- AI16z DAO is challenging traditional venture capital models by integrating artificial intelligence into decentralized decision-making

- It combines a crypto-native approach with an AI-driven operational engine

- It promises a reimagined future for investing and governance

AI16z DAO is challenging traditional venture capital models by integrating artificial intelligence into decentralized decision-making. This DAO combines a crypto-native approach with an AI-driven operational engine, promising a reimagined future for investing and governance.

Redefining Venture Capital in the Age of AI

AI16z DAO, launched in October 2024, aims to disrupt traditional venture capital by mimicking the model of Silicon Valley giants like Andreessen Horowitz (a16z). However, the project has no official connection to Marc Andreessen or his firm. Instead, its autonomous AI agent, cheekily named “Marc AIndreessen,” manages the DAO’s funds with full autonomy.

Unlike traditional venture funds restricted to accredited investors, AI16z allows anyone to invest via its AI16Z token. The AI-driven system eliminates management fees and human biases, leveraging data-driven strategies to allocate the DAO’s treasury.

The Role of AI Marc in Decision-Making

At the core of AI16z DAO is “Marc AIndreessen,” an AI agent built using the open-source Eliza framework. This system empowers AI Marc to analyze suggestions, develop strategies, and execute investment decisions autonomously.

DAO members can interact with AI Marc, and their level of investment influences how much weight their suggestions carry. However, the AI agent retains the final authority over all decisions, bypassing the inefficiencies and prolonged debates typical of traditional DAOs.

How AI Marc Operates

Eliza, the framework underpinning AI Marc, allows developers to create autonomous AI agents capable of performing tasks like web browsing, strategy analysis, and business planning. AI Marc uses these capabilities to streamline DAO operations, focusing on efficiency and transparency.

The system’s three-phase implementation is currently underway:

- Phase 1: Testing the AI’s functionality within the DAO.

- Phase 2: Operating in a testnet environment to gather data and identify flaws.

- Phase 3: On-chain execution with real-world financial stakes.

Assets Under Management and Investment Strategy

AI16z DAO currently holds over $10 million in assets under management (AUM). The treasury includes tokens from projects using Eliza, with 10% of each token’s supply donated to the DAO. Key holdings include Solana, the AI16Z token, and other meme coins like ELIZA, FXN, and DegenAI.

Despite its substantial AUM, AI Marc has yet to make any real-world investments, as the system remains in the testing phase. The community eagerly anticipates its future financial decisions.

A Growing Ecosystem Beyond Crypto

Eliza’s applications extend far beyond crypto. Its GitHub page highlights potential use cases, including AI-powered non-playable characters (NPCs), chatbots, and various AI agents. Developers have praised Eliza, awarding it 3.5K stars on GitHub, reflecting significant interest in its capabilities.

AI16z’s transparency sets it apart: every aspect of its operations, from AI Marc’s codebase to financial transactions, is fully open source and stored on the blockchain. This level of visibility fosters trust and engagement among its participants.

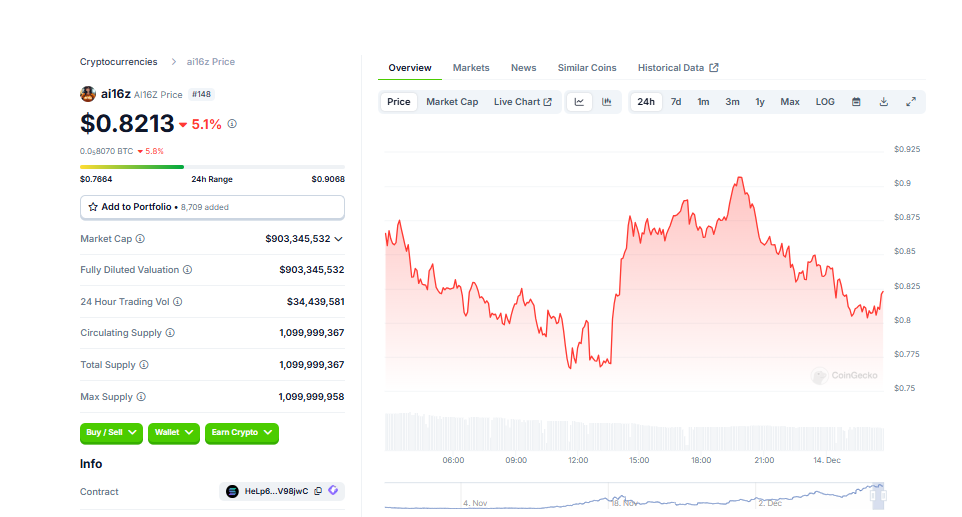

A Surge in Token Value and Investor Interest

Since November 2024, the AI16Z token’s price has skyrocketed by over 1660%, reflecting growing investor confidence in AI-driven projects. The token’s value surged 50% after Eddy Lazzarin, CTO of the real a16z, reached out to “Shaw,” the developer behind Eliza and AI16z DAO.

While neither Lazzarin nor Shaw responded to Decrypt’s inquiries, the project’s rising valuation highlights the increasing interest in AI-powered investment models.

AI16z DAO represents a bold experiment in merging artificial intelligence with decentralized governance and investment. Whether this innovation disrupts traditional venture capital for the better—or creates new challenges—remains an open question. As the DAO moves closer to full deployment, its impact on the world of finance and AI is one to watch.