- February 2026 forecasts cluster around $0.0000095, with volatility expected inside a tight range

- Weak Shibarium usage and slowing burn rates continue to cap long-term upside

- A breakout depends on holding key support and overcoming resistance near $0.0000090

The Shiba Inu price outlook for February 2026 is shaping up as a tight but tense range, with most forecasts pointing to trading between roughly $0.00000787 and $0.0000125. A growing number of analysts are clustering around a midpoint near $0.0000095, which has quietly become the consensus target for now. As this outlook takes shape, volatility has picked up across major exchanges, with traders watching closely for either a clean breakout above resistance or a sharper pullback into nearby support.

That rising attention isn’t happening in a vacuum. SHIB has once again moved into a zone where price reactions tend to accelerate, for better or worse. Some see this as early positioning ahead of a breakout attempt, while others are more cautious, pointing out that momentum still feels fragile, almost hesitant.

Price Targets Shape February Trading

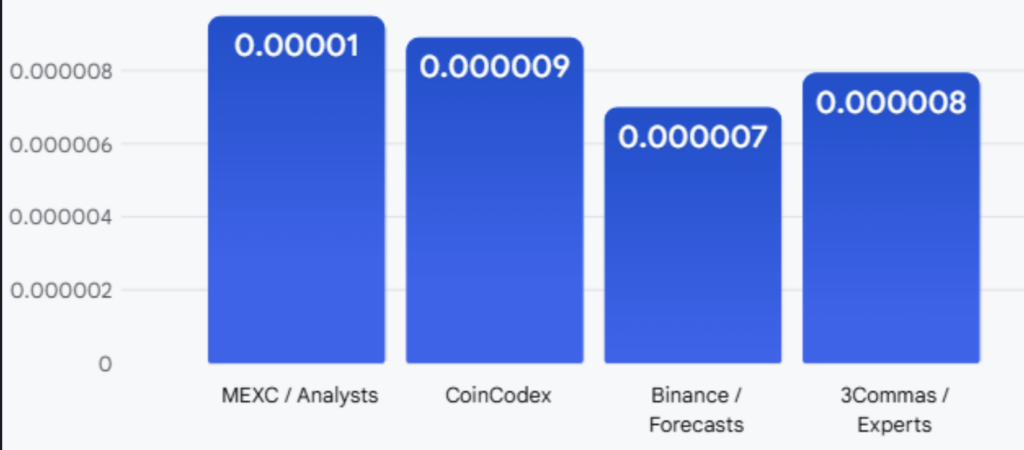

Forecasts for February remain fairly clustered, though not identical. Data from Changelly suggests a minimum target near $0.00000841 and a potential high around $0.00000940, implying a possible 19% move across the month. CoinCodex projections lean closer to $0.000009, while estimates from 3Commas sit slightly lower near $0.000008. Taken together, these models suggest SHIB may stay range-bound, even as volatility spikes within that range.

Some analysts believe the current setup is more meaningful than it looks. TradingView analyst Crypto Patel has pointed out that SHIB is revisiting a historically important support zone. In the past, price has tended to react strongly when entering this area, often followed by short but aggressive rallies. That history doesn’t guarantee a repeat, but it’s one reason traders are paying closer attention than usual.

Ecosystem Factors Weigh on the 2026 Outlook

Beyond price charts, the broader SHIB ecosystem continues to send mixed signals. Shibarium’s Layer-2 network currently holds around $870,000 in total value locked, which remains modest. Even more concerning for longer-term bulls, daily transactions have dropped sharply from roughly 4 million in mid-2025 to just about 2,600 by January 2026. That slowdown suggests adoption has cooled, limiting upside pressure for now.

Token burn activity has also lost momentum. Daily burns have fallen by nearly 88%, sliding from around 28 million SHIB to roughly 3 million per day. While a total of about 410 trillion tokens have been burned so far, the remaining supply of nearly 589 trillion still hangs over price action. Many traders are now watching to see whether burn rates can recover, because without that, the deflation narrative weakens pretty quickly.

Technical Setup Defines Breakout Risk

From a technical standpoint, SHIB remains a high-beta asset with strong correlation to Bitcoin. Momentum indicators are offering cautious optimism, with the MACD histogram flashing short-term bullish signals, even as overall sentiment stays neutral. The 23-day moving average has crossed above the 50-day average, forming a golden cross that some analysts interpret as a potential mid-term trend shift, though confirmation is still needed.

For a meaningful breakout, several conditions would likely need to align. Continued Shibarium usage, renewed burn activity, and supportive macro conditions all play a role. Whale behavior adds another layer of uncertainty, especially after 82 trillion SHIB moved onto exchanges during a 23% price drop earlier in 2026. If SHIB can hold above $0.0000080 and push higher, a move toward the 200-day moving average near $0.00001050 becomes possible. If not, a drift back toward lower support around $0.0000065 can’t be ruled out either.