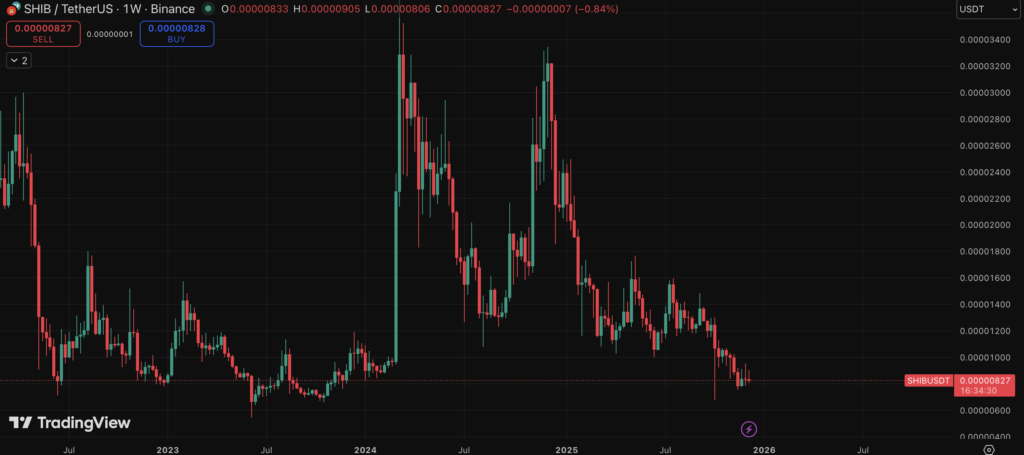

- SHIB remains down roughly 90% from its 2021 peak, with weak recovery and fading investor interest over time.

- Analysts point to limited real-world utility, low developer activity, and an oversized token supply as major structural risks.

- As the market matures, capital is increasingly rotating toward assets with proven use cases, leaving meme-driven tokens more vulnerable.

For investors asking why not to buy Shiba Inu, financial analyst Neil Patel has been fairly blunt. His concerns aren’t about short-term price swings or meme coin drama, they go deeper than that. SHIB is still down roughly 90% from its 2021 peak, and years later, it’s struggling to show meaningful real-world value. According to Patel, this isn’t just a cooling-off phase. It points to structural weaknesses that are becoming harder to ignore as the crypto market matures.

No clear problem being solved

One of the biggest red flags Patel highlights is utility, or the lack of it. Unlike Bitcoin, which is increasingly viewed as digital money, or Ethereum, which underpins thousands of applications, SHIB remains largely driven by hype. Social momentum, memes, and online speculation still do most of the heavy lifting.

While the Shiba Inu ecosystem has talked up projects like Shibarium, ShibaSwap, and even a metaverse concept, actual adoption remains thin. On-chain activity is limited, and developer engagement is noticeably low compared to other networks. In fact, SHIB doesn’t even rank among the top projects when measured by developer participation. That’s not a great sign for long-term sustainability, especially in a space where builders usually lead value creation.

As Patel put it, it’s simply difficult to argue that Shiba Inu’s blockchain solves a real-world problem right now. And that gap matters more than many holders want to admit.

A brutal fall from its peak

The price history tells its own story. Shiba Inu peaked in October 2021 during the height of the meme coin frenzy, touching roughly $0.000088. Since then, it’s been a long and painful slide lower. A drawdown of around 90% wipes out more than just paper profits, it often wipes out confidence too.

Even in the past year alone, SHIB has shed a significant chunk of its value, reflecting how much enthusiasm has faded since the boom. Patel notes that while speculative behavior never truly disappears from markets, the sustained downtrend suggests interest is shifting elsewhere. In his view, the price action doesn’t look like temporary weakness. It looks like a market slowly moving on.

Supply math works against SHIB

Another major issue comes down to simple math. SHIB’s circulating supply sits around 589 trillion tokens, an almost incomprehensible number. That sheer scale creates a ceiling on price growth that’s hard to escape.

For SHIB to reach even one cent, not a dollar, the market cap would need to exceed the combined value of the world’s largest companies. That kind of valuation isn’t just unlikely, it’s essentially unrealistic under current market conditions. Token burns help at the margins, but they don’t change the underlying problem fast enough to materially shift the equation.

This supply dynamic makes it extremely difficult for SHIB to deliver the kind of returns that many retail investors still hope for.

Stronger alternatives already exist

Patel also points out that investors aren’t short on better options. Bitcoin continues to benefit from scarcity and growing institutional acceptance. Ethereum remains the backbone of decentralized finance, NFTs, and tokenized assets, with real usage across global markets. These networks aren’t perfect, but they’re solving tangible problems and attracting long-term capital.

Compared to that, Shiba Inu looks more like a speculative bet than an investment. Patel argues that investors seeking crypto exposure don’t need to gamble on meme-driven assets when more established projects offer clearer fundamentals and stronger adoption.

A warning rooted in fundamentals, not fear

The broader takeaway from Patel’s warning is that SHIB’s risks go well beyond volatility. Its value still hinges heavily on social media sentiment, which can flip quickly and without warning. That makes the token unpredictable in a way that feels closer to gambling than long-term investing.

When you combine weak utility, overwhelming supply, fading hype, and growing competition from assets with real-world use cases, the caution starts to make sense. Shiba Inu may still have its moments, speculation always finds a way, but from a fundamentals-first perspective, the concerns raised by analysts aren’t easy to dismiss anymore.