announced plans to trade tokenized stocks, like Nvidia and Microsoft, on Solana through Ondo Finance. In calmer markets, news like that often sparks aggressive rallies. Tokenization is a long-term growth theme, and Solana sits right in the middle of it.

Yet the market barely reacted. That’s usually a sign. When positive developments get ignored, it suggests sentiment is too fragile to support upside, at least for now.

Should Investors Stay on the Sidelines?

Legal uncertainty rarely resolves quickly. Lawsuits drag on, headlines resurface, and sentiment stays fragile even if nothing breaks on-chain. Solana also tends to move more violently than Bitcoin. If BTC drops 3%, SOL often drops more, sometimes a lot more.

That volatility cuts both ways, but with legal risk hanging over the ecosystem, caution makes sense. For existing holders, an 8% weekly drop is uncomfortable but not unusual. Panic-selling locks in losses, though, and can’t be undone.

Patience usually beats bravado in moments like this. Many analysts suggest letting volatility cool, watching how the legal situation develops, and waiting for clearer price structure to form. Solana’s long-term future likely isn’t decided by a single lawsuit, but the market just delivered a reminder. Fast networks still come with fast risk, and right now, that risk is firmly in the spotlight.