- Solana now supports tokenized stocks and ETFs on-chain, bridging DeFi and traditional finance

- Over 100 tokenized equities mark the largest asset expansion in Solana’s history

- Despite short-term volatility, bulls remain focused on a long-term move toward much higher levels

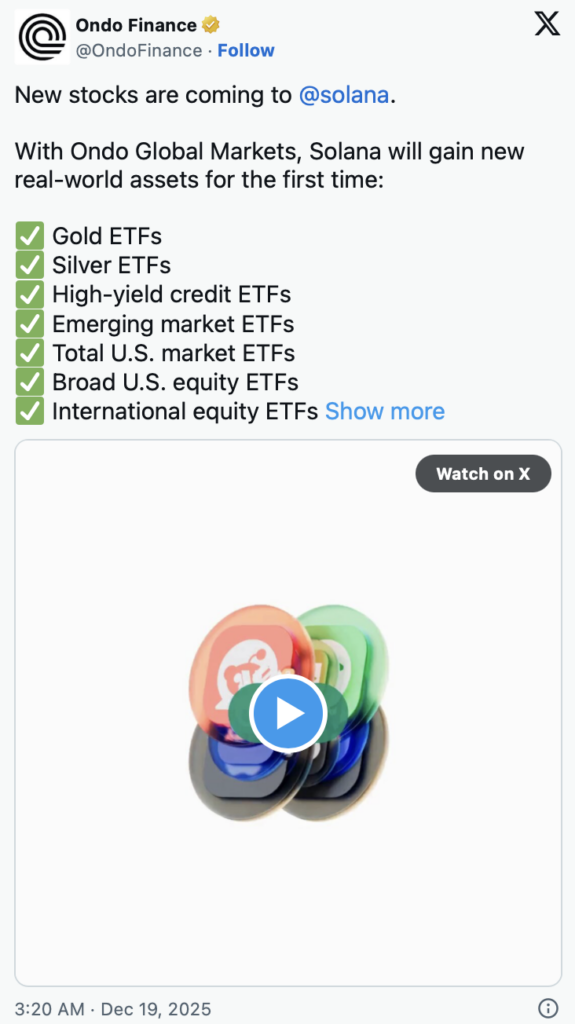

Solana is entering a very different phase of growth, and this one goes beyond DeFi experiments. With Ondo Global Markets launching on-chain financial assets, Solana now supports tokenized stocks and ETFs directly on its blockchain. That means users can access traditional market instruments, equities, funds, and bonds, without leaving the on-chain environment. It’s a meaningful step toward merging decentralized finance with global capital markets, and it’s happening at real scale.

The offering isn’t narrow either. Tokenized ETFs now span precious metals like gold and silver, high-yield credit, emerging markets, U.S. equities, international stocks, inflation-linked bonds, and Treasury fixed income. Mid-cap, small-cap, and total market ETFs are included as well, giving Solana users exposure to a broad slice of traditional finance, all settled on-chain.

Over 100 Tokenized Stocks Mark a Major Expansion

Beyond ETFs, the rollout of tokenized equities may be the bigger story. More than 100 stocks are being introduced, covering sectors such as payments, semiconductors, consumer brands, automotive, enterprise software, defense, industrials, and global e-commerce. This is the largest expansion of tokenized assets Solana has seen so far, and it firmly places the network in the conversation around the future of on-chain traditional finance.

At this point, Solana isn’t just experimenting. It’s positioning itself as infrastructure that can handle real-world financial assets at scale, with speed and low cost still at the core.

SOL Price Holds Near $120 as Market Watches Closely

While fundamentals quietly improve, price action is doing what markets often do, test patience. SOL is currently hovering around the $120 level, which traders are watching closely as potential support. Lower timeframes show plenty of noise, but zooming out reveals a structure that still looks intact from a macro perspective.

The bigger discussion isn’t about short-term swings. It’s about whether current levels hold long enough for the next major leg higher to develop.

Bulls Stay Focused on the Bigger Picture

Analysts tracking the broader trend argue that a bounce from current levels would reinforce Solana’s long-term strength. Even a deeper pullback into the $70–$80 range wouldn’t necessarily invalidate the bullish setup. For patient investors, that kind of correction could be an accumulation opportunity rather than a breakdown.

Volatility, in this context, is part of the process. It shakes out weaker hands while allowing longer-term conviction to build beneath the surface.

Building Toward a Much Larger Target

No matter how the next few weeks or months unfold, bullish participants tend to agree on the destination. Short-term turbulence may create anxiety, but the groundwork continues to form through real adoption and expanding use cases. With tokenized stocks and ETFs now live on-chain, Solana is no longer just chasing narratives. It’s building quietly toward ambitions that include, eventually, a push beyond $500.