- Robinhood listed SHIB in April 2022 after heavy community pressure and widespread anticipation.

- Potential investor numbers could be in the hundreds of thousands, though no official data has been shared.

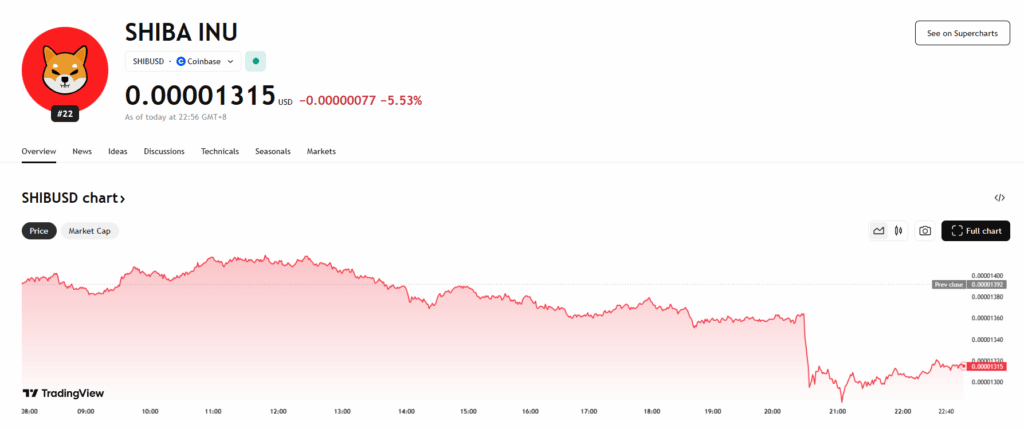

- Three years later, SHIB’s price remains stagnant, testing investor patience despite the early hype.

When Robinhood finally added Shiba Inu (SHIB) to its exchange on April 12, 2022, the crypto world lit up. The long-awaited listing came with plenty of fanfare — and relentless pressure from the SHIB community. For months, under nearly every Robinhood post on Twitter, you’d see the same question flood the replies: “Hey Robinhood, when SHIB?” Even CNBC’s Jim Cramer brought it up during a Mad Money segment with CEO Vlad Tenev, adding to the hype.

The excitement made sense. Robinhood’s nearly 26 million users suddenly had the ability to buy SHIB directly, and expectations for a price surge ran high. In the days that followed, many new traders jumped in — some looking for quick flips, others locking in for the long haul. Robinhood itself saw a spike in downloads and registrations, with younger investors in particular eager to grab a piece of the dog-themed token.

The Investor Numbers Remain a Mystery

To this day, Robinhood hasn’t released data on exactly how many of its users hold SHIB. Out of its 26 million users, around 12–13 million are considered active traders — almost half the platform’s base. If even 5% of those active accounts bought Shiba Inu, that’d be roughly 600,000 investors. Still, this is pure speculation; without official figures, it’s impossible to know for sure. Historically, most individual assets on Robinhood don’t exceed that 5% active-investor threshold unless there’s overwhelming demand.

The Hype Didn’t Translate Into Long-Term Price Growth

Now, more than three years later, the SHIB price story is far less exciting. Despite the initial rush, the token’s value has struggled to find momentum. The inflow of fresh investors has slowed, and the price chart has spent more time trending downward than up. Many holders — especially those who bought in after the Robinhood listing — have found themselves waiting, sometimes impatiently, for the big move that never came.