- Solana has broken key macro structures across multiple timeframes and is now struggling to hold the $69–$70 zone

- ETF outflows have remained consistent, signaling a slow but steady loss of confidence among market participants

- Despite the sell-off, Solana’s RWA market cap surpassing $1B shows the ecosystem is still growing under the surface

Not long ago, the market was packed with optimism and SOL was one of the loudest winners of the cycle. Now, it’s caught in the same brutal risk-off wave hitting the entire crypto complex, and it’s showing real signs of stress. At press time, Solana was down more than 20% since the start of February, dragged lower by the broader correction and a breakdown in its own structure.

And this wasn’t just a small crack either. SOL has now breached a macro head-and-shoulders setup across multiple timeframes, including the daily, weekly, and even the monthly chart. When breakdowns start aligning like that, it usually means the market isn’t just “pulling back.” It’s resetting.

Solana Lost Key Support, and the Chart Looks Heavy

The price action has been rough. After losing its key support zones, SOL slid under $70 in early February, which is the kind of level that tends to flip sentiment from “buy the dip” to “maybe this isn’t the dip anymore.”

More importantly, the $79–$81 region failed too, and that zone had been acting like a reliable floor. Once it broke, the drop accelerated quickly and Solana fell toward $69. And yes, it bounced a little, but it was the kind of bounce that looks more like survival than strength.

Now the risk is pretty clear. If SOL can’t hold this region, the next real demand pocket sits much lower, between $49 and $53. That’s a nasty range to even talk about, but markets don’t care about what feels comfortable. They care about liquidity.

ETF Outflows Add Another Layer of Pressure

Solana’s weakness hasn’t just been on the chart. It’s also been showing up in the flow data, which is arguably even more uncomfortable.

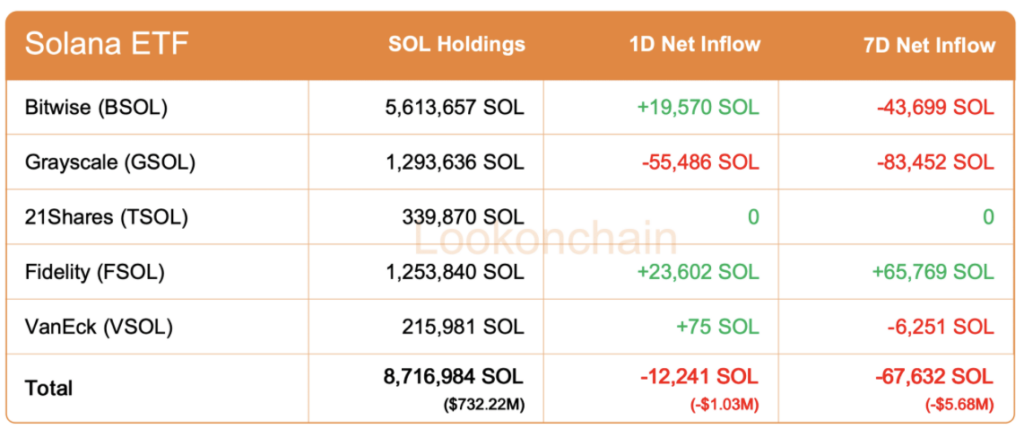

Over the past week, Solana-focused ETFs reportedly saw net outflows totaling around -67,632 SOL, roughly $5.68 million. And on February 6 alone, more than $1 million worth of SOL exited these products, marking the seventh instance of consistent outflow pressure.

That kind of pattern doesn’t scream “temporary fear.” It looks like investors slowly backing away, day after day, which is how confidence erosion actually happens. It’s rarely one big dramatic exit. It’s usually death by a thousand small cuts.

Solana’s RWA Growth Is Real, Even If Price Isn’t Showing It Yet

Here’s where it gets interesting though, because Solana isn’t exactly “dead” under the surface. According to Token Terminal, Solana’s Real-World Asset (RWA) market cap surpassed $1 billion on February 7, 2026. That’s a real milestone, and it suggests the ecosystem is still pushing forward even while the market is bleeding.

Tokenized assets don’t grow in a vacuum. They require partnerships, infrastructure, and actual demand. So this is one of those awkward moments where fundamentals and price are moving in opposite directions. It happens a lot in crypto, honestly.

And it creates tension.

Because if Solana can keep building out its RWA base while the market stabilizes, that could eventually become a strong narrative tailwind. But narratives don’t stop sell-offs in real time. Not usually.

Can SOL Stabilize Here, or Is This Just the Start?

Right now, the big question isn’t whether Solana can “recover soon.” The question is whether the market can even absorb the current outflows without breaking further.

SOL has already slipped into new lows, and ETF money is still leaving. Unless Solana can reclaim key zones between $118 and $145, the odds of a clean recovery remain low. Those levels are basically the line between “relief bounce” and “trend reversal,” and at the moment, SOL is nowhere near them.

To flip the script, Solana likely needs fresh institutional inflows, stronger absorption, and a return of risk appetite across crypto. If that doesn’t show up, downside risk stays very real, and the market could drift toward a deeper capitulation phase before a real bottom forms.

For now, Solana isn’t showing strong strength. It’s showing hesitation, and the chart is still leaning bearish.