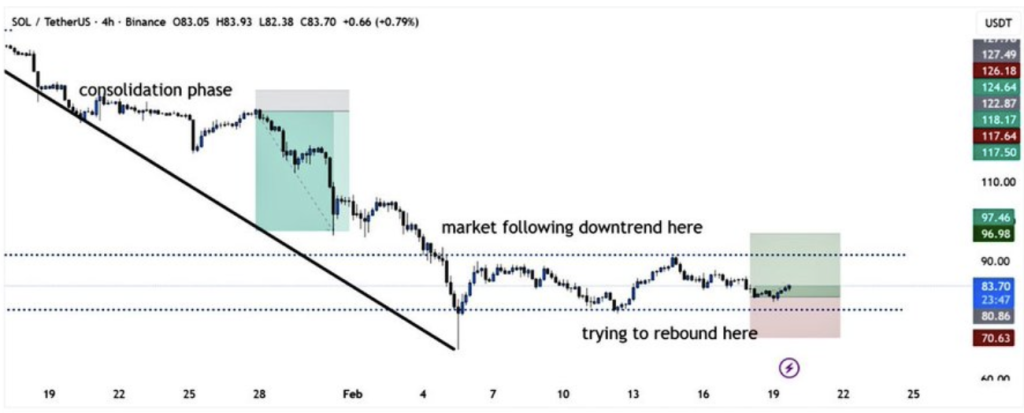

- Solana rebounded from the key $80 support zone, but remains in a broader consolidation phase.

- A decisive breakout above $90 is needed to confirm a short-term trend reversal.

- Losing the $80 level could reintroduce strong bearish pressure and extend the correction.

Solana has finally caught a small breath of air after weeks of steady selling pressure. The token bounced from the $80 zone, a level that traders have been watching almost obsessively, and is now trying to stabilize. At the time of writing, SOL trades near $83.18, up 2.85% over the past 24 hours, with roughly $5.74 billion in daily volume and a market cap hovering around $47 billion.

It’s a bounce, yes. But whether it’s a reversal… that’s still up for debate.

The $80 Zone Becomes a Battlefield

Over the past few sessions, SOL has been consolidating between $80 and $83, forming what some analysts describe as a potential accumulation pocket. According to crypto analyst BitGuru, this range has been defended multiple times, which increases its technical importance. Repeated holds often strengthen a support zone — until they don’t.

There’s something subtle happening here. Price has ticked higher while volume has remained relatively stable, which can suggest buyers are gradually stepping back in. Not aggressively. Not euphorically. Just… slowly.

Still, consolidation alone doesn’t confirm anything. For bulls to gain real control, SOL needs to clear $90 decisively. That level now acts as the gatekeeper. A strong breakout above it would invalidate the recent pattern of lower highs and potentially shift short-term structure back in favor of buyers.

Until that happens, this is simply range-bound price action. Nothing more.

Is This a Recovery — or Just a Pause?

Not everyone is convinced the rebound has legs. Analyst More Crypto Online offered a more cautious interpretation, suggesting the recent uptick could represent a temporary relief rally rather than a full trend reversal. In downtrends, sharp counter-moves are common. They can look convincing. They rarely last unless structure changes.

That’s why $80 matters so much.

If SOL loses that support after this bounce, the market could interpret it as weakness, not resilience. And in thinner liquidity environments, downside can accelerate faster than most expect. Momentum works both ways.

The Next Move Will Be Decisive

Right now, Solana sits at a technical crossroads. The $80–$83 band continues to act as near-term demand, while $90 stands as clear overhead resistance. It’s clean. Almost textbook.

A convincing daily close above $90 could invite renewed momentum, possibly triggering sidelined capital to rotate back in. On the flip side, a breakdown below $80 would likely re-empower sellers and extend the broader corrective structure.

In short, SOL isn’t out of danger. But it isn’t collapsing either. It’s compressing — and markets that compress tend to expand eventually. The only real question is direction.