- Silver suffered its largest intraday collapse on record after a parabolic rally

- Gold and risk assets sold off as rate expectations reset sharply

- The move rippled into crypto sentiment as markets turned defensive

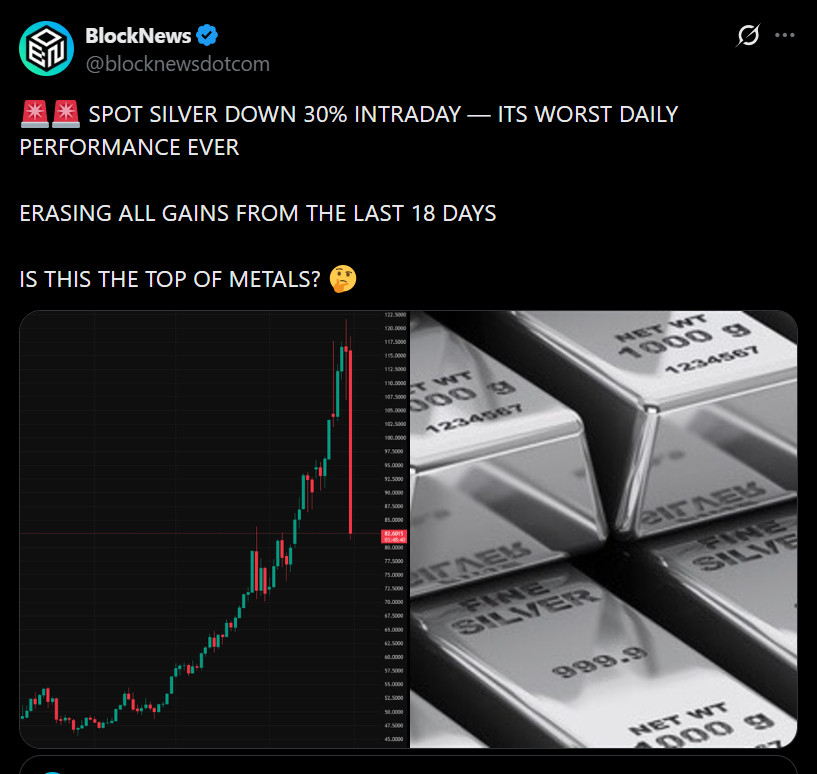

Silver plunged more than 30% in a single session, briefly falling into the mid-$70s after trading above $120 earlier in the week. Even with a rebound toward $82, the damage was severe. This marked the largest intraday decline ever recorded for silver and wiped out more than $1.2 trillion in market capitalization. Gold followed closely, dropping over 12% after touching record highs above $5,500. What looked like a relentless precious metals supercycle suddenly hit a wall.

Profit Taking Meets a Hawkish Macro Shift

The trigger was not just exhaustion. Traders rushed to lock in profits as macro conditions flipped quickly. President Donald Trump’s decision to nominate Kevin Warsh as the next Federal Reserve chair changed rate expectations almost instantly. Markets interpreted the move as a signal toward tighter monetary policy and stronger Fed independence. That repricing hit metals first, where positioning had become crowded and momentum-driven.

Bonds, Dollar, and Risk Assets React Together

Bond markets reflected the shift immediately, with the 10-year Treasury yield climbing toward 4.25%. The US dollar index rebounded roughly 0.7% after hitting multi-year lows earlier in the week. This combination created a textbook risk-off environment. When yields rise and the dollar strengthens, assets that thrived on easy liquidity, including precious metals and crypto, tend to suffer together.

What This Means for Crypto Markets

While the selloff was centered in metals, the signal matters for crypto. Bitcoin and major digital assets often track broader liquidity conditions, not inflation narratives alone. The violent reversal in silver highlights how fast sentiment can flip when macro assumptions change. For crypto traders, this reinforces that markets are currently pricing policy risk and liquidity above long-term store-of-value narratives.

Conclusion

Silver’s collapse was not random. It was the unwind of an overheated trade colliding with a sudden macro reset. The lesson extends beyond metals. In an environment where positioning is heavy and confidence is fragile, rallies can reverse just as fast as they form. Crypto markets are watching the same forces, and the message is clear: liquidity still rules everything.