- A mysterious Shiba Inu whale owns 10% of the total supply across 150 wallets.

- The $10,000 investment from 2020 is now worth $2.5 billion, a 250,000-fold return.

- Analysts believe Shiba Inu could see a bullish breakout with a cup-and-handle formation.

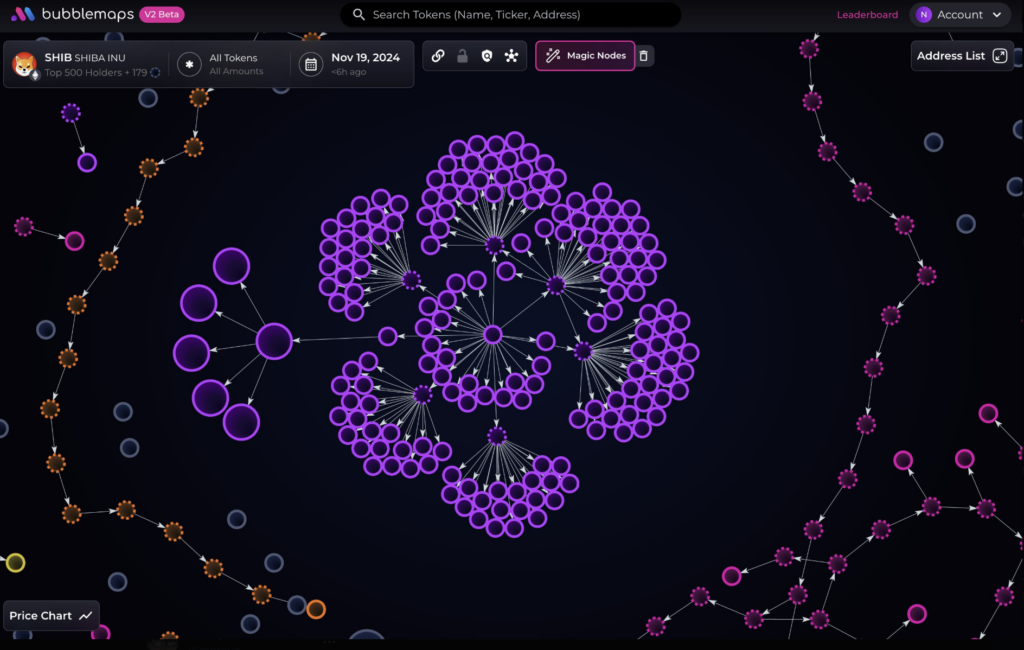

An unidentified investor has drawn attention for owning over 10% of Shiba Inu’s total token supply, raising concerns about the concentration of the memecoin’s distribution. The holdings, spread across 150 addresses, highlight the influence large holders, or whales, can have on a cryptocurrency’s market dynamics.

The Whale’s Historic Investment

Blockchain data from Bubblemaps revealed that the whale, who started accumulating Shiba Inu in 2020, purchased 103 trillion SHIB tokens for just 38 ETH, which was valued at $10,000 at the time. Today, that investment has grown to over $2.5 billion, marking a 250,000-fold return and earning recognition as one of the most remarkable trades in history.

Despite the immense value of these holdings, the investor has yet to sell any of the tokens, suggesting long-term confidence in Shiba Inu’s potential. Analysts warn, however, that such concentrated ownership could lead to market instability if the whale decides to liquidate a significant portion.

Source: Bubblemaps

Bullish Signals and Market Performance

Shiba Inu has experienced a 134% increase year-to-date, with a 27% rise in the past month. Market analysts are now observing a bullish cup-and-handle pattern forming in the SHIB price chart, which could signal a breakout. This technical setup is often associated with significant upward price movement, calculated by adding the pattern’s height to its breakout point.

While Shiba Inu has underperformed compared to some other memecoins, this potential bullish signal has led some to label it as a “sleeping giant” for the current market cycle. The token’s future performance will likely depend on whether the whale’s holdings remain untouched and broader market conditions support further gains.