- Whales triggered 406 large transactions and over 1T SHIB inflows as structure held firm.

- Falling-wedge breakout + strong CVD + 1,244% burn spike create a powerful confluence.

- Funding flipped positive, giving SHIB a real chance to extend momentum if buyers defend the retest zone.

Shiba Inu just recorded its strongest burst of whale activity since early June, and the shift is hard to ignore. Santiment flagged 406 whale transfers above $100k, along with over 1.06 trillion SHIB flowing onto exchanges — a clear sign that large holders are repositioning themselves. Normally, that kind of influx sparks panic, but interestingly, SHIB didn’t cave under the pressure. Instead, it kept respecting its key structural zones, almost like the market was waiting for confirmation rather than running straight into a selloff.

This is the kind of setup where whales usually lead the next direction during low-volatility phases. SHIB still sits inside that compressed environment, and the consistency across metrics makes it easier to read demand — though the price still needs a clean confirmation above its retest area before anything meaningful plays out.

Retest Zone Decides SHIB’s Next Big Move

SHIB recently broke out of a falling wedge and immediately retested the upper edge — the spot where trends either continue higher… or fall apart. That level around $0.00000883 has already acted as a reaction zone multiple times on the chart. Traditionally, falling-wedge breakouts hold if buyers defend this boundary sharply and without hesitation.

The MACD on the daily timeframe is tilting upward again, and the histogram is finally pulling away from earlier flat behavior — giving traders a little more confidence that momentum might shift into something stronger. Even so, SHIB is still stuck in a tight range. The structure favors upside only if buyers keep defending this retest area cleanly.

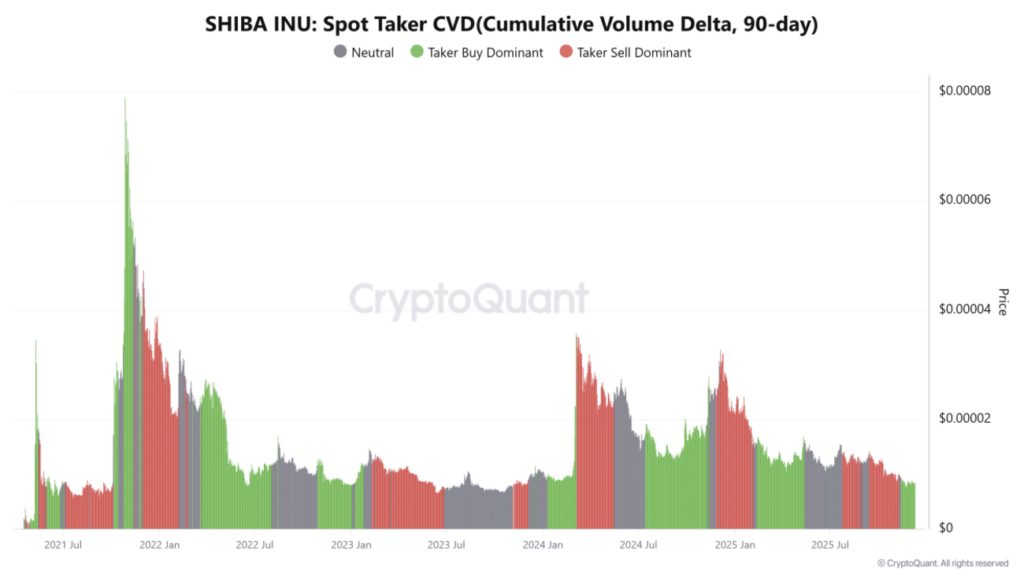

CVD Shows Aggressive Buy-Side Absorption

Taker Buy CVD (90-day) continues to show buyers absorbing every dip. Dips that should’ve sent price lower just… didn’t. Instead, each one built a small base that held, which is a strong indicator that someone with size is quietly accumulating rather than exiting.

Whale activity + persistent buy-side CVD is usually how accumulation phases form underneath the surface. And while SHIB hasn’t exploded yet, the directional lean in CVD supports the idea that strength is building even as price moves sideways. In setups like this, CVD often becomes the most reliable signal long before price reacts.

Burn Rate Surges 1,244% as Supply Thins Out

SHIB’s burn rate just spiked more than 1,244% in 24 hours, tightening supply at the exact moment whale activity is rising and CVD stays positive. Burns don’t automatically guarantee upside, sure, but when they spike during a technical breakout and demand starts rising, supply gets thinner right when buyers need it most.

This burn surge arrives right as SHIB forms one of its cleaner bullish structures in weeks, adding yet another pillar supporting the current momentum. If trend continuation holds, supply reduction will amplify price responsiveness.

Funding Turns Positive as Traders Regain Confidence

Funding rates flipped positive on CoinGlass, showing that long traders are finally stepping in with conviction rather than hesitation. The OI-Weighted Funding Rate climbed while SHIB maintained structure above its breakout line — a healthy alignment between spot demand and derivatives sentiment.

Meanwhile, liquidation heatmaps show clusters around $0.0000084 and $0.00000886, zones that often trigger volatility as liquidity hunts unfold. These areas could act as magnets before SHIB chooses its next direction.