- Shiba Inu is down roughly 72% in 2025, ranking among the year’s worst-performing assets.

- Technical indicators from Traders Union and TradingView point to a strong sell bias.

- Some analysts suggest reallocating funds into Bitcoin or Ethereum instead of holding SHIB.

As 2025 wraps up, Shiba Inu has landed on an unfortunate list — one of the worst-performing cryptocurrencies of the year. SHIB is now trading near the $0.0000078 level, down roughly 72% over the past twelve months. For investors who entered positions anytime over the last two years, the picture is bleak, with most still sitting on deep unrealized losses despite repeated calls to “buy the dip.”

With sentiment split between hope and frustration, attention has shifted toward technical indicators to see whether SHIB still has a realistic recovery path. Several on-chain and technical analysis firms have weighed in, and the signals aren’t exactly encouraging.

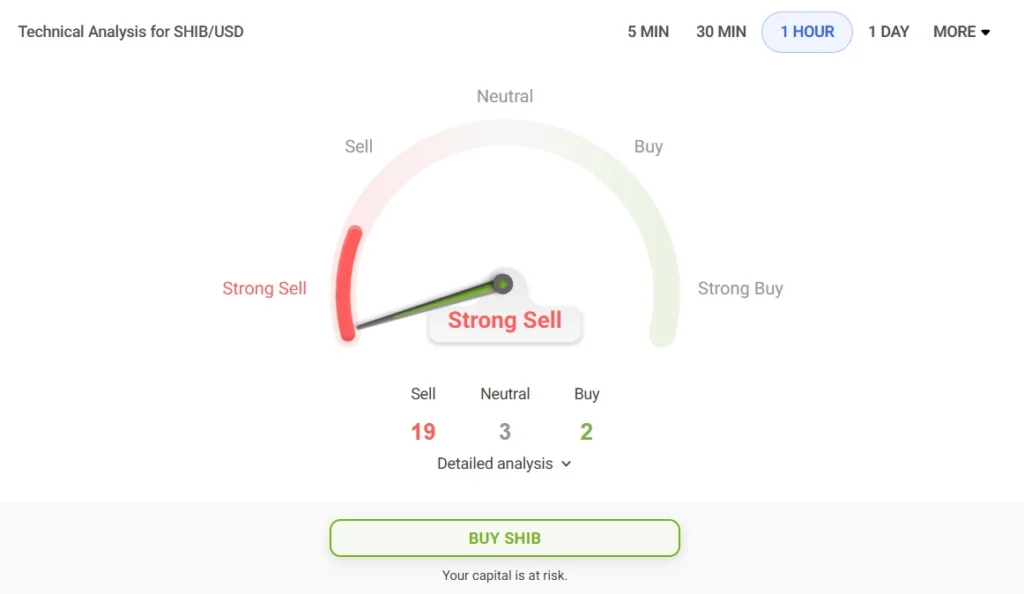

Technical Indicators Flash Strong Sell Signals

Data from Traders Union points heavily toward a bearish outlook. Of the 24 analysts surveyed, 19 have issued a strong sell rating, while only two suggest buying at current levels. The remaining three analysts remain neutral, effectively recommending investors hold rather than add exposure. Overall, the balance of signals leans sharply negative, reflecting the token’s tendency to erase gains quickly during short-lived rebounds.

TradingView Metrics Reinforce the Bearish Case

TradingView’s latest technical readings echo a similar message. Moving Averages are firmly planted in strong sell territory, and the overall summary points toward continued downside risk. Repeated price dips have steadily worn down investor confidence, leaving SHIB struggling to attract meaningful demand. The lack of sustained upside has made even long-time supporters more cautious, especially as momentum continues to fade.

Is Capital Better Deployed Elsewhere?

Given SHIB’s performance, some analysts argue that reallocating capital could be the more practical move. Bitcoin, trading near $87,000, has historically rebounded toward the $91,000–$93,000 range after pullbacks, offering potential short-term trading opportunities. Ethereum is also viewed as a diversification option for investors looking to reduce volatility exposure. In contrast, SHIB’s current risk-to-reward profile remains unfavorable unless broader market conditions improve significantly.