- Potential Breakout for SHIB: Shiba Inu is approaching the apex of a three-year symmetrical triangle pattern, with key resistance at $0.000017 (50-day SMA) and potential breakout targets at $0.00005 and $0.0001 — a possible 733% gain from current levels.

- Shifting Holder Composition: On-chain data shows a 1.46% increase in long-term SHIB holders while speculative traders decline, suggesting a shift toward accumulation and potentially reducing sell-side pressure.

- Market Sentiment and Funding Rates: Despite bearish sentiment, SHIB has maintained support at $0.00001, with CoinGlass data indicating a slight tilt toward long positions, setting up a possible bullish reversal if momentum picks up.

Shiba Inu (SHIB) has been trading in a pretty tight range lately, hovering between $0.000012 and $0.000013 over the past week. Despite some brief intraday volatility, the broader trend has been sliding downward. But, according to TradingView analyst BITfinity, there might be a bigger move brewing — one that’s been three years in the making.

Long-Term Triangle Formation – A Shift in Momentum?

BITfinity is zooming out to the weekly chart, pointing to a massive symmetrical triangle that’s been forming since SHIB hit its all-time high of $0.0000884 back in October 2021. This triangle is made up of a descending resistance line and a flat support base at around $0.00001.

Since that ATH, SHIB has been gradually squeezing within the triangle, creating lower highs but holding that key support level. Resistance has proven tough to crack. In December 2024, SHIB attempted a breakout near $0.000032 but got smacked back down to the base. Before that, in March 2024, there was a quick surge to $0.000045, but once again, momentum fizzled.

Now, as the apex of the triangle gets closer, BITfinity’s chart outlines a speculative breakout path, eyeing initial resistance at the 50-day SMA, which is sitting around $0.000017. If SHIB can push through that, the next targets would be $0.00005 and $0.0001. A move from the current $0.000012 to $0.0001? That’s a whopping 733.33% potential gain.

Long-Term Holders Grow as Speculative Traders Decline

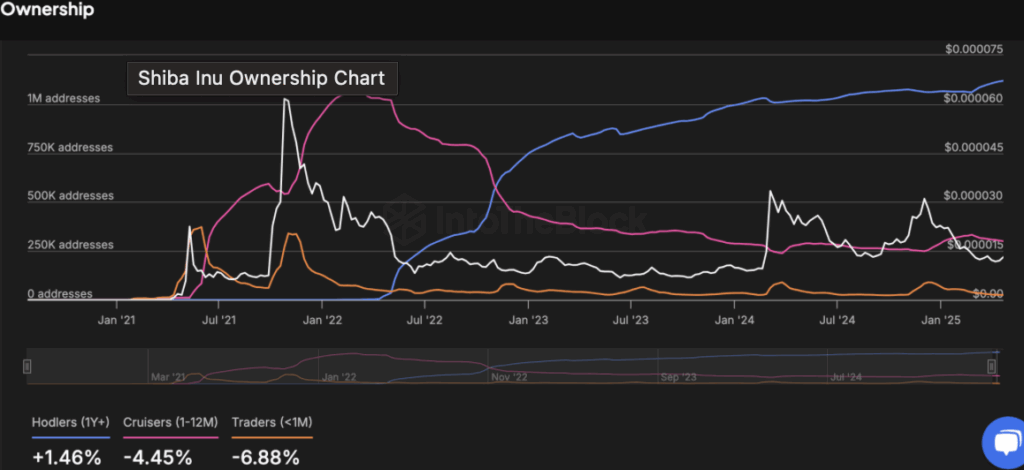

While SHIB consolidates, some interesting trends are popping up in the on-chain data. According to IntoTheBlock, the number of long-term SHIB holders — those hanging onto their tokens for over a year — has ticked up by 1.46%.

Meanwhile, the number of short-term traders (under a month) and mid-term holders (one to twelve months) has dropped by 6.88% and 4.45%, respectively. This suggests a bit of a redistribution phase, where speculative activity is cooling off while long-term holders hold firm.

This shift is also reducing selling pressure. With fewer traders looking for quick flips, the chance of sudden liquidation spikes decreases, potentially setting the stage for a more stable price base.

Market Sentiment: Gradual Tilt Toward Long Bias

On the derivatives side, data from CoinGlass reveals a subtle but noticeable shift in sentiment. Since early April, SHIB’s OI-Weighted Funding Rate has swung from bearish to more neutral, with occasional long bias showing up.

Despite several dips in funding rates, SHIB’s price has managed to hold above the key $0.00001 support. Short sellers haven’t been able to force a deeper breakdown, even during multiple bearish cycles. Now, with funding rates leaning slightly toward long positions, the stage could be set for a potential bullish reversal — but it’s still a wait-and-see game.