- Trump’s crypto reserve announcement sent Bitcoin surging to $95,000 and Cardano up 72%.

- Analysts warn that the reserve plan still requires Congressional approval and could increase token volatility.

- Bitcoin and Ethereum face key resistance levels, with traders watching if the rally has lasting strength.

Crypto traders got a shocker on March 2 when President Donald Trump revealed plans for a U.S. crypto strategic reserve, set to include Bitcoin (BTC), Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA). The news sparked a frenzy of buying, pushing Bitcoin from around $85,000 to $95,000, while Cardano surged over 72%. Other altcoins also joined the rally.

However, Nansen principal research analyst Aurelie Barthere cautioned that setting up a U.S. crypto reserve won’t happen overnight, as it still requires Congressional approval. Another analyst, Nicolai Sondergaard, noted that the selected tokens could face increased volatility in the coming months.

Market Sentiment Shifts as Crypto Reserve Plan Takes Shape

Before Trump’s announcement, the crypto market had been struggling with negative sentiment. CoinShares reported $2.9 billion in outflows from crypto exchange-traded products last week, marking the third consecutive week of withdrawals after a long stretch of inflows.

Now, with the initial reaction pushing prices higher, traders are watching closely—will this rally hold? Let’s dive into the charts.

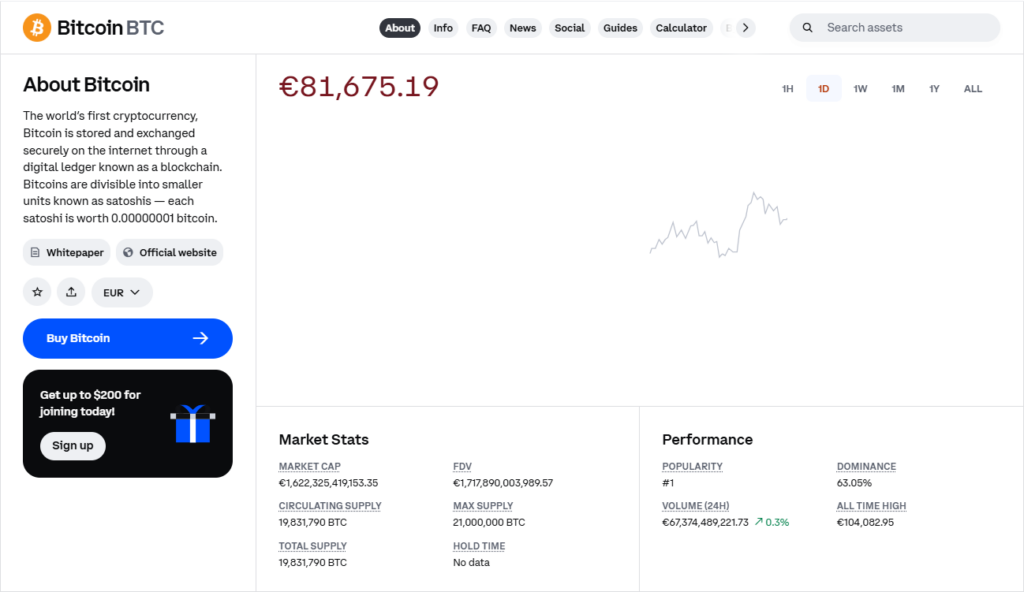

Bitcoin Price Analysis

Bitcoin dipped below its 20-week EMA ($90,623) last week and briefly tested the 50-week SMA ($75,534), but strong buying at lower levels helped it recover. The uptrend still favors bulls, though a weakening RSI suggests momentum may be slowing. If BTC fails to hold above the 20-week EMA, it could signal a deeper pullback toward the 50-week SMA.

If buyers keep the price above the 20-week EMA, BTC could retest its all-time high of $109,588. A breakout above that level could pave the way for a surge toward $138,000.

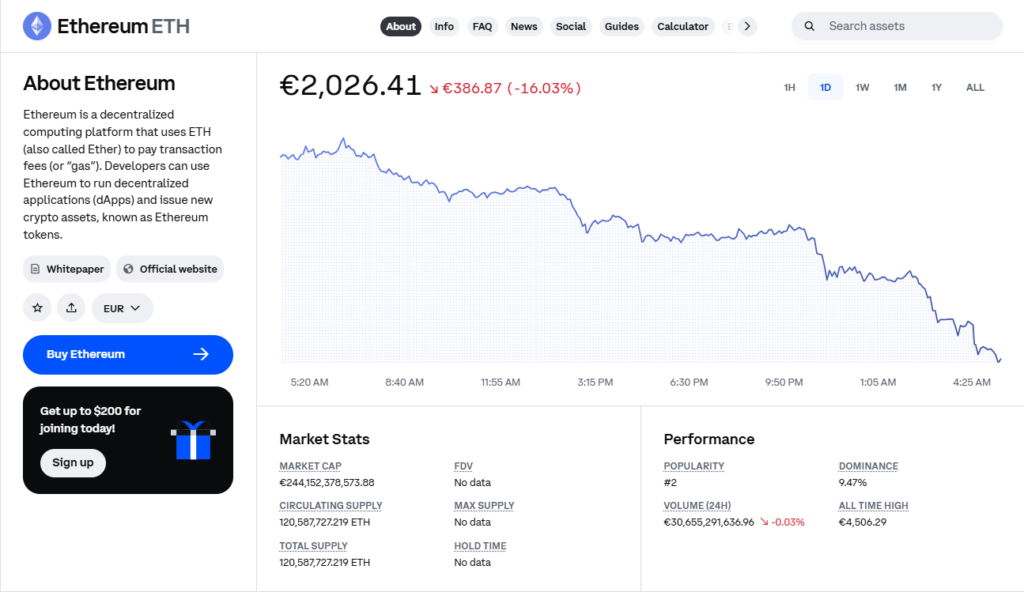

Ethereum Price Analysis

ETH has been trapped in a range between $2,111 and $4,094, showing buying interest near the lower bound and selling near the upper resistance. The moving averages are tilting downward, and the RSI is in bearish territory, signaling potential downside pressure.

A breakdown below $2,111 could open the door for a slide to $1,500. However, if bulls defend this level and push ETH past its moving averages, it could trigger a rally toward $4,094, which remains a key resistance.

XRP Price Analysis

XRP has struggled to maintain a breakout above $3, indicating strong resistance from sellers. The upsloping 20-week EMA ($2.18) and positive RSI favor bulls, but they must push XRP beyond $3 to initiate the next leg of the uptrend to $4 and then $5.

Failure to hold the 20-week EMA could lead to a retest of $2, with a breakdown potentially dragging XRP down to $1.50.

Solana Price Analysis

Solana rebounded from $125, but sellers are defending the 50-week SMA ($173). If SOL loses support at $157, it could revisit $125, with a further breakdown sending it to $80.

For a bullish outlook, SOL must reclaim the 20-week EMA ($191), which could trigger a rally to $220 and eventually $260.

Cardano Price Analysis

ADA is attempting to complete a cup-and-handle pattern on the weekly chart, which would confirm a breakout above $1.25. The 20-week EMA ($0.82) is trending higher, and the RSI is in bullish territory, supporting an upside move.

If ADA closes above $1.25, it could rally to $1.60 and later $2.26. However, failure to hold above the 20-week EMA might keep it range-bound between $1.25 and the 50-week SMA ($0.59).

With the crypto reserve plan stirring up fresh momentum, traders are bracing for increased volatility in the coming weeks. The key question remains—will the rally have staying power, or is this just another short-term pump?